Overseas

March 26, 2020

CRU: Global Steel Prices Are on the Precipice

Written by George Pearson

By CRU Prices Analyst George Pearson, from CRU’s Steel Monitor

In the U.S. Midwest market, sheet prices were split this week. The price of HR coil fell $21 /s.ton to $561 /s.ton while CR and HDG coil prices fell by only $1-$3 /s.ton to $770 and $747 /s.ton, respectively. The spread between HDG coil and HR coil is now $186 /s.ton, an increase from $168 /s.ton last week.

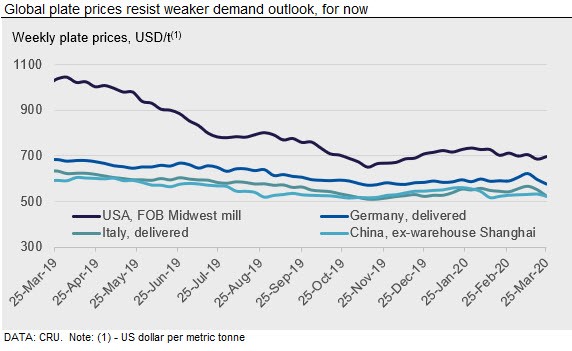

Overall volume for HR coil was lower w/w, yet still represented multiple transactions and was in fact higher than volume recorded just two weeks ago. Plate prices, meanwhile, increased, gaining $10 /s.ton w/w after falling $18 /s.ton last week. Over the near term in 2020 Q2, we expect to see a large drop in scrap prices as well as serious decline in sheet and plate prices.

Due to numerous government orders to limit activity outside of the home, there have been several questions from clients about our price. We have published our Prices Business Continuity Plan at this link. Based on our previously stated methodology, we will always publish a price.

In Europe, all but two flat product prices declined between €2-10 /t. New business is low or zero. Many buyers have stepped back and will now look to wait for as long as possible before placing new orders with mills. End-users are closing by the day and in Italy all non-essential businesses have been shut since a government decree on Sunday. Nearly 20 Mt of EU flat products capacity is shutting down. Mills have so far announced a combined total of 18.7 Mt of cuts and the remaining mills are reducing minimum run rates. This does not include the 3.7 Mt already idled in H2 2019. Supply cuts should match demand shortage, but we expect European developments will follow what happened in China as supply takes longer to shut down, creating oversupply and pressuring prices. Although European prices show little movement, price indicators elsewhere show declines. Iron ore fines 62% Fe CFR China has fallen by $9.5 /t in a week to $81 /t. HMS 80:20 scrap CFR Turkey is now around $225-230 /t, down $40 /t in two weeks. HR coil prices in Turkey were offered $20 /t lower last week and falls in CIS export offers were greater than this.

Chinese rebar prices softened this week by RMB40 /t w/w while HR coil prices fell RMB110 /t. Long products demand in China improved over the past week and some traders reported that their cargo lifting activities from the warehouse to end-users had resumed to about 70-80 percent of their level a year ago. Meanwhile, rebar inventory dropped by 5 percent w/w for the first time since the epidemic occurred. However, steel output has increased in the last few days. Some idled BFs have been restarted and the EAF utilization continues to increase. High inventory therefore remained a concern despite demand restarting.

The HR coil futures price fell sharply in the second half of last week. This was mainly due to the bearish sentiment over weak demand in the manufacturing and automotive sectors. Unlike for longs, sheet products face slowing overseas market demand that is expected to be severely disrupted by the pandemic. Along with month-end liquidity issues, the physical market reacted with sharply lower prices.

Looking ahead, the rebar price will remain weak while HR coil price should consolidate at low levels. Having said that, aggressive economic support measures are expected in two government sessions in April and may improve the outlook for demand.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com