Market Data

December 20, 2019

Update on Manufacturing Indicators in December

Written by Peter Wright

Based on Steel Market Update’s analysis of 10 indicators, there is a faint glow in the manufacturing environment.

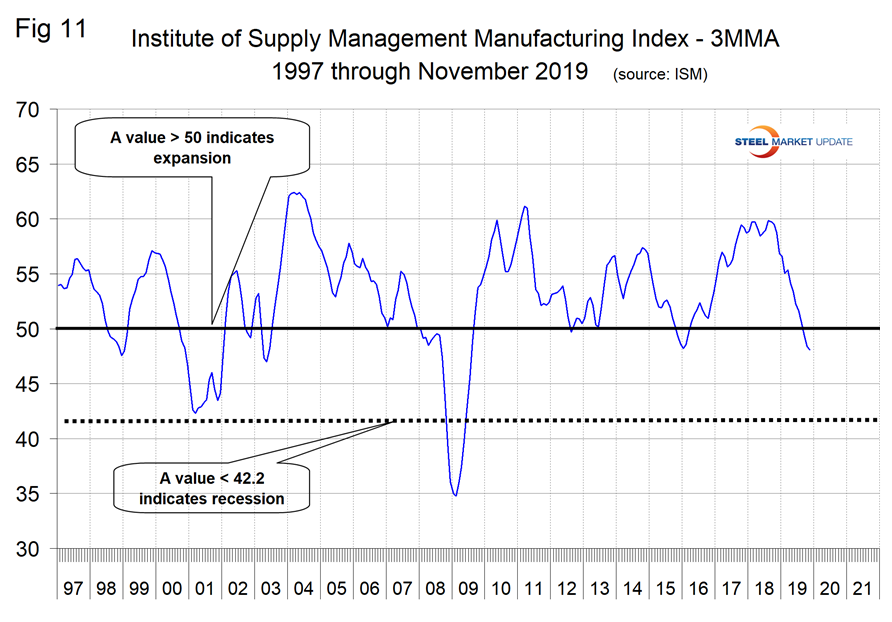

This report summarizes 10 data streams that describe the state of U.S. manufacturing in general and the steel industry in particular. We have reported on most of these separately in our Steel Market Update publications, and therefore will be brief in this summary. We don’t expect these data sources to all point in the same direction. Our intent in summarizing them in one document is to provide a consensus of the state of this critical steel consuming sector. In data released in December, the year-over-year growth rate of nine of the 10 data streams was negative on a 3MMA (three-month moving average) basis and one was positive. The faint glow is that four of the 10 declined more slowly in the data released in December. Figure 1 is a summary of data received in December and shows the year-over-year percentage change on a 3MMA basis. The summary sheet shows directional arrows comparing December data releases to November’s data. Based on American Iron and Steel Institute estimates of steel mill shipments by market classification, almost 50 percent of the steel consumed in the U.S. is manufacturing-oriented. This breaks down to about 27 percent in ground transportation, 9 percent in machinery and equipment, 5 percent in appliances, 4 percent in defense and about 4 percent in containers.

