Overseas

October 3, 2019

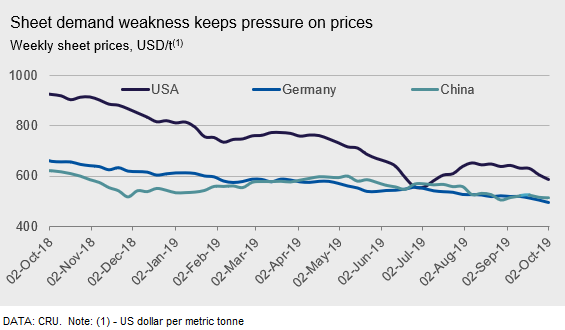

CRU: Global Sheet Price Decline Worsens

Written by Tim Triplett

By CRU Principal Analyst Josh Spoores

Sheet prices in North America have taken another step down this week losing $15-17 /s.ton w/w. Industrial demand remains limited as evidenced by the most recent ISM Purchasing Manager’s Index, which showed another contraction. Adding to this structurally weak demand environment is the ongoing strike at General Motors. This strike, now in its third week, is only beginning to affect sheet demand. As this strike continues, we will further lower our sheet price forecast as supply and demand become further unbalanced.

West Coast sheet mills have adjusted their prices down to compete with declining prices offered by Midwest mills. Negativity about slowing demand and sliding scrap prices prompted mills to cut prices for November and December orders. The West Coast mills are trying to hold up prices for CR coil and HDG coil, but HR coil remains the weakest product—falling $30 /s.ton w/w.

Europe

Sheet prices fell again across Europe this week. The past four weeks have been tough going for producers, with HR coil prices down by a total of €20 /t in that time. There is little immediate sign of any turn in the market. Demand is weak and increasingly reported to us as weaker than anticipated in the sense that no recovery has happened since the summer. If anything, orders have gotten worse. At some point the market will find itself short on inventory and prices could see a sharp uptick, but that point is certainly not today.

China

There is no market commentary on China this week due to holidays.

Asia

Prices of imported sheet products tumbled on fierce competition between Indian and Russian mills.

For HR coil SAE1006 grade, offers from India dropped to $445 /t CFR Vietnam for November shipment, while the highest bid was only $440 /t CFR Vietnam last week and it dropped to $435 /t CFR Vietnam on Monday. Meanwhile, a trading house was offering Russian materials at $435-437 /t CFR Vietnam for shipment at the end of December; this was not included in the price assessment, however, as it was not within the 3-8 week shipment window.

For HR sheet/coil SS400 grade, a major Chinese mill dropped their offer by around $8 /t w/w to $471 /t CFR Vietnam. However, traders were offering this grade at $468 /t CFR Vietnam for Chinese origin and $460 /t CFR for open origin.

CRU assessed HR coil prices at $443 /t, CFR Far East Asia, an $11 /t decrease w/w. CR coil prices were assessed at $520 /t CFR Far East Asia, flat w/w, while HDG prices were assessed at $545 /t CFR Far East Asia, unchanged w/w.