Market Data

November 19, 2018

2019 Gulf Coast Energy Outlook

Written by Tim Triplett

Editor’s note: Following is an edited excerpt from the 2019 Gulf Coast Energy Outlook published by Louisiana State University’s Center for Energy Studies and the E. J. Ourso College of Business.

The past two decades have seen a dramatic change in the energy landscape along the Gulf Coast with the “revolution” created by unconventional gas and oil drilling. Prior to the unconventional revolution, U.S. production accounted for a little under 8 percent of world oil production. Today, the U.S. accounts for over 12 percent of all world crude oil production and has the possibility of improving that market share if prices are sustained at higher or even current levels.

While unconventional drilling has changed the outlook for the development of U.S. energy reserves, it has not, unfortunately, decoupled the relationship between drilling activity and prices. U.S. drilling activity continues to be highly correlated to prices, making the industry as cyclical today as in years past.

Permian’s Dominance Challenged

Most new drilling activity continues to be concentrated in unconventional basins. Since 2016, the Permian has been the predominant shale play in the U.S. accounting for more than 33 percent of all drilling activity in the first half of 2018. This dominance may soon be challenged, however, since this high concentration of Permian-oriented drilling activity has come at a cost: constrained pipeline capacity moving crude oil out of the area and exceptionally low net-backs for producers in the region. The Permian is quickly running out of spare crude oil transportation capacity, with some reports estimating current pipeline capacity utilization as high as 96 percent.

These pipeline capacity constraints are real and could slow the region’s (and the United States’) ability to meet anticipated global production shortfalls that could arise from the geo-political situations in Iran and Venezuela. In fact, pipeline constraints have been associated with more than $20/barrel price differentials during the peak of the shale boom.

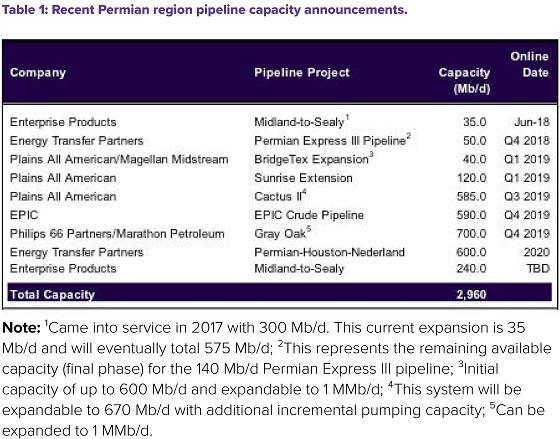

While these constraints are problematic and could result in some disruptions, the authors of this study believe the market has better-than-average odds of hitting a “goldilocks” outcome, one where there is just enough transportation capacity to meet the rising production from the region, but no more. This shorter-term optimism arises from two observations. First, a considerable number of major crude oil transportation projects have been announced to move production from the Permian to the Gulf Coast. In total, almost three million barrels per day of crude oil transportation capacity is expected to come online in the Permian region in the next two years. Second, there is a relatively good chance that the incremental transportation capacity increase will be enough to meet the 2020 production increase from the Permian basin.

Price Forecasting

Over the past decade, the underlying relationships between prices, drilling activities, and production have been fundamentally altered due to the advent of shale, making it especially difficult to forecast prices. As of Oct. 1, 2018, crude oil projections were estimated to rise to about $75 per barrel by the end of the year. But to illustrate how quickly markets can change, as of the time of this writing (early November 2018), prices had corrected down to less than $63 per barrel. Thus, while shocks are likely to occur, the intermediate range forecast has crude staying at around this new level. Longer term, the futures market anticipates crude prices to converge to around $60-$65/Bbl over the next few years. Natural gas prices are anticipated to drop over the next two years and then stabilize at between $2.50 to $3/MCF.

Overall, the 2019 outlook for the Gulf Coast’s energy industries is a mixed bag. U.S. and Gulf Coast domestic crude oil and natural gas production should continue to be strong. The nation and region will build upon existing productivity gains, and higher overall prices will continue to facilitate more drilling activity. This drilling activity may start to diversify, in terms of location, over the upcoming few years, but not enough to knock the Permian basin off its perch as the premier U.S. unconventional basin.