Product

August 15, 2019

Service Center Spot Pricing: Some Staying Power

Written by John Packard

The upturn in steel prices appears to have some staying power as both service centers and their manufacturer customers reported rising prices in the first half of July, according to findings from Steel Market Update’s latest market trends questionnaire.

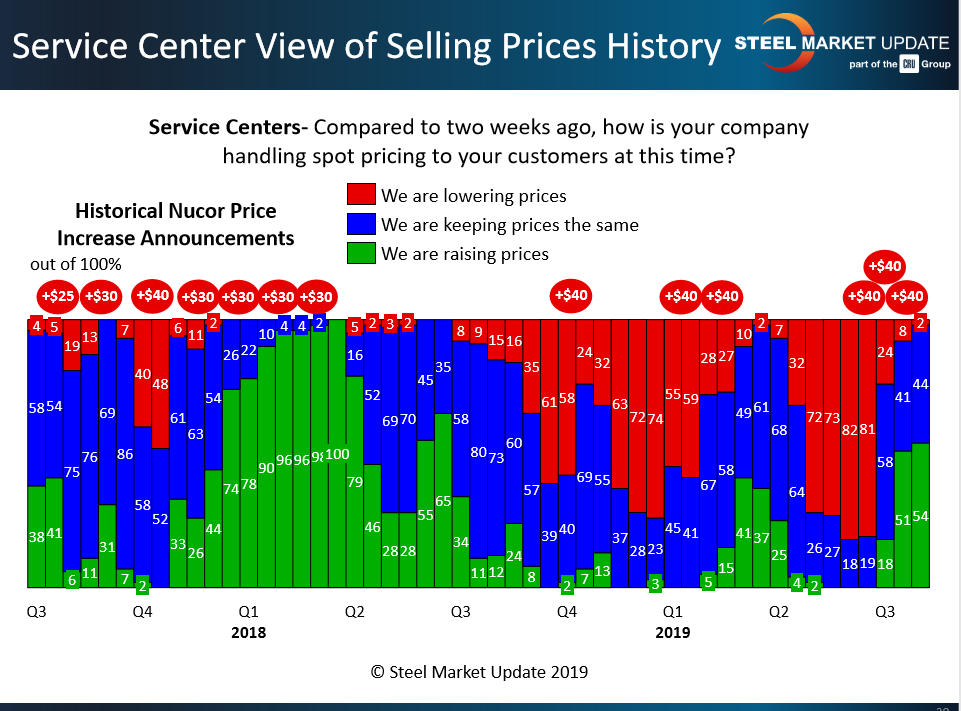

As seen in the chart below, the majority of service centers (54 percent) said they are raising prices to their customers, up from just 18 percent last month. Nearly all the rest are holding the line on prices. Only 2 percent admit they continue to discount to secure sales.

Steelmakers have announced three $40-per-ton increases on flat rolled products since late June, and two $40 hikes in plate prices this month, managing to reverse the downward slide in steel prices. The benchmark price for hot rolled began 2019 around $730 per ton and slid by more than 25 percent in the first half to a low around $520. Since then, following the mill price increases, hot rolled has rebounded to $585 per ton.

The mill price hikes are clearly receiving some support from the service centers. As the chart shows, service centers passed what SMU calls the “point of capitulation” in June when 82 percent reported lowering prices. While it may seem counterintuitive, when the number of service centers lowering prices reaches 75 percent, that historically has signaled a tipping point at which distributors begin to raise prices to protect the value of their inventories.

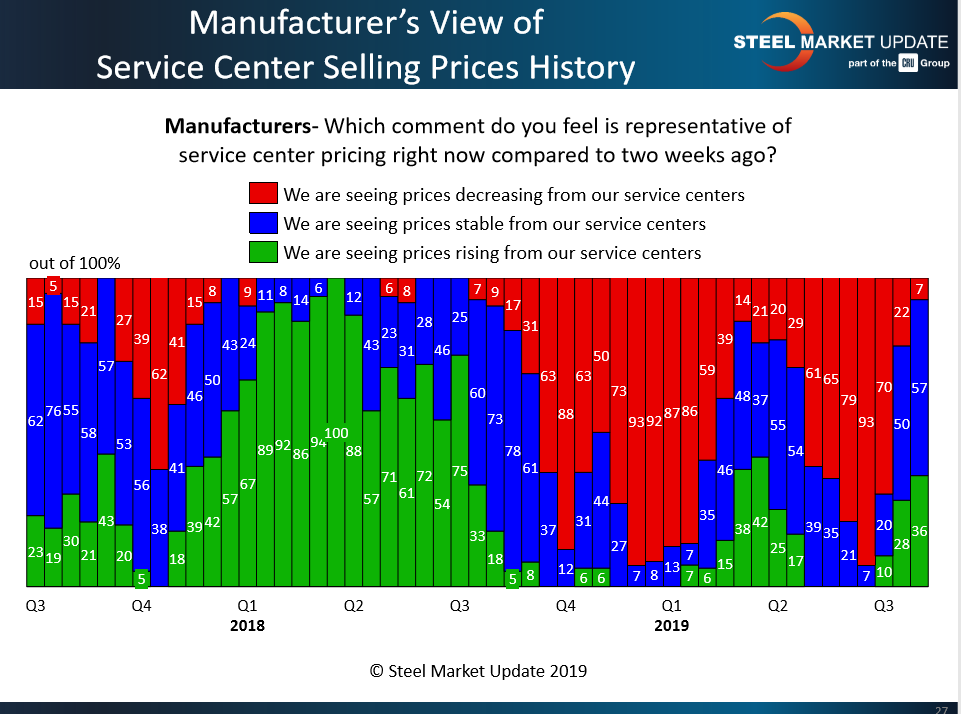

Corroborating the trend, just 7 percent of the manufacturers responding to SMU’s questionnaire said they are still seeing lower prices from their service center suppliers. That’s down from 70 percent at the beginning of the third quarter. Thirty-six percent said they are now seeing higher prices from service centers. The biggest group, 57 percent of the manufacturers, characterize service center prices as stable, neither increasing nor decreasing.

With a small majority of service centers raising prices, but the majority of their customers saying prices are stable rather than rising, that brings into question how much momentum the uptrend can sustain, absent further price increase announcements.