Analysis

April 12, 2018

Swiecki: “Let Me Put You at Ease” on Automotive

Written by John Packard

Much has been made of the downshift in automotive and its impact on steel demand, but “let me put you at ease about the market slowdown,” said auto analyst Bernard Swiecki with the Center for Automotive Research.

Speaking at the Fabricators and Manufacturers Association annual meeting March 8 in Scottsdale, Ariz., Swiecki told the group the slowing of vehicle production in the NAFTA market will be modest and temporary.

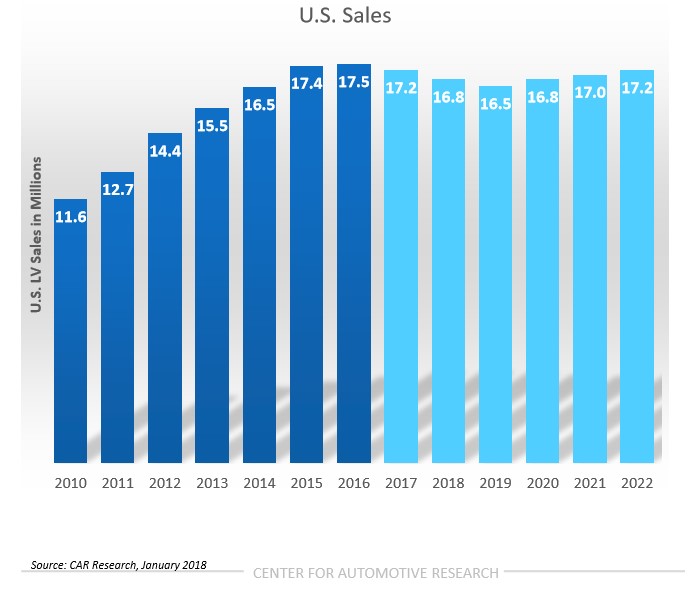

U.S. sales of light vehicles declined from the peak of 17.5 million in 2016 to 17.2 million last year. That trend is expected to continue this year and next with U.S. sales forecast at 16.8 million vehicles in 2018 (sales were down 0.7 percent in January and February) and dipping further to 16.5 million in 2019. No cause for alarm, Swiecki said, as CAR forecasts a gradual rebound to sales of 17.2 million cars and light trucks by 2022. The expected trough of 16.5 million is still a very healthy level on a historical basis.

In North America, light vehicle production is expected to increase slightly from 2017 to about 17.9 million units this year. Then after a slight dip in 2019, it will grow to 18.6 million by 2022. Automakers have made capital investments in new production facilities totaling $119.5 billion since 2009, including $87.6 billion in the U.S., $24.8 billion in Mexico and $7.1 billion in Canada to prepare for future demand.

Consumers continue to favor the popular crossover utility vehicles (CUVs), which now own more than a 34 percent share of the market, followed by pickups at 16 percent. Relatively cheap gasoline prices, currently averaging around $2.66 per gallon, have kept car buyers from moving toward smaller, more fuel-efficient vehicles, making it difficult for the car companies to meet the fleetwide environmental standards, now under review by the EPA. On a positive note, purchases of electrified vehicles now represent 3.3 percent of the market and are the fasted growing segment.

Several economic factors favor increased auto sales, Swiecki said. U.S. GDP is tracking at 3 percent or better. The U.S. labor market is still growing, and the unemployment rate has reached the lowest level since 2000. Two million full-time employees were added to the market last year. Wages are increasing above the inflation rate, and the stock market and household net worth have both reached historical highs.

Unfortunately, Swiecki said, vehicle sales no longer correlate precisely with economic growth. North American vehicle production declined in 2017. The balance of subprime auto loans is at high levels and the delinquency rate is rising, even though more workers have jobs. Interest rates are up, and credit availability is tightening.

On top of that, the possibility of the U.S. exiting from NAFTA adds a great deal of uncertainty to commerce, as well as steel and aluminum prices. NAFTA negotiations with Canada and Mexico are contentious. Emergence of a so-called “zombie NAFTA,” in which trade with the U.S. is not dead, but not fully alive, either, would not be good for automotive, Swiecki said.