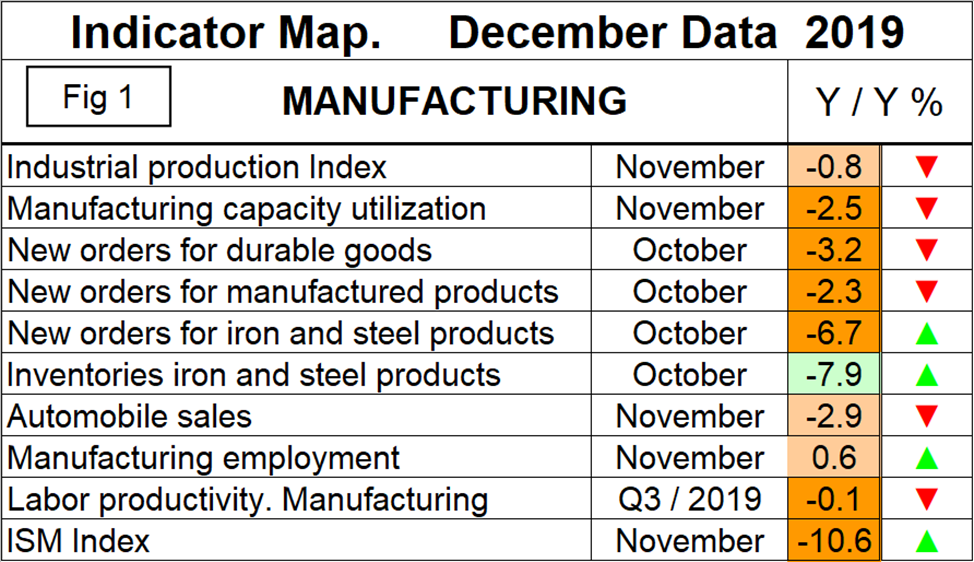

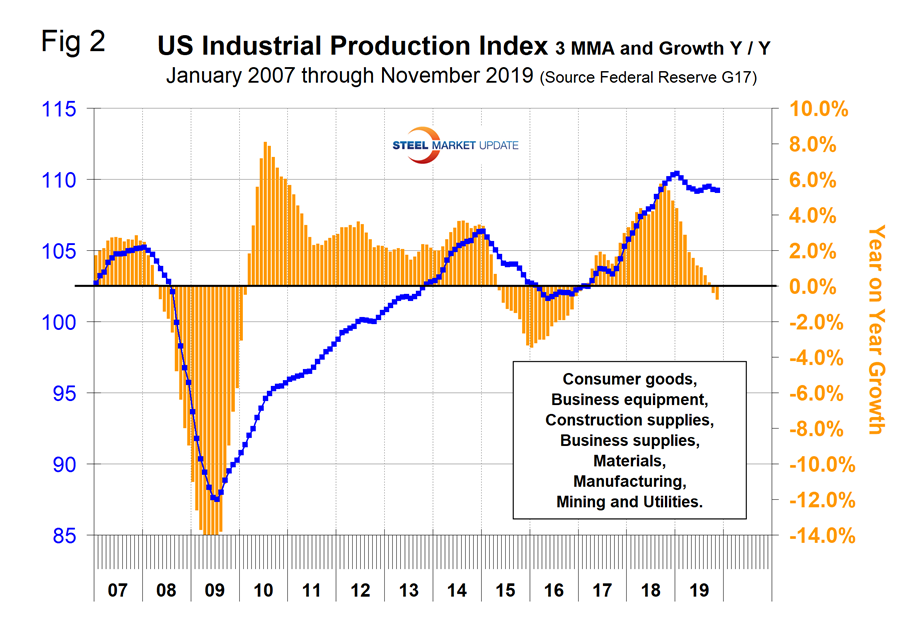

The Industrial Production Index

Figure 2 shows the 3MMA of the IP index since January 2007 as the blue line and the year-over-year growth as the brown bars. March 2017 was the first month of positive growth in the 3MMA since April 2015. Year-over-year growth peaked at 5.8 percent in September of last year and has contracted every month through November when it reached negative 0.8 percent. Manufacturing capacity utilization improved from 74.48 percent in January 2017 to 77.01 percent in December last year and has declined in 2019 to 74.93 percent in November with a negative year-over-year growth rate of 2.5 percent on a 3MMA basis (Figure 3).

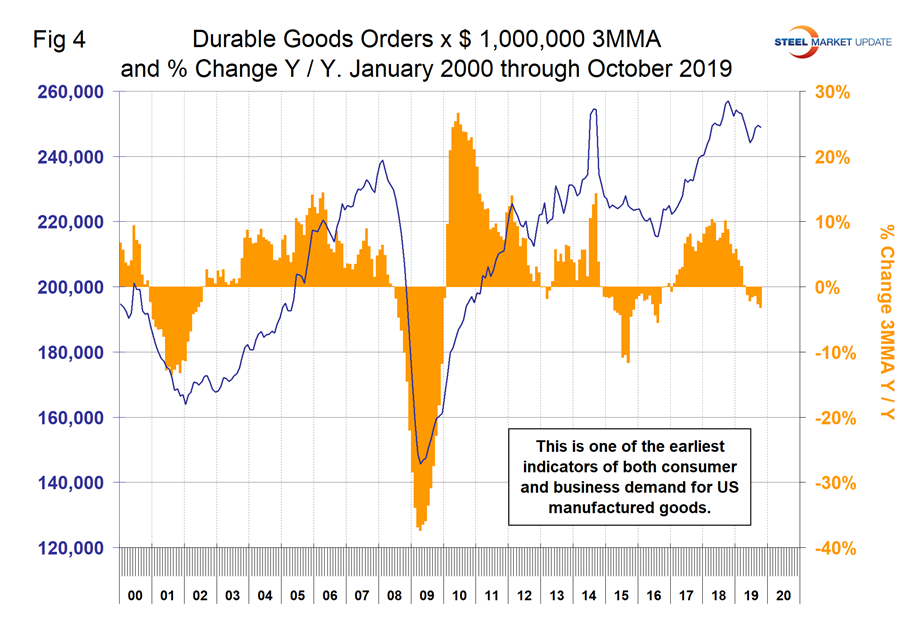

New Orders for Durable Goods (Advance Report)

