Analysis

January 8, 2020

Dodge Index Indicates Potential Setback for Construction Spending in 2020

Written by Sandy Williams

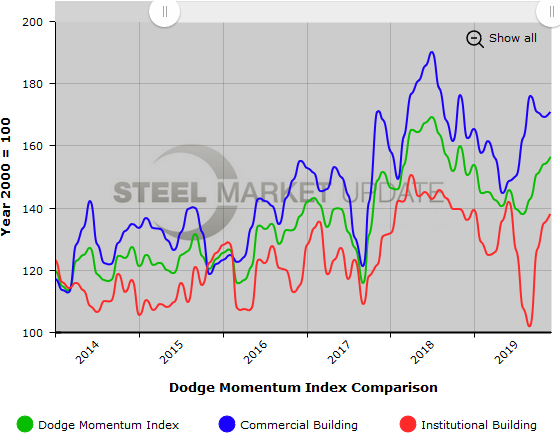

A leading indicator of nonresidential construction spending rose in December, but yearly data suggests construction spending may see a slowdown in 2020. The Dodge Momentum Index, a monthly measure of the initial report for nonresidential building projects in planning, gained 1.5 percent last month for a reading of 156.2. Planning for institutional projects rose 2.3 percent, while the commercial component rose 0.9 percent.

The Momentum Index averaged 149.9 in 2019, a decline of 3.7 percent from the previous year. The average for the institution component fell 5.9 percent and the commercial component 2.3 percent compared to the averages in 2018.

“Last year’s slip in the dollar value of projects entering planning suggests that construction spending for nonresidential buildings could see a setback in the year to come,” said Dodge Data & Analytics. “However, the Momentum Index did end the year on a high note indicating that a decline in 2020 construction is likely to be modest in nature.

Thirteen projects valued at $100 million or more entered the planning stage in December.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.