Prices

March 8, 2018

Hot Rolled Steel and Scrap Futures: Market's Hopping

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

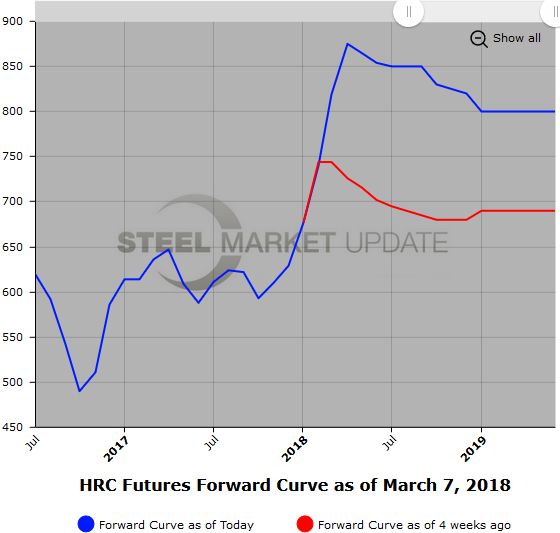

HR futures prices have moved up. POTUS has been keeping the HR futures market hopping this week. The plethora of news releases on steel tariffs has kept the ferrous market off balance. Q2’18 HR futures traded at $872/ST on a weighted average price basis today, $10/ST above where we traded this past Friday ($862/ST). Q3’18 HR futures traded at $856/ST on a weighted average price basis today, $9/ST above where we traded this past Friday ($847/ST). Q4’18 HR futures traded at $852/ST on a weighted average price basis today, $40/ST above where we traded this past Friday ($812/ST). Also of note, 1H’19 traded here today at $850/ST.

The slope of the backwardation has become much less steep in the last few days as participants paid up the latter half of 2018 and the 1H’19 on the expectation of higher prices due to more constrained imports.

HR futures trade volume including last Friday through today has been pretty heavy with over 86,500 ST trading, of which 25,000 ST traded today.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact Brett at 706-216-2140 or Brett@SteelMarketUpdate.com.

Scrap

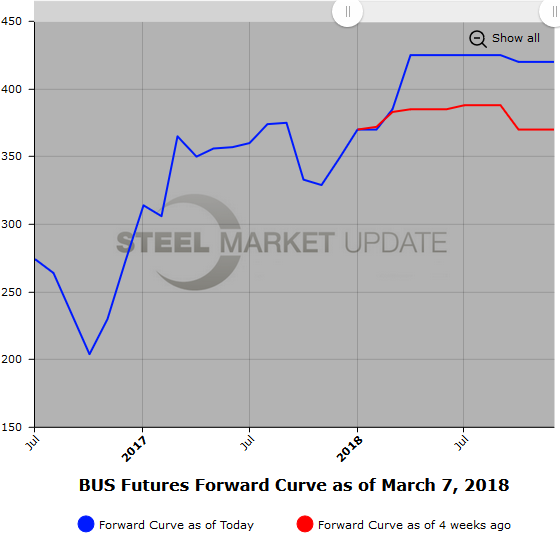

BUS futures have traded in a narrow range this week. Q2’18 has been trading $420-$425/GT in light trading. Participants are waiting for the March BUS settlement. Market sentiment is that it will be sideways to $5-$10 higher. HMS 80/20 scrap futures (SC) prices have retreated as Turkish importers slow purchases, and also on the back of weaker ferrous prices in Asia. Q2’18 SC prices have dropped about $15/MT since last Friday. They are currently around $377/MT.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.