The year-over-year growth rate of durable goods reached 10.1 percent in September last year and since then declined to negative 3.2 percent in October. Figure 4 shows the 3MMA since January 2010. This is considered to be one of the earliest indicators of both consumer and business demand for U.S. manufactured goods. Orders have picked up since May this year, but year over year are still in negative territory.

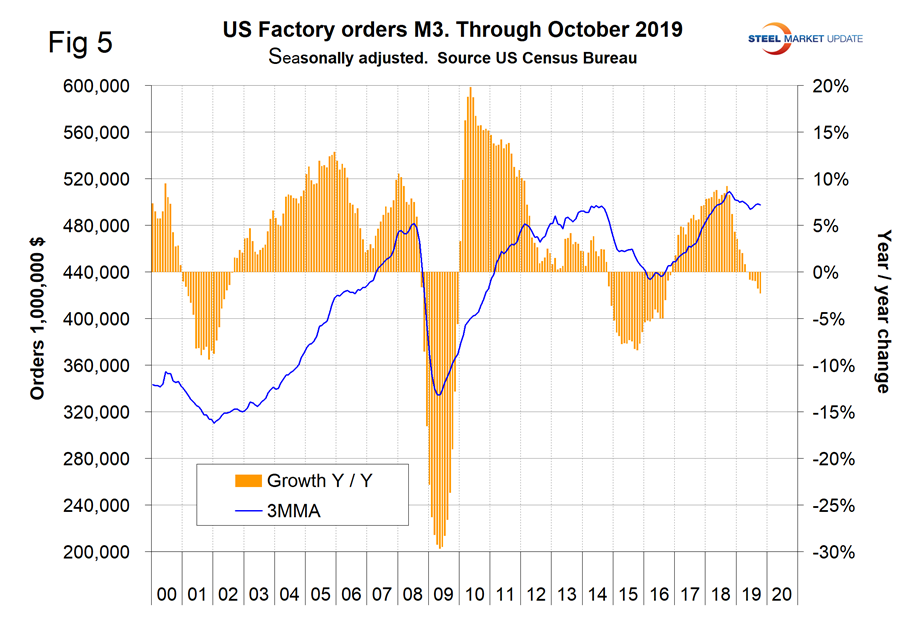

New Orders for Manufactured Products

The growth rate of new orders for manufactured products as reported by the Census Bureau declined for 13 straight months on a 3MMA basis since September last year through October 2019 when it reached negative 2.3 percent (Figure 5).

