Prices

November 5, 2019

License Data Shows Steel Imports Down in November

Written by Brett Linton

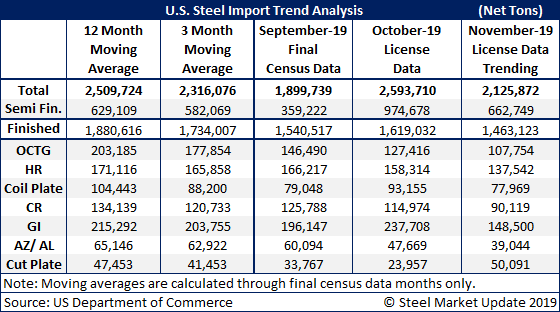

Two-thirds of the way through the month, steel imports into the United States are trending significantly lower in November compared with the prior month and averages for the year. Steel Market Update projections based on Commerce Department license data estimate imports will total about 2.1 million tons this month, well below the average for the past 12 months of 2.5 million tons.

The decline in semifinished imports to about 663,000 tons accounts for much of the decrease compared with October. Mills stocked up on nearly one million tons of slabs in October, the first month of the fourth quarter, to secure raw materials ahead of quarterly quota limits.

Imports are trending lower in November versus October in every product category except cut plate, perhaps indicating some seasonal weakness in demand. November is on track to see finished steel imports of less than 1.5 million tons.

See the chart below for more detail.