Market Data

June 4, 2020

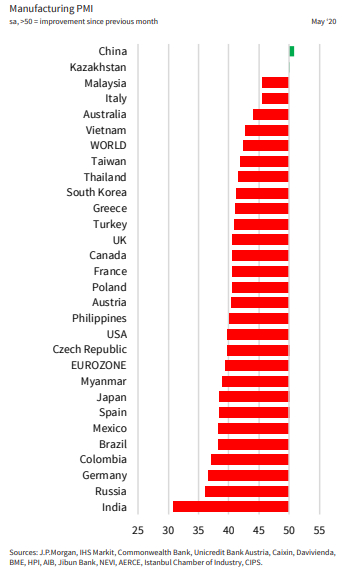

Global Manufacturing Contracts Except in China

Written by Sandy Williams

Rates of contraction eased in the latest analysis of global manufacturing by J.P. Morgan and IHS Markit. The J.P. Morgan Global Manufacturing PMI rose to 42.4 in May from 39.6 in April, but remained well in contraction territory.

Manufacturing output fell in 27 of the 28 nations surveyed with only China showing a surge in growth. The survey highlighted the disruption to international trade flows with new export business falling by its third greatest extent in the survey’s history. Supply chains were under severe stress and vendor lead times lengthened. Employment losses were widespread. Business sentiment was subdued with confidence at its second lowest level since the survey began tracking the measure in July 2012. Output is expected to increase only marginally over the next 12 months.

The Eurozone PMI rose to 39.4 in May from 33.4 in April, but new orders and output continued to fall sharply. Italy’s PMI rose to 45.4, in contrast to Germany’s 36.6 posting at the bottom of the PMI rankings. All nations recorded severe reductions in employment, said IHS Markit. Input prices fell for the 12th month and were accompanied by lower output charges.

The manufacturing downtown in the Eurozone may have bottomed out in April, said IHS Markit Chief Economist Chris Williamson. “While we are still set to see unprecedented falls in industrial production and GDP in the second quarter, the survey brings hope that the goods-producing sector may at least see some stabilization – and even potentially a return to growth – in the third quarter.” He added: “Whether growth can achieve any serious momentum remains highly uncertain, however, as demand – both domestically and in export markets – looks set to remain subdued by social distancing measures, high unemployment and falling corporate profits for some time to come. “

Easing of COVID-19 restrictions allowed China’s manufacturing to expand at its quickest rate in nine years. Manufacturers saw a solid rise in output, although demand was subdued by falling export orders. Supply chains stabilized and input costs fell for the third month in a row. Firms were optimistic that a global economic rebound would occur once the pandemic situation improves. The Caixin China General Manufacturing PMI emerged from contraction to post a reading of 50.7 in May.

Manufacturing conditions in Russia suffered another marked decline in output in May. Staffing was reduced as global lockdowns and falling order rates impacted demand. Firms anticipate production to continue to fall in the coming 12 months and fear a lengthy recovery with muted demand. The IHS Markit Russia Manufacturing PMI registered 36.2 in May, up slightly from 31.3 in April and marked the second-sharpest deterioration in operating conditions in the Russian manufacturing sector since early-2009.

North American manufacturers continued to see manufacturing conditions contract in May, but there were signs of a tentative recovery.

The Canada PMI rose from 33.0 to register 40.6 in May. A severe drop in demand, domestically and abroad, curtailed production volumes last month. COVID-19-related closures caused a strain on the manufacturing supply chain and purchasing prices rose swiftly as a result of the Canadian/U.S. currency exchange rate. Unemployment rates increased at a faster pace in May with 40 percent of firms reporting reductions in staffing. Firms expressed concern that the pandemic would cause long lasting impacts on business operations.

The manufacturing PMI in Mexico rose from a record low of 35.0 in April to 38.3 in May, but output and demand continued a downward trend. Fewer new orders and government imposed pandemic measures limited production and led to further worker layoffs. Supply chain disruptions, shortage of materials, and longer input delivery times were noted. Input prices fell for a second month and the cost reduction was reflected in lower output charges.

The May PMI for the U.S. indicated weak demand resulting in a decline in new orders and output. The PMI posted 39.8 last month, up from 36.1 in April, but still the second steepest deterioration of operating conditions since April 2009, said IHS Markit. New business fell for a third month due to COVID-19 measures and cancellation and postponement of orders. Employment, production, backlogs and pricing all declined in May and supply chain disruptions continued. Firms were pessimistic about the 12-month outlook, but with businesses beginning to reopen conditions are expected to improve.

“With increasing numbers of companies restarting production, we should see some improvements in the output trend in coming months, and it was reassuring to see signs of the downturn already starting to ease in May, suggesting April was the eye of the storm as far as the production collapse is concerned,” said Williamson.

“There remains a high risk that any recovery will be frustratingly slow as ongoing social distancing measures, high unemployment, job insecurity and damaged balance sheets constrain consumer and business spending. The recovery will of course also fade quickly if virus infections start to rise again. For now, however, we focus on the good news that we may be past the worst in terms of the economic decline.”