Logistics

April 26, 2020

Trucking Braces for Worst Second Quarter on Record

Written by Sandy Williams

The U.S. trucking industry could be facing the worst second quarter on record, says FTR after analysis of the latest Trucking Conditions Index. Steep drops in freight volume and declining utilization rates due to the COVID-19 pandemic will create challenging conditions through this year and into next.

“Although trucking conditions might prove to be comparable to the worst of the Great Recession, the trucking industry – like the rest of the economy – has never seen such an abrupt deterioration,” said Avery Vise, vice president of trucking at FTR. “The need to restock grocery shelves provided a brief boost for some segments, but the economic shutdown now has taken a toll on the whole industry. While an economic restart likely will begin in May, the damage wrought during this period will weaken trucking conditions for months to come.”

The American Trucking Association reported that For-Hire-Truck Tonnage rose 1.2 percent in March to 120.4, but is not likely to continue an upward trend for the near future.

“March was the storm before the calm, especially for carriers hauling consumer staples, which experienced strong freight levels,” said ATA Chief Economist Bob Costello. “But there was a huge divergence among freight types. While freight to grocery stores and big box retailers was strong in March, especially late March due to surge buying by households, freight was anemic in other supply chains, like that for gasoline, restaurants, and auto factories.

Costello expects April tonnage to be very soft due to shutdowns in many areas of the economy.

The American Transportation Research Institute has been tracking GPS data from trucks and found that trucking activity declined 8-10 percent or more in April compared to early February. A spike in activity was noted from February to March as states imposed stay-at-home orders and trucks rushed to deliver emergency medical supplies and fill consumer demand for non-perishable food and paper products. The analysis of satellite data from trucks supported anecdotal information the institute had received.

“The GPS data we use is a valuable tool into what is going on in the economy and the trucking industry right now,” said ATRI President and COO Rebecca Brewster. “We knew from talking to drivers and carrier executives that there were significant impacts on operations as a result of COVID-19, but now, by analyzing this data, we are able to put numbers and data to feelings and anecdotes.”

HDT conducted a survey in late March and early April and found that 53 percent of survey respondents said volume and/or number of loads had decreased. Fifteen percent of that those respondents reported volume/loads down by more than 50 percent. The rapid change in volumes prompted FTR to revise its total truck loadings from a 4 percent dip in 2020 to a drop of more than 9 percent

“As in our prior forecast, segments linked to industrial and construction activity are set to take the biggest hits. The bulk/dump loadings forecast is a drop of nearly 17 percent. The outlook for flatbed is a decline of around 12 percent.”

“As in our prior forecast, segments linked to industrial and construction activity are set to take the biggest hits. The bulk/dump loadings forecast is a drop of nearly 17 percent. The outlook for flatbed is a decline of around 12 percent.”

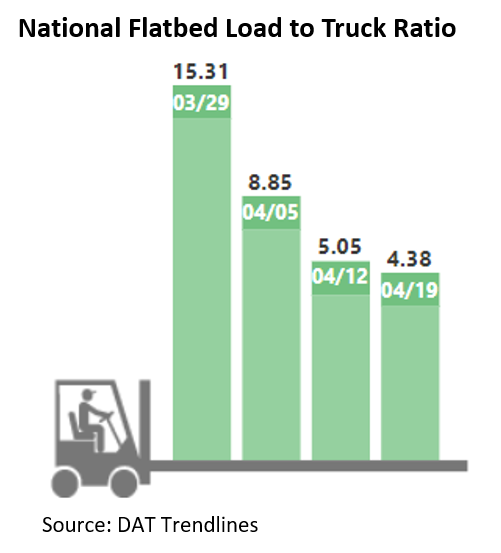

Spot market rates for trucks rose in March, but as shipping slowed due to closure of non-essential businesses, April rates declined. DAT Trendlines reported spot rates fell for vans, reefers and flatbed trucks as volumes decreased. In the week ending April 19, average van rates were $1.68 per mile, flatbed $1.96 per mile and reefer rates fell to $1.95 per mile.

“There’s not much good news for truckers this week,” said DAT, adding that falling spot rates were a sign that a rebound has not started. “The weak freight market reflects the economic malaise due to coronavirus-related shutdowns and historically low oil prices.”

As of April 20, on-highway diesel fuel prices fell to an average of $2.48 per gallon, according to the U.S. Energy Information Administration.

DAT Market Analyst Peggy Dorf wrote, “A few governors have announced phased plans to re-start their states’ economies, starting in May. That’s sure to add some new freight into the pipeline, just as fresh produce harvests gear up in the Southeast and parts of California.

“On the other hand, oil prices have plummeted to historic lows, to the point where short-term futures for West Texas Intermediate (WTI) crude oil are well below zero. If that trend holds, producers will have to pay buyers to take the oil in May. Oil drilling and production generate a lot of freight, especially for flatbed fleets, and when oil prices are negative, drilling just doesn’t pencil out. All that activity will come to a halt, if it hasn’t already, and the freight won’t need to move. Now you have a lot of flatbedders with nothing to do, and they’re hooking up van trailers.”

As the economy begins to cautiously reopen, said ATA President Chris Spear, trucking will be there to help “bridge from crisis to recovery.”

“As crucial as they’ve been in responding to the outbreak and curbing its impact, truckers will be just pivotal now as we turn toward recovery. Trucks have kept rolling while the rest of the country stays locked down, and they’ll remain at the forefront when called to power our economy back up.”