Market Data

October 5, 2019

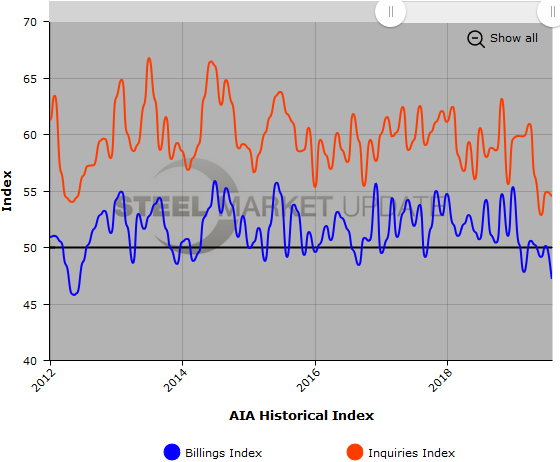

Double Decline for ABI in August

Written by Sandy Williams

The American Institute of Architect’s Architecture Billings Index (ABI) posted a score of 47.2 for August indicating a decline in planning activity for nonresidential construction. The national score for new design contracts was also below the neutral point of 50 at 47.9, a rare occurrence for the two scores. Having both indexes in contraction means less work is coming into architectural firms and less design work is being completed.

Most of the slowdown was in the Midwest with a billings score of 46.4, according to the AIA. The South ABI was 48.2 and the Northeast 49.1. Only the West showed growth in August, posting a reading of 51.2.

Commercial and industrial project planning declined the most in August, after reporting a significant drop in July. Firms focused on multifamily residential or institutional planning saw modest gains in August.

AIA noted that the economy continues to expand but at a much slower pace. Payroll gains are slowing and manufacturing has seen a modest decline due to weaker demand from key trading partners.

“Weaker export markets, coupled with ongoing concerns over tariffs on imported goods, both already imposed or threatened, has helped to push down business confidence scores to levels last seen as the economy was emerging from the Great Recession,” said AIA.

The slowdown in design activity in the U.S. is prompting architectural firms to seek new work abroad. Only about 10 percent of firms are currently working on international projects, 13 percent have had international projects within the past five years and another 13 percent have projects planned for the near future. Nearly 35 percent of firms say they have no specific plans to pursue international projects, but might consider doing so for the right project.

“Of the more than $10 trillion spent annually on international construction activity, the U.S. has only about a 12 percent market share,” said AIA. “And much of the growth in construction activity will come not from developed areas like Western Europe and Japan, but rather from China, India, Central and South America, and the Middle East and Africa.

This month, Work-on-the-Boards participants are saying:

“Cash flow has significantly tightened over the summer. Clients are holding on to money and not releasing it. Our accounts receivable is already over 120 days and growing.” — Five-person firm in the Northeast, commercial/industrial specialization

“Tariffs affect agricultural business, which affects the regional economy, which affects public sentiment, which places public bonds and public projects at risk.” — Twenty-six person firm in the Midwest, institutional specialization

“With construction costs so high, we are hearing rumblings of a slowdown. It hasn’t hit yet, but there are signs.” — Twenty-five person firm in the South, mixed specialization

“There is plenty of work, although there does seem to be more projects with delayed starts.” — Thirty-six person firm in the West, commercial/industrial specialization

The ABI is considered a leading economic indicator of construction activity, and reflects the approximate nine- to 12-month lead time between architecture billings and construction spending. The survey panel asks participants whether their billings increased, decreased or stayed the same in the month that just ended. The regional and sector categories are calculated as a three-month moving average, whereas the national index, design contracts and inquiries are monthly numbers. The monthly ABI index scores are centered on the neutral mark of 50, with scores above 50 indicating growth in billings and scores below 50 indicating a decline.

Below is a graph showing the history of the AIA Billings and Inquiries Indices. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.