Market Data

August 2, 2019

CRU: Consumer Spending is the Major Driver of GDP Growth

Written by Tim Triplett

By CRU Principal Economist Lisa Morrison

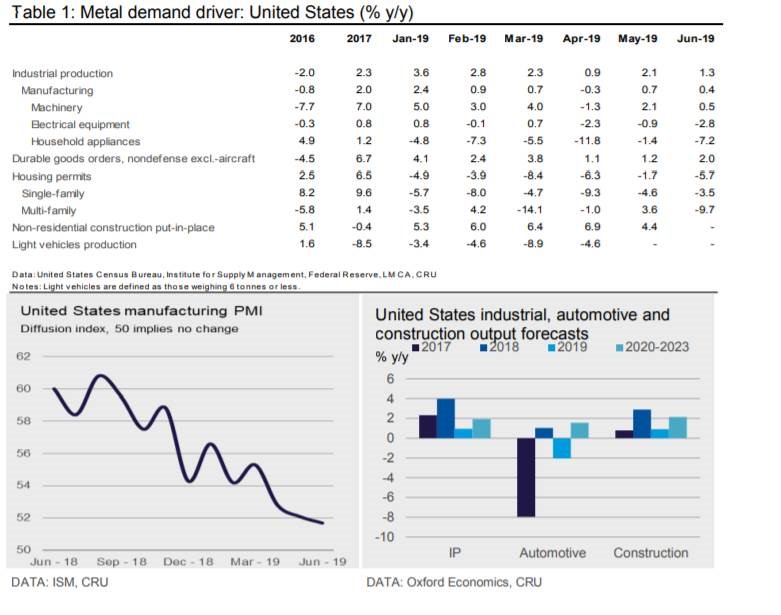

Total IP contracted q/q in both Q1 and Q2, but the June report pointed to potential stabilization in manufacturing. YTD through June, total IP is up 2.2 percent y/y, but it is averaging just 1 percent higher than in 2018. Since we expect little expansion during H2, we now forecast total IP growth of 0.9 percent in 2019, increasing to 1.5 percent in 2020 (barring any further negative impacts from trade policy).

Construction activity continues to ease, contributing to the weaker manufacturing outturn. Total housing starts are now running close to 1.25M units so far this year due to a pickup in multi-family starts during Q2. In 2020, we expect total starts to decrease to ~1.23M units as the high cost of housing constrains demand for single-family homes. Nonresidential construction spending peaked in Q2 2018. The feeble investment spending data released for H1, along with the weaker corporate profits results for Q1, indicate that it is unlikely private sector nonresidential construction outlays will accelerate in H2.

Given the very tepid demand for cars and the end of the upswing in the heavy vehicle cycle, we project total vehicle production to decline to 11.2M units this year, down 2 percent from 11.4M units last year. For 2020, presuming there are no additional tariffs placed on imported cars, we expect a small increase in total vehicle output to 11.3M units. After expanding by 2.4 percent this year, we forecast that GDP growth will slow to a rate of 1.6 percent in 2020, the weakest pace since 2016.

Stronger GDP growth depends largely on two things: the ability of consumers to continue to spend at current levels and the settlement of the trade war with China, which should boost business confidence and lead to stronger investment spending.