Market Data

February 25, 2019

Service Center Spot: Are Spot Sales Philosophies Changing?

Written by John Packard

Flat rolled steel service centers are beginning to believe a change in spot pricing is necessary. We saw a precipitous decline in the percentage of distributors who were lowering their spot pricing to their customers compared to a couple of weeks ago.

One of the proprietary indices created by Steel Market Update is our Service Center Spot Pricing Index. The purpose of the index is to discover how flat rolled steel service centers are handling pricing on spot sales to their end customers. We look at spot sales from two perspectives, that of the distributors and from the manufacturing companies they service. We believe the information collected provides a good picture of the potential weakness or support for pricing in the marketplace. This in turn provides perspective for steel buyers as they prepare to make inventory purchasing decisions, whether from a distributor or from a steel mill.

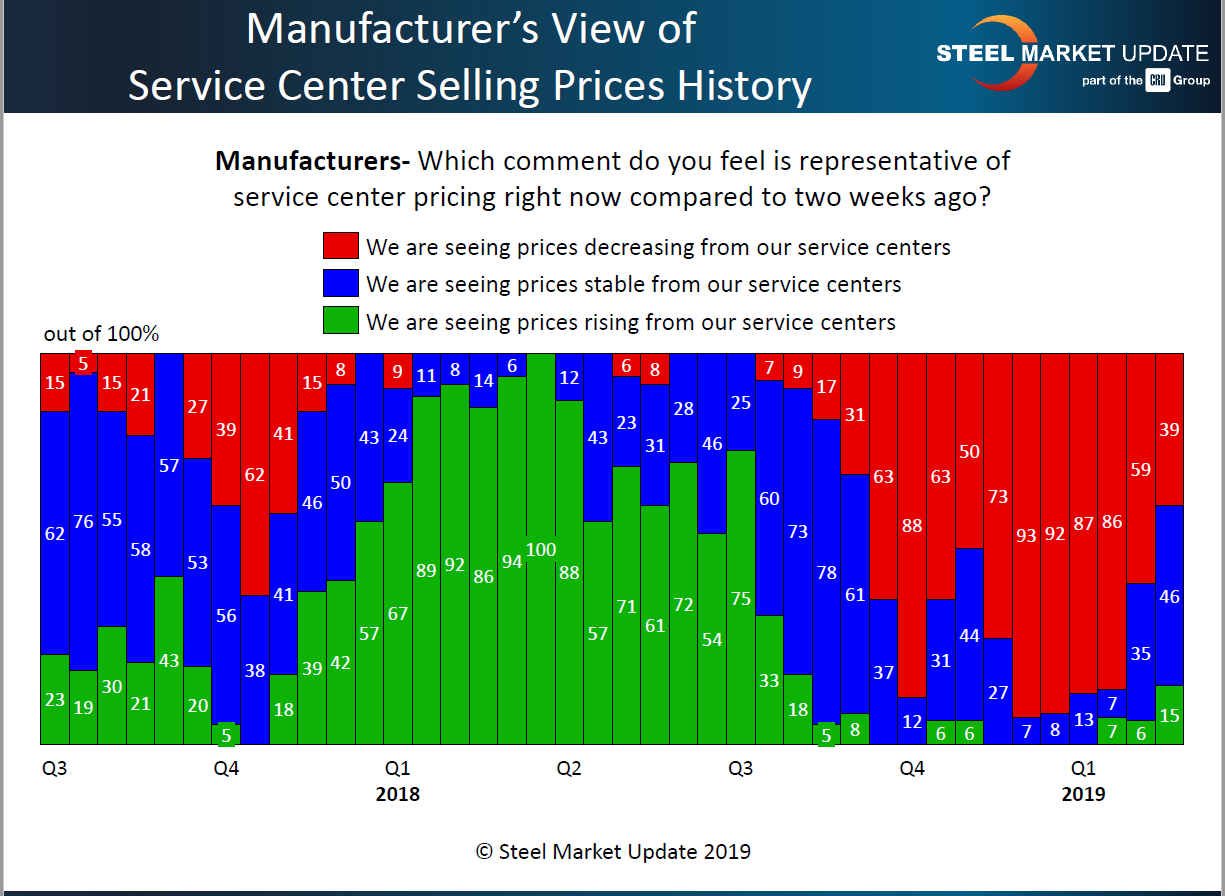

Manufacturers Report Majority of Distributors Holding the Line or Increasing Spot Prices

In the analysis conducted by SMU this past week, we found 39 percent of the manufacturing companies reporting their service center suppliers as dropping spot pricing compared to two weeks earlier. This is down 20 percentage points from our early February survey and 47 percentage points below what we measured during our mid-January analysis.

