Overseas

July 11, 2019

CRU: Production Cuts Fail to Stem Price Falls

Written by Tim Triplett

By CRU Principal Analyst Josh Spoores

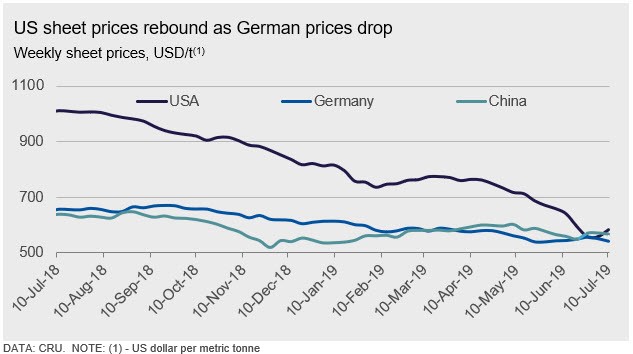

Sheet price movements have varied across the major markets since mid-June. There were slight gains in China and South East Asia, while prices in Europe were primarily steady m/m. However, for all other markets including North & South America, CIS, India and Japan, prices were lower by 3-9 percent m/m. This downward trend was also reflected in slab prices with declines of $10-$40 /t m/m, the largest of which from Brazilian producers.

The Global Flat products Price Indicator (CRUspi flats) reflected these regional trends as it fell for the fourth consecutive month, losing 1.1 percent m/m to 151.2. This benchmark continues to sit at its lowest point since November 2016.

One area of recent, yet limited, price support was Europe. While demand here has been challenged, mills instituted price increases which were followed with capacity shutdowns by multiple producers. Prices did rise by a limited amount since late May, though these reversed course with recent w/w declines.

In Asia, recent production curtailments in the Chinese steelmaking hub of Tangshan, along with the recent spike in iron ore prices, drove Chinese domestic and South East Asian sheet prices higher m/m. The Indian market, meanwhile, was expecting the government’s new budget to include updated trade protection measures which did not come about—sheet prices subsequently fell back. Further, the monsoon season is now weakening construction demand in some markets, though conversely the lack of a monsoon and subsequent water shortage in Chennai and Bengaluru is limiting industrial demand there. Additionally, market liquidity issues have stunted automotive sales and thus sheet demand.

U.S. sheet prices fell rapidly over the past few weeks as demand has failed to live up to expectations. This led U.S. Steel to temporarily idle two furnaces while NLMK Pennsylvania has laid off up to 100 union steelworkers. Prices did find a bottom though as virtually all mills raised prices by $40 /s.ton and now, just two weeks later with the low price offers off the table, Nucor has again raised prices by an additional $40 /s.ton.

Outlook: Steelmaking Costs Limit Further Price Declines

Global sheet prices are expected to stabilize in the near term as production cuts across multiple regions help balance supply with demand. Meanwhile, steelmaking costs, particularly from iron ore, will continue to provide a price floor unless crude steel production cuts are enough to loosen the iron ore market or at least sentiment, and prick the current price bubble.