Market Data

October 1, 2019

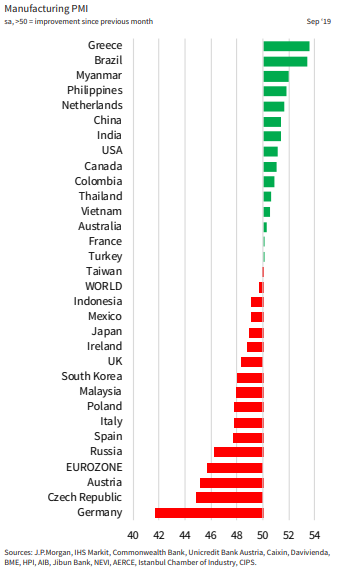

Global PMI Still in Contraction

Written by Sandy Williams

The global manufacturing sector remains in contraction but is beginning to stabilize, says the latest report from J.P. Morgan and IHS Markit. The J.P. Morgan Global Manufacturing PMI rose for a second month in a row reaching 49.7, although still below the 50 neutral point.

Global manufacturing production was mostly stagnant as new order volumes remained weak. Export orders declined for the 13 month including in the U.S., China, Germany and Japan.

In the larger industrial countries, China and the U.S. saw the most growth while Japan and the Eurozone fell deeper into contraction.

Business optimism was unchanged from the series record low set in August.

The Eurozone PMI fell to 45.7 from 47.0 in August for it lowest reading since October 2012. Demand was weaker at home and abroad and output was in freefall. Other than Greece and the Netherlands, at 43.5 and 51.6, respectively, the rest of the region was at no-change or in contraction.

“The health of the Eurozone manufacturing sector went from bad to worse in September, with the PMI survey indicating the steepest downturn for nearly seven years and sending increasingly grim signals for the fourth quarter,” commented Chris Williamson, chief business economist at IHS Markit.

“There’s likely worse to come with forward-looking indicators (such as the orders-to-inventory ratio) deteriorating further during the month,” added Williamson. “Businesses also remain downbeat about the year ahead, with optimism around a seven-year low amid trade war worries, signs of slowing global economic growth and geopolitical concerns, including heightened anxiety over a disruptive Brexit.”

The China manufacturing sector showed growth in September with an improvement in production and new orders. The Caixin China General Manufacturing PMI posted 51.4, up from 50.4 in August. Domestic demand improved as new export orders continued to decline, albeit at a slower rate.

“Central policymakers have recently been emphasizing the strong growth in the domestic market,” commented Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group. “Faster construction of infrastructure projects, better implementation of upgrading the industrial sector, and tax and fee cuts are likely to offset the influence of the subdued overseas demand and soften the downward pressure on China’s economic growth.”

The manufacturing PMI in Russia was at is lowest level since 2009. Operating conditions deteriorated at the fastest rate in more than a decade as production and new orders contracted sharply. The PMI dropped to 46.3 from 49.1 in August. Optimism plummeted as firms reported weak demand and loss of clients. The Central Bank of Russia cut interest rates in response to subdued inflationary pressures, lower domestic demand and a slowdown in global manufacturing. IHS Markit expects further rate reductions going into 2020.

The manufacturing PMI in Canada inched out of contraction to post a 51.0 for September. New orders, output and exports made gains during the month while job creation reached a seven-month high. The rate of cost inflation slowed for a third month and firms reported declining steel prices. Output prices rose slightly in response to input costs. Input delivery slowed with manufacturers noting shortages of some materials and issues with transport.

“The latest PMI figures for Canada provide some cause for optimism at the end of the third quarter,” said Andrew Harker, economics associate director at IHS Markit. “Tentative signs of demand improving helped firms secure greater volumes of new business and increase production slightly, though conditions clearly remain challenging.”

Manufacturing weakness was evident in Mexico during September. The PMI was nearly unchanged at 49.1 last month, compared to 49.0 in August. Production decreased for the fourth month due to economic conditions and weak demand. Business sentiment was generally subdued despite strengthening to a four-month high. Some firms reported an increase in new orders while others said a reduced plant capacity, a sluggish economy and weak demand negatively impacted order books.

“Mexico ended the third quarter of 2019 with its worst manufacturing performance in the eight-and-a-half-year survey history, owing to a record deterioration in business conditions in August and a broadly similar performance in September,” commented IHS Markit Principal Economist Pollyanna De Lima.

The IHS Markit U.S. Manufacturing PMI reached a five-month high in September posting 51.1 in September, a 0.8 gain from August.

“News of the PMI hitting a five-month high brings a sigh of relief, but manufacturing is not out of the woods yet. The September improvement fails to prevent U.S. goods producers from having endured their worst quarter for a decade. Given these PMI numbers, the manufacturing recession appears to have extended into its third quarter,” commented Williamson.

Williamson added that subdued orders may continue into the fourth quarter with production supported by reduction of back orders. Business sentiment was characterized as “stuck at gloomy.”

“The current situation contrasts markedly with earlier in the year, when companies were struggling to keep up with demand,” said Williamson. “Now, spare capacity appears to be developing, which is causing firms to curb their hiring compared to earlier in 2019 and become more cautious about costs and spending.“