Prices

June 16, 2020

CRU: Iron Ore Steady as Vale’s Northern System Recovers

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

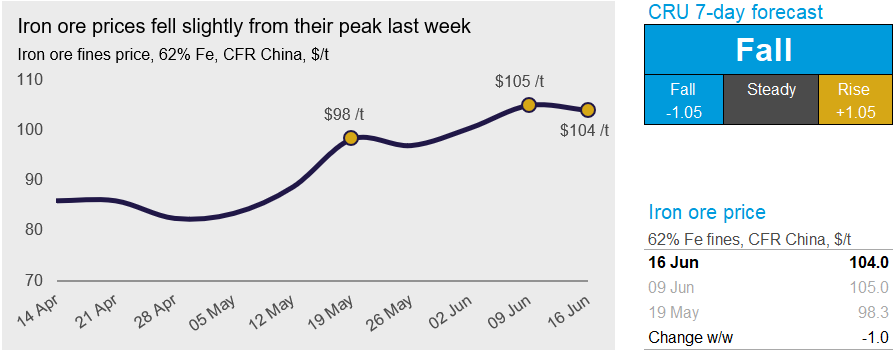

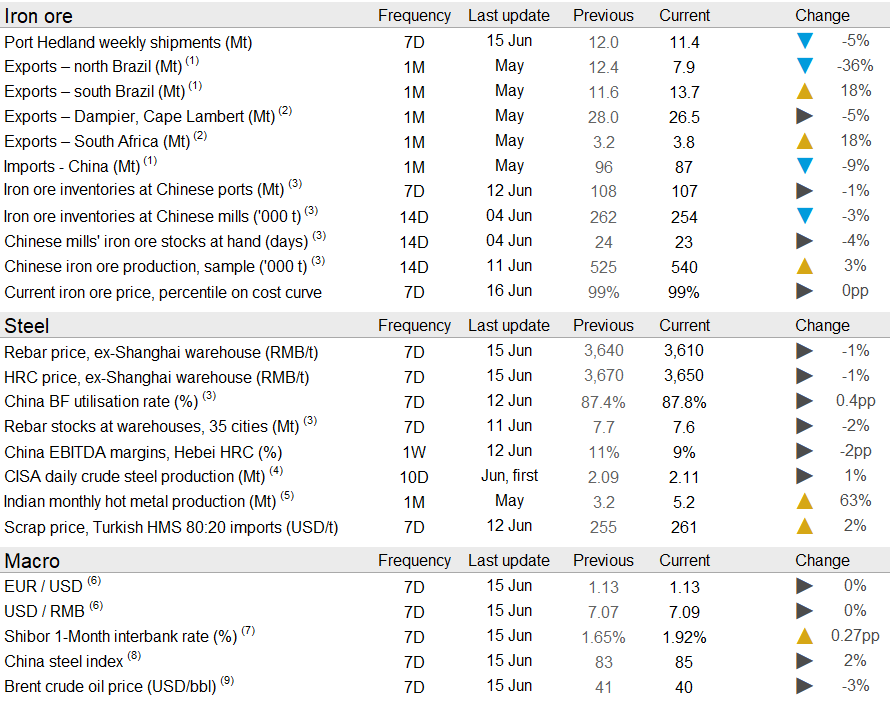

Iron ore prices held steady in the past week as Chinese demand remained robust while seaborne supply registered another strong week. After struggling for most of 2020, shipments from Vale’s Northern System reached the highest level of the year in the past week. On Tuesday, June 16, CRU assessed the 62% Fe fines price at $104.0 /t, down by $1.0 /t w/w.

In China, steel production achieved record highs last week with BFs running their operations at a very high utilization rate of 87.8 percent. Even EAF capacity utilization lifted to 72 percent, only marginally lower than the highs of last year. Strong steel production was met with relatively weak demand, due to which the pace of steel inventory drawdown decelerated w/w. We are currently approaching a slower demand period due to the hot and wet weather in southern China, which typically reduces steel demand in the construction sector. Weaker steel prices in the past week resulted in steel margins contracting somewhat.

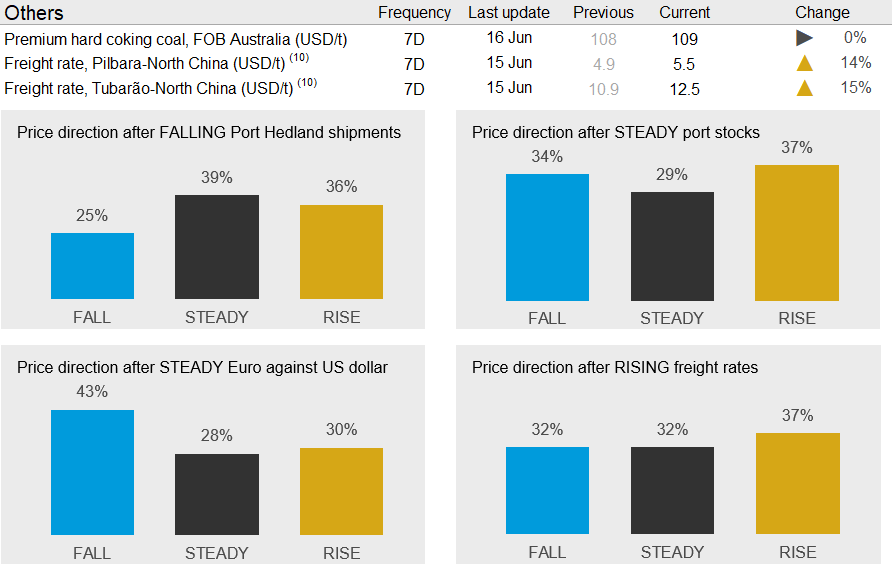

Seaborne supply has remained at high levels. Although falling slightly w/w, shipments from both Port Hedland and Rio Tinto’s ports were still high compared with the previous months and the same time last year. According to shipment tracker Kpler, Vale’s Northern System registered its strongest week of the year, but there are talks in the market about some of the volumes having quality issues. The strong shipments from the north, coupled with a recovery in the south after the rain season, has resulted in strong Capesize vessel demand from Brazil. Therefore, freight rates have risen sharply in the past week.

There have been two derailments reported in the past week. ArcelorMittal’s Liberia mine, which ships ~5 Mt/y, is likely to see disruptions for a few days after a derailment near the mine, just south of the border with Guinea. LKAB has also reported a derailment affecting its transportation of pellets to its customers in Sweden and Finland. No impact on seaborne supply is expected.

In the coming week, we expect further pressure on prices as rebar prices in China have fallen further, which is reducing margins somewhat. Seaborne arrivals are expected to remain high and shipments from Brazil are recovering. Therefore, we expect prices to take another small downturn in the coming week.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com