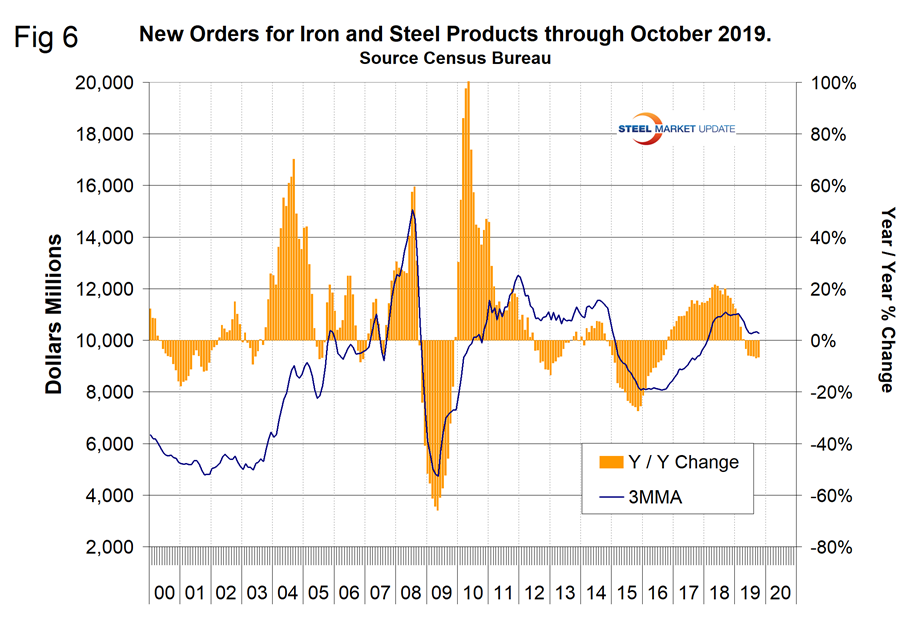

New Orders for Products Manufactured from Iron and Steel

Within the Census Bureau M3 manufacturing survey is a subsection for iron and steel products. Figure 6 shows the history of new orders for iron and steel products since January 2000. This is the first faint glow on the manufacturing horizon. The year-over-year growth rate declined by 6.6 percent, which was a slight improvement from September when the growth rate declined by 6.9 percent.

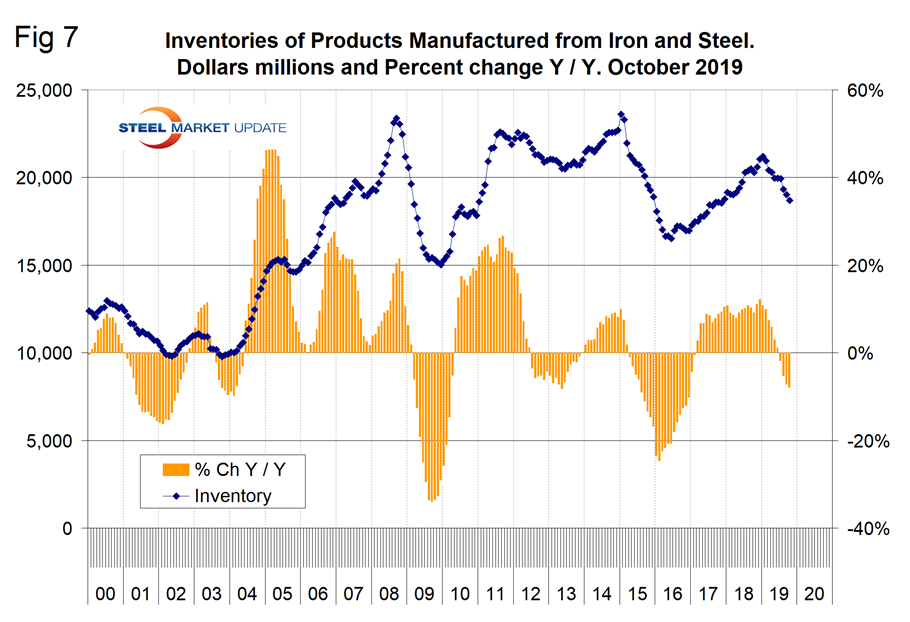

Inventories of Products Manufactured from Iron and Steel

The only indicator showing a year-over-year improvement in this whole report is inventories of iron and steel products, which declined by more than new orders; therefore, we rated this indicator as having a positive direction in Figure 1. The inventory build was at a rate of 12.2 percent year over year in December and fell every month through October when it was negative 7.9 percent (Figure 7).

