Prices

August 30, 2018

Steel Futures: Steep Backwardation Persists in Final Months of 2018

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

Due to the Monday UK bank holiday and the Atlanta SMU Steel Summit Conference this week, we had a slow start to the week in ferrous futures. Given general HR price sentiment, it seemed as though the final August HR Index price left a few folks surprised that it did not reflect a lower price. Lately prices have continued to shift up and back in the front forward month given the steep backwardation from spot to the front month. The backwardation in the spot to the front month increased by $10/ST in the last week.

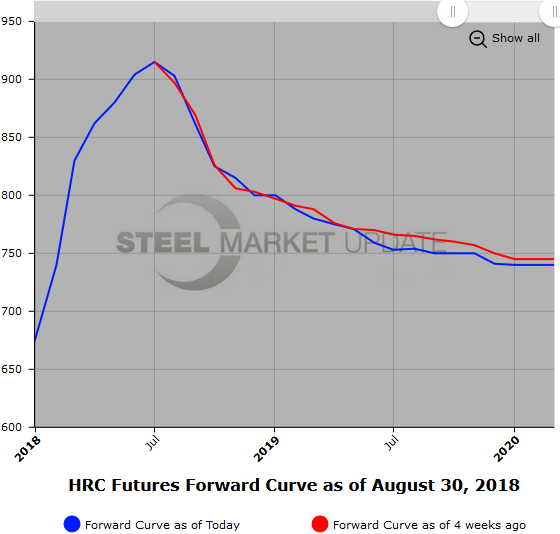

Trading volume in CME HR futures this week will top 40,000 ST as the market participants returned today. Post Summit near-term sentiment that HR prices will soften further helped spur transactions, the bulk of which have been in the front months with heavy trading in the Sep’18 HR contract as buyers accommodated some strong selling interest. Today, Sep’18 HR traded at $861/ST ($43.05/cwt) average price in just under 15,000 ST (a steep $30 discount to the latest HR spot index). Given the latest HR index price that the CME uses to settle its HR contract, the index would have to drop by over $12/ST linearly for the four prints in September to reach an $861/ST average.

In Cal’19 HR the latest per month value comes in at just over $766/ST with a $59/ST backwardation (Jan’19, $802/ST / Dec’19, $743/ST).

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact Brett at 706-216-2140 or Brett@SteelMarketUpdate.com.

Scrap

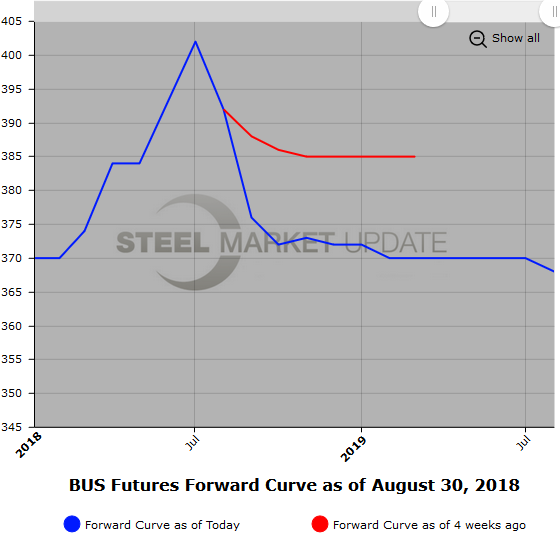

Latest talk has Prime scrap spot prices easing $10/20 per GT from Aug’18 $392/GT. BUS curve has been relatively flat and surprisingly not reflecting the steep backwardation reflected in HR. The curve is basically $368 bid at $378 offer out through Q1’19 on the outside.

Shred scrap chatter has spot prices expected to be off $20/30/GT. Recent Sep’18 USSQ (NASDAQ Midwest Shred) traded in the low $330/GT area with latest followup selling interest just above $330/GT. We are seeing a bit of backwardation in Q4’18 as buying interests are $10/GT lower.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

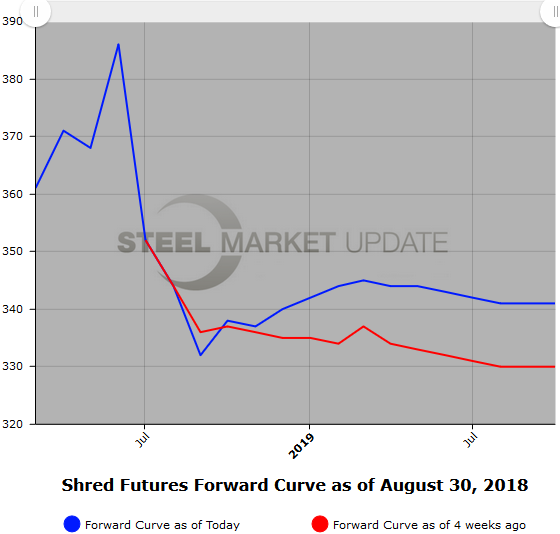

We have started tracking USSQ shredded scrap futures, shown below. Once we have built a sizable database, we will add this data to our website.