Overseas

August 6, 2020

CRU: Chinese HR Coil Reaches 22-Month High

Written by George Pearson

By CRU Prices Analyst George Pearson, from CRU’s Steel Monitor.

The U.S. Midwest sheet market was somewhat mixed this week as prices for both HR and HDG coil fell w/w, while CR coil rose by $3 /s.ton. The price of HR coil fell $5 /s.ton w/w and is at its lowest level since the prior bottom at the beginning of this past May. Market participants continue to talk about a potential increase. However, supply is rising from numerous furnace restarts.

ArcelorMittal is bringing their Indiana Harbor #4 furnace back online while the Burns Harbor D furnace will be down for only a couple more weeks as repairs are made. While demand is rising alongside these restarts, buyers are wary of ordering anything more than for immediate needs.

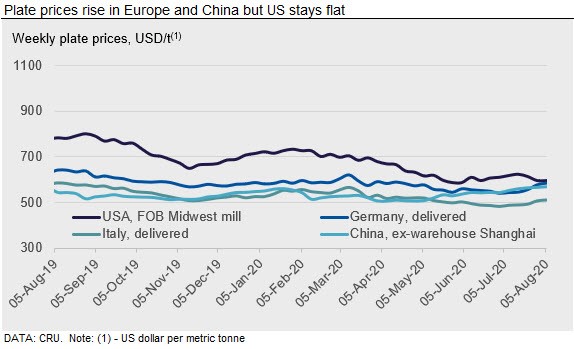

The U.S. plate market prices were steady w/w at $541 /s.ton. Demand here remains limited as buyers and producers alike are awaiting an increase in activity from both manufacturing and construction sectors. While demand may continue to remain subdued over the near term due to the pandemic-related slowdown, costs may not offer much support as August scrap is set to be steady, if not lower, m/m.

European prices increased again this week, more strongly in Germany where prices were up by €5-13 /t across all products. German CR coil rose the most, up by €13 /t at €525 /t. Business for HR coil heard at €410–415 /t in northern Europe last week underlined that prices are on a firmer footing than they were a few weeks ago, but not yet at the offer levels of €440-450 /t from some mills. Several European buyers have purchased for arrival in October and subsequently left for summer holiday. This includes import volume purchases from buyers in southern Europe. A depreciation of the Turkish lira and the U.S. dollar last week alongside a strengthening in the Euro saw increased buying activity for various steel products. Turkish HR coil offers have since increased, and Russian HR coil was also on the high end, offered to southern Europe at €435 CIF, including duty. The Italian market was largely quiet this week as the August holiday began.

Chinese steel prices continued to edge up this week. Rebar price increased by RMB40 /t w/w and HR coil prices rose significantly, by RMB140 /t. Higher prices were mainly due to surging raw materials prices and economic recovery, with data such as Caixin’s PMI reading 52.8 in July. There remains evidence of strong infrastructure demand, with heavy truck sales in July increasing by 89 percent y/y. Although some new sales were to replace trucks that did not comply with new emission standards, this still implies that construction activity is at high levels.

On the supply side, as a result of improved steelmaking EBITDA margins, now at 5 percent and 15 percent for rebar and HR coil, respectively, according to the CRU Steel Cost Model, blast furnace capacity utilization in the country reached 90 percent. Restocking continued as total inventory grew by 1 percent w/w. Going forward, we expect steel prices to remain strong in the short term; however, risk remains as the hot weather in August may slow construction activity and the historically high level of steel output presents a further risk of oversupply.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com