Prices

October 10, 2019

CRU: Worst-Case Scenario in U.S.: GM Strikes as Scrap Costs Collapse

Written by Tim Triplett

By CRU Principal Analyst Josh Spoores

The North American sheet market has taken a turn for the worse. At a time when sheet demand and prices have already been stunted by a weaker trend of industrial growth and sheet demand, two recent events are only now starting to affect sheet prices: an on-going strike at General Motors (GM) and lower scrap prices.

The GM strike, which started on Sept. 15, was not in our base forecast. This strike is now in its fourth week and is only now starting to have an impact on a key source of steel demand. Due to the nature of supply chain logistics in the auto industry, mills today are producing steel that is not on track for immediate consumption. This strike has lasted long enough to send sheet products to other markets due to this lack of demand from GM.

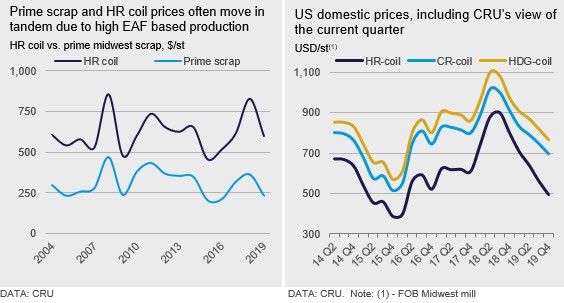

As for scrap, prices here are a key indicator for steel products in the U.S. This is because around two in every three tonnes of steel produced in the country are via EAF assets. Often, changes in scrap prices can lead to the same changes in finished steel prices, such as sheet. Prime scrap in the Midwest (CRU assessment is #1 Busheling, Great Lakes) fell from $300 /l.ton in August to $260 /l.ton in September and is now set to fall another $40 to $220 /l.ton in October. Based on this cost decline, it is not unreasonable to expect further declines in sheet prices in the near term (see chart).

Like scrap, sheet prices have fallen back from their recent high in August. The price of HR coil has seen the largest movement of all sheet prices with our recent assessment at $511 /s.ton, a decline of $62 /s.ton from our Sept. 11 price. The price of CR and HDG coil products have also fallen back, though their spread over HR coil remains wide. Our current HDG coil price of $789 /s.ton is reflective of a base price of $721 /s.ton and a coating weight extra of $68/s.ton for G90 .06” substrate.

For the U.S. West Coast market, sheet prices remained unchanged this week, though lower m/m. Buyers here continue to assess what pricing could be achieved from the West Coast and Midwest mills, while also weighing import options for next year. Buy-side sources said they expected further price cuts, which kept them risk-averse about placing new orders.

In Mexico, significant falls were assessed which ended the brief two-month trend of rising prices. Domestic HR coil prices have fallen by around 8 percent m/m and CR coil dropped by around 7 percent m/m. Lower international prices, particularly in the U.S., have influenced the developments in Mexican prices. Also, weakness in the domestic market, especially in the automotive sector, has prevented prices from rising. Not even the recent announcement of the extension of the 15 percent import tax on steel products (including sheet) was sufficient to offset the weakness in domestic prices.

Outlook: Scrap May be at Multi-Year Low, Yet Sheet Prices Have More Near-Term Weakness

As mentioned earlier, industrial growth is slowing and is weighing on sheet demand. Specifically, the last two Purchasing Managers Index readings from the ISM have shown an overall manufacturing environment that is contracting. The now prolonged GM strike has yet to affect economic data and it is likely to worsen the overall manufacturing contraction and negatively affect both sheet demand and prices in the near term.

Due to the GM strike as well as scrap prices falling further than previously anticipated, we will be revising our sheet price forecast down later this week. Recent inventory data has given hints that service center inventory may now be quite low, yet with short lead times and seasonal demand weakness up ahead, inventories could fall further, though there is a limit to these declines. Additionally, with scrap prices falling not only due to weak demand for finished steel but also due to multiple shutdowns in October, we see the opportunity that prime scrap may now be at a multi-year low. Therefore, further sheet price weakness may be at hand, though a rebound is also likely to take place in the next few months as seasonal demand weakness and low scrap prices ultimately reverse course.