Community Events

April 30, 2020

Construction Faces Stiff Headwinds from Pandemic and Recession

Written by Sandy Williams

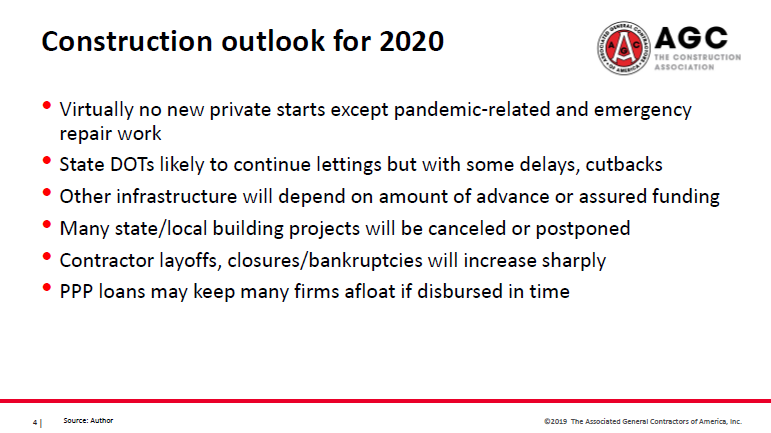

Ken Simonson, self-proclaimed optimist and chief economist for the Associated General Contractors of America, offered a fairly pessimistic forecast for the construction sector during Wednesday’s SMU Community Chat. Real GDP fell 4.8 percent in the first quarter due to the coronavirus shutdowns, he said, the worst quarterly contraction since 2008. “I consider myself an incurable optimist, but not in this case. To see this steep a drop for an event that basically hit in the last three weeks of March is shocking and ominous.”

Half of the contractors responding to AGC surveys have had current projects halted by an owner, governor or mayor, while 28 percent reported future project cancellations. Disruptions and delays are growing steadily, with firms reporting PPE shortages, delays in deliveries of construction materials, equipment and parts, and a shortage of craftworkers. In the latest survey, 49 percent of suppliers said they have received notices that deliveries would be late or canceled.

Some governors are opening businesses too early, he said, creating significant risk of setbacks in combating the pandemic. “That will shake the confidence of developers going forward.”

AIA’s Architecture Billings Index, a predictor of future construction spending, reported a record drop of more than 20 points in March, and hit all-time lows for the project inquiry and design contract indices. The period between project planning and actual construction has become more tenuous, said Simonson. Owners may get projects designed and then find funding isn’t available or demand isn’t there. With thinner portfolios and earning streams shaky, investors will have to look at whether there is enough demand for their proposed projects. “The answer will be no in most cases,” said Simonson.

With the travel industry on shutdown, hotel utilization and construction are now on hold. Some hotels may not reopen and others may do so under a different flag. Before hotel construction can resume, travel needs to resume, said Simonson.

Some state highway projects are going forward to take advantage of reduced traffic during the pandemic, but reduction in tax receipts of all types will cause public agencies to cut back spending. The Department of Transportation reports that fuel tax revenues have dropped 30-50 percent and toll revenues are down 60 percent or more.

Federal infrastructure legislation and reimbursement to states and localities would enable firms to keep general construction going. Hopefully, the government will maintain the construction spending it has already approved, although some dollars have been shifted from military base to border wall construction. Continuation of projects under the Water Resources Act is needed, he said, as well as a renewal of the Highway Trust Fund.

On the institutional side, universities were hit hard by COVID-19, closing campuses, refunding dorm fees, and losing funding for endowments and capital campaigns. Construction spending will be nil as universities focus on reopening and fall enrollment.

Pointing to some positives, Simonson said K-12 construction, funded by property tax and bond issues, could remain on track. As home buying returns, new schools will be needed along with renovations to existing buildings to alleviate crowding. Public funding of water and sewer and federal construction should also maintain momentum long term. Sectors that should pick up relatively quickly include distribution facilities, last-mile type facilities, data centers, cell towers and anything else related to connectivity. Private and institutional construction will be on hold much longer than other areas of the economy, said Simonson.

The pandemic could bring other changes to the construction landscape such as improving space for office workers or eliminating it as more individuals continue to work at home. Better teleconferencing facilities will be needed as well as adaptations for large venue spaces.

One of the biggest concerns in the construction industry is the shortage of skilled labor. During past recessions workers were lost to other industries. “It really depends on how fast demand comes back,” said Simonson, “or we risk losing workers to other sectors.”

Editors note: Next week’s webinar on Wednesday, May 6, at 11 A.M. Eastern Time will feature Timna Tanners, Metals and Mining Analyst at Bank of America Merrill Lynch. This free webinar is open to SMU & CRU members, as well as anyone in the industry. Click here to register.