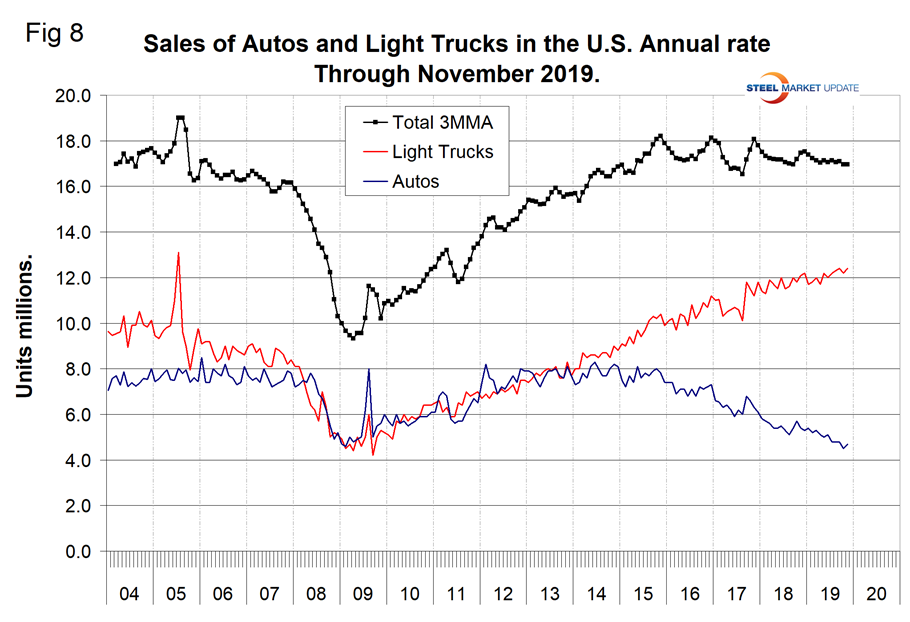

Light Vehicle Sales in the U.S.

Year over year on a 3MMA basis, light vehicle sales were down by 2.9 percent in November when sales totaled 17.1 million units annualized and were comprised of 72.5 percent light trucks and 27.5 percent autos. Light vehicle sales have trended down slightly in the last three years as measured by the cyclical peaks. The declining sale of the auto component in the last three years has resulted in GM closing several small car plants. The light truck category includes SUVs and crossovers. Overall, sales are still higher than the pre-recession level of 2007 (Figure 8). Import market share in November was 22.8 percent, which was normal for the last two years.

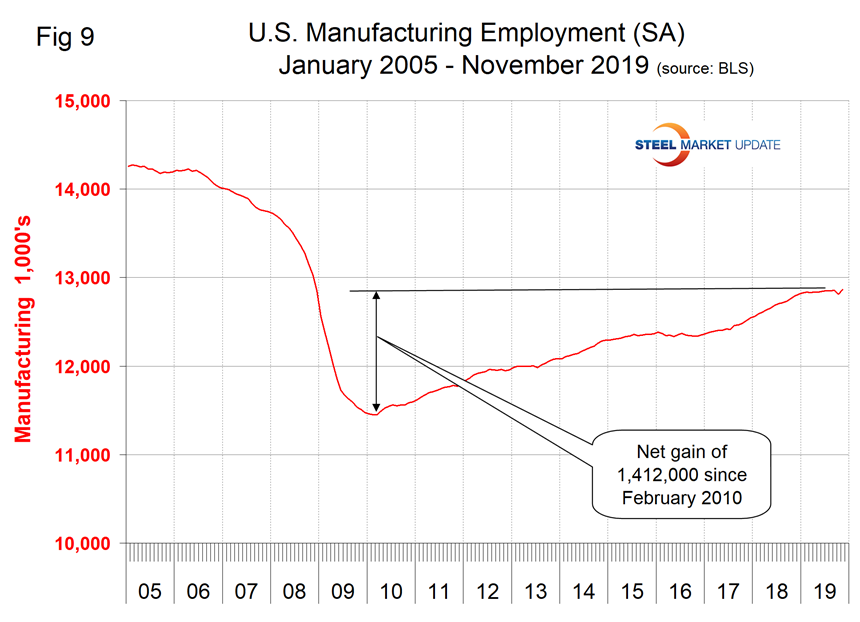

Manufacturing Employment

Manufacturing employment plummeted during the recession and gradually improved from the spring of 2010 through 2014. Growth was flat in 2015 and declined slightly in 2016 when 23,000 jobs were lost during the year as a whole. There was a turnaround in 2017, and in the 12 months of 2018, 264,000 jobs were created. The annualized rate of manufacturing job creation in the first 11 months of 2019 was 61,000. Lost manufacturing jobs caused by the GM strike were recouped in November, but overall job growth in manufacturing has slowed markedly from last year (Figure 9). Year over year, manufacturing employment grew by 0.6 percent in November on a 3MMA basis, which was a small improvement from October. The motor vehicles and parts subcomponent of manufacturing employment had a net loss of 15,000 jobs in the first 11 months of 2019.

