Prices

February 10, 2020

CRU: U.S. Ferroalloys Trade Lower

Written by Estelle Tran

By CRU Prices Analyst Estelle Tran, from CRU’s Bulk Ferro Alloys Monitor

The steel market got a stronger than expected start to the year, lifting year-to-date U.S. steel mill capability utilization to 82.1 percent—the highest level since May 2019, according to the American Iron and Steel Institute. The Institute for Supply Management reported that the U.S. manufacturing purchasing managers’ index (PMI) moved back into expansion territory in January with a reading of 50.9, ending a five-month period of contraction that began in August. Seasonal restocking has bolstered steel demand and, as a result, the ferroalloys market has seen end-users increase offtake from their long-term contracts.

Market activity across the North American sheet market slowed ahead of year-end holidays, but picked up momentum as buyers reengaged with the market in January. HR coil prices increased by 4.5 percent m/m to $582 /s.ton in January, and prices for rebar, merchant bars and wide-flange beams increased by approximately 5 percent in January as well.

Sheet steel prices appear to be close to the top of the current cycle at the beginning of February, however, we expect consumption to remain steady. Lead times for all sheet products have continued to rise as order rates remain strong. Longs prices have increased with scrap prices and the boost in seasonal demand in January. Since October, scrap prices have increased by $80 /l.ton, which has attracted more inbound scrap. There are signs that mill scrap purchases will be down $10-20 /l.ton this month, which is not unusual for February.

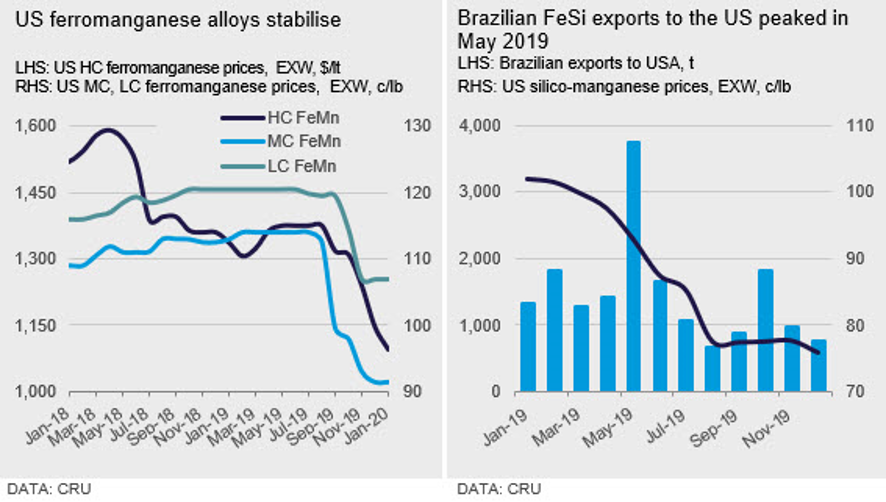

FeMn Prices Mostly Stable

U.S. HC FeMn prices have stabilized in January after correcting in late December. Average prices for HC FeMn in January fell by 4.4 percent m/m to $1,096.1 /l.ton, EXW, from $1,147.7 /l.ton, EXW. This price decrease was mostly because of falls that started in the second half of December. Market sources in the U.S. see prices flat, despite prices in Europe increasing.

Prices for MC and LC FeMn were unchanged in January, holding at 91.5 c/lb and 107 c/lb, EXW, respectively. Sellers said there was no reason for prices to soften with Mn ore prices holding at their current levels and demand from steel mills remaining strong at the start of the year. The spot market has been largely inactive, with single truckload transactions confirmed at current price levels.

The U.S. EMM market softened in January because of limited spot activity. However, that trend could come to an end in the near term as replacement costs from both China and Europe are on the rise. Concerns that the novel coronavirus in China could cause reduced exports have allowed sellers both in China and Europe to push up prices. These higher costs will likely impact the U.S. market in the coming weeks and offers have already been reported above 100 c/lb, EXW. If EMM prices do move higher, this may also see buyers opt for refined FeMn prices, if availability becomes tight and the impact of the virus on supply causes longer-term disruptions to supply.

FeSi Prices Show Strength

U.S. FeSi sellers have been trying to raise prices in the last few months, citing higher replacement costs. There has been success in pushing prices up to the low 80s c/lb level for small volumes on an EXW basis, although most transactions have been in the mid-to-upper 70s c/lb.

Prices have been slow to increase, though, as some sellers have been able to sell lower cost inventory at prices below 75 c/lb. The range of spot prices in the U.S. market has therefore widened, but the trend is higher. U.S. 75 percent FeSi prices increased by 1.2 percent m/m to 76.8 c/lb, EXW, in January from 75.8 c/lb, EXW. Demand has been strong, contributing to supply tightness, however, market sources do not see prices increasing significantly, as replacement costs from Brazil have been steady.

SiMn Prices Likely to See Downward Pressure

U.S. SiMn prices remained flat for the third consecutive month in the absence of an increase in spot demand. The U.S. SiMn spot market has been illiquid in the last few months, as buyers have negotiated long-term deals at lower levels.

There is not likely to be any change to prices until negotiations start for Q2, and with any new spot bookings there is the possibility that prices could fall. SiMn prices held at 60 c/lb, EXW, in January. The U.S. spot market did not see the downtrend that occurred in Europe in Q4, and now that prices have risen in Europe, we do not expect U.S. prices to follow European prices higher.

Outlook: EMM and Refined Mn Alloys to Rise?

We don’t expect to see Mn and Si alloy prices increase significantly over the next month apart from those markets where the novel coronavirus has the potential to disrupt supply from China. EMM prices saw sharp increases in Europe at the end of January as a result of fears that export material would not be available and we would expect to see U.S. prices also increase, especially if the impact of the virus is long term. China controls around 95 percent of the EMM market. This could see prices for refined FeMn alloys increase if supply of EMM is disrupted, and tighter availability of EMM makes MC and LC FeMn prices more attractive. CRU’s most recent analysis of the impact of the novel coronavirus on commodity markets can be found via this link.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com