We also gathered data showing 15 percent of the manufacturing companies reporting their service center suppliers as raising spot prices. We have not seen distributors (according to the manufacturing companies) at this level of price support since early August 2018.

Manufacturing companies have been consistently reporting the distributors as lowering spot prices going back to late third-quarter 2018.

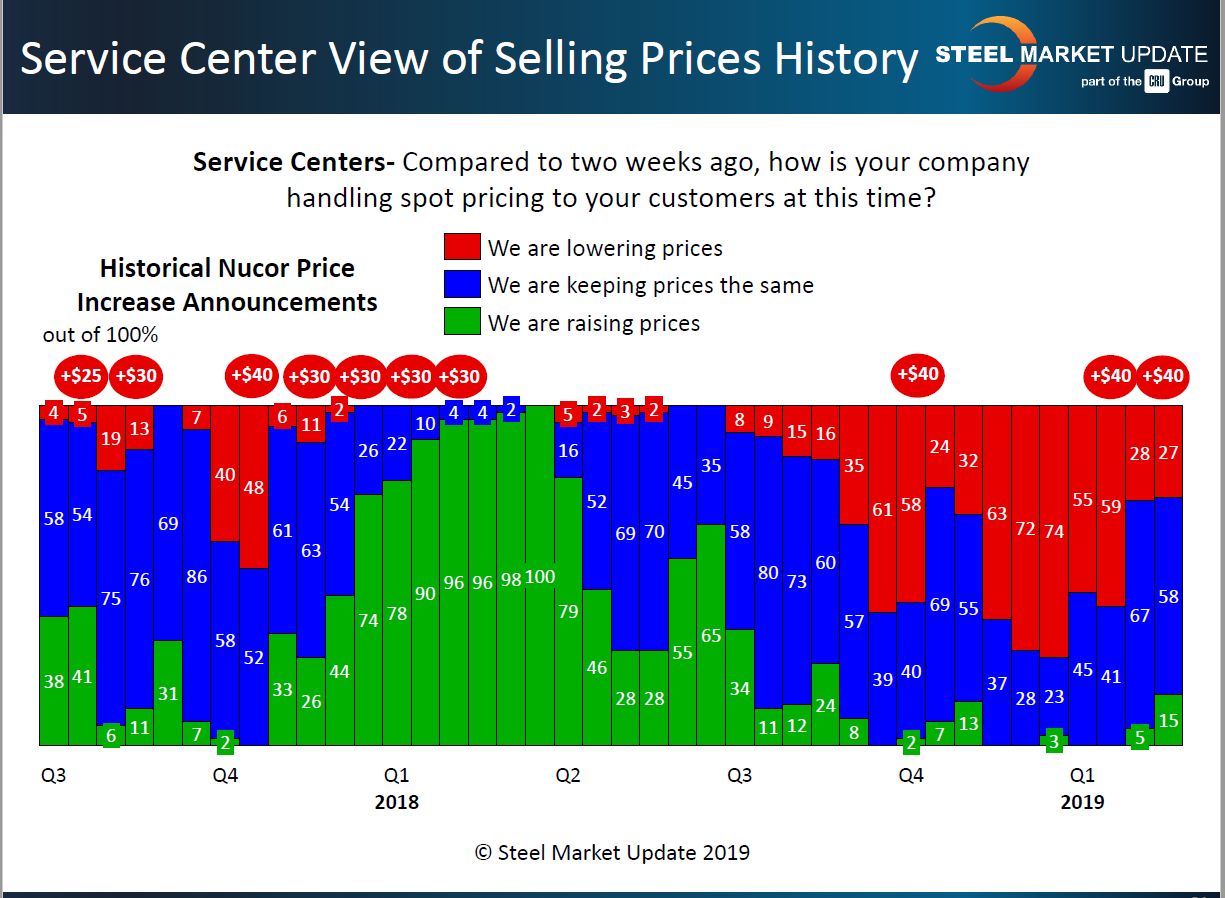

Service Centers Adjusting Spot Pricing Philosophy

The steel distributors also reported a decline in the percentage lowering spot prices to their end user customers. Last week, we found 27 percent of the steel distributors reporting their company was offering lower spot pricing. We saw 58 percent keeping prices the same, and we collected data pointing to 15 percent of the distributors as now raising spot prices. The last time the service centers tried to increase spot prices was shortly after the Nucor price announcement made in early fourth-quarter 2018.

From Steel Market Update’s perspective, having steel distributors changing the pricing philosophy at their company and now beginning to move spot prices higher is very supportive of the domestic steel mill price increases announced over the past 30 days.

In the graphic below, the red ovals represent the price increase announcements made by the domestic steel mills. The red ovals on the lefthand side of the graphic are from AK Steel. Those on the right represent the increase announcements out of Nucor. We made the move away from AK Steel as they no longer are posting their spot price announcements on their website.