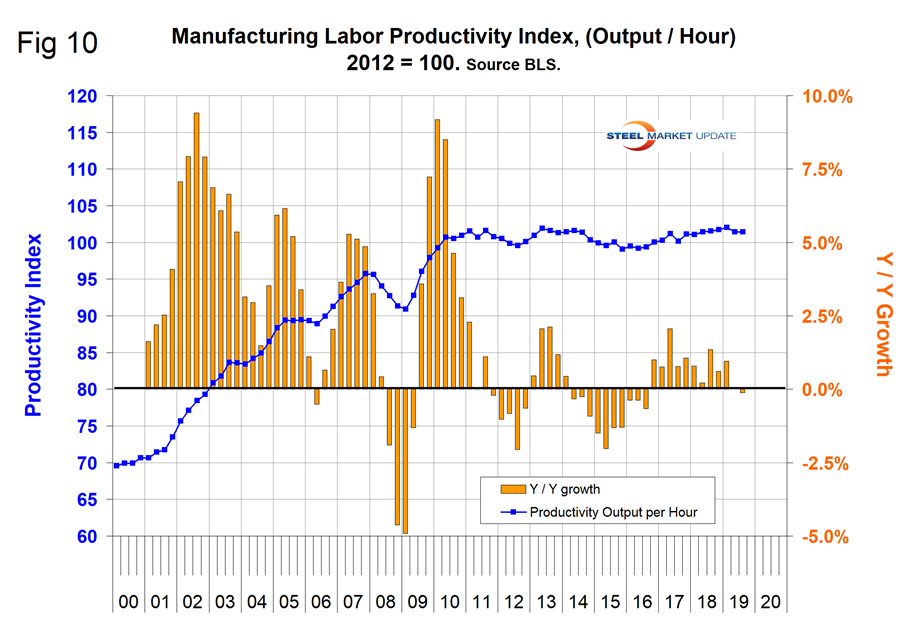

Manufacturing Productivity

The Bureau of Labor Statistics reported that in Q3 2019 manufacturing productivity declined by 0.1 percent, down from an average of positive 0.74 percent in the four quarters of 2018 (Figure 10).

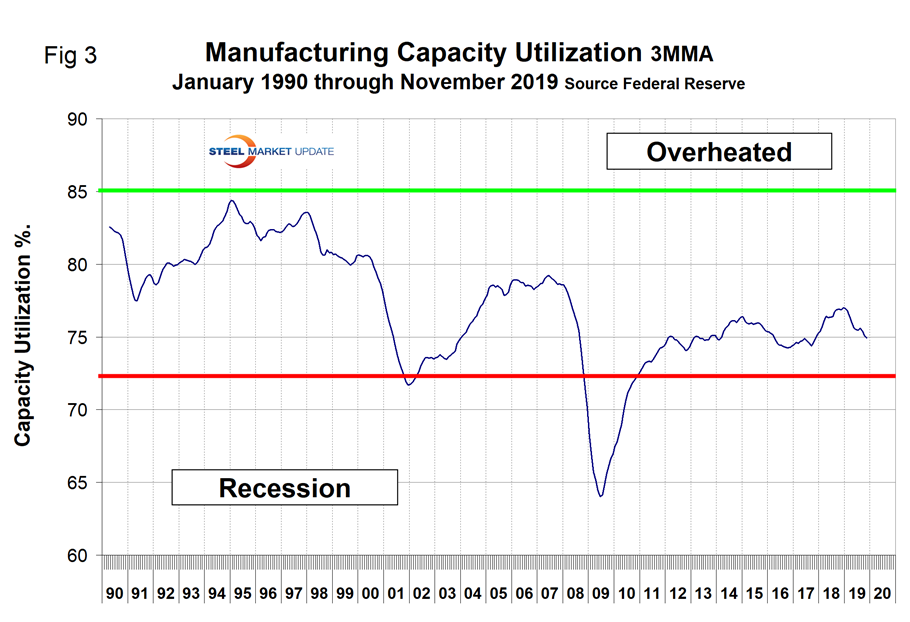

The ISM Manufacturing Index

The Institute for Supply Management’s Manufacturing Index is a diffusion index. ISM states: “Diffusion indexes have the properties of leading indicators and are convenient summary measures showing the prevailing direction of change and the scope of change. An index value above 50 indicates that the manufacturing economy is generally expanding; below 50 indicates the opposite.” Figure 11 shows the 3MMA of the ISM index from January 1997 through November 2019. The index surged from January 2016 through October 2017, leveled off through October 2018, and has declined since. The index had a value of 48.1 in November with a 3MMA of 48.07. The 3MMA was down by 10.63 points year over year, which was a slight improvement from October when it was down by 11.13 points. September 2019 was the first month for the 3MMA of the index to be below 50 since March 2016.