Prices

September 8, 2020

CRU: Iron Ore Prices at Multi-Year High

Written by Eduardo Tinti

By CRU Research Analyst Eduardo Tinti, from CRU’s Steelmaking Raw Materials Monitor

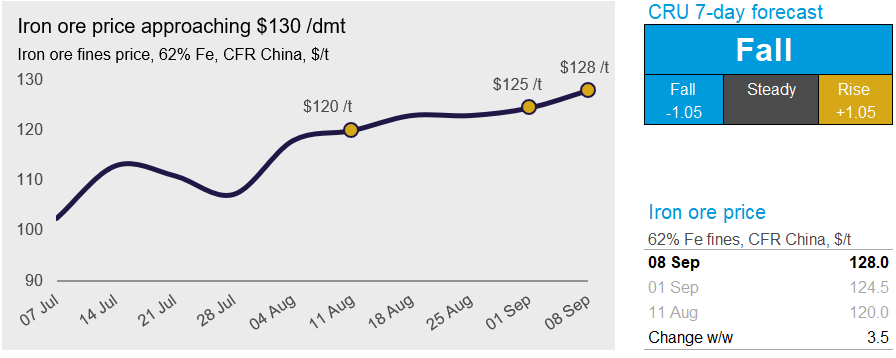

The iron ore price rose further last week and is now approaching the $130 /dmt mark as demand from Chinese steel mills remains strong and seaborne supply declined w/w. On Tuesday, Sept. 8, CRU assessed the 62% Fe fines price at $128.0 /dmt, $3.5 /dmt higher w/w. This is the highest price level since early-2014.

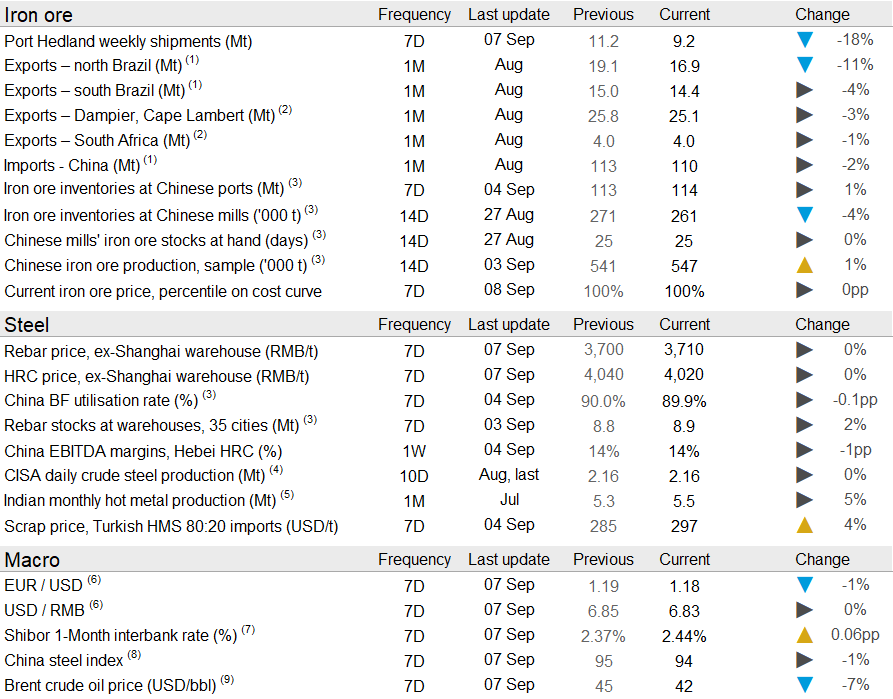

In China, HRC and rebar prices remained relatively stable last week, but continued moving in opposite directions. While the HRC price edged down by RMB20 /t w/w, the third consecutive w/w decline, the rebar price posed further gains of RMB10 /t. While underlying demand for flat steel products was stable, demand for long products improved. There has also been some shift of longs inventories from mills to traders indicating good demand expectations as the peak construction season approaches. Despite announced operating restrictions on various facilities across the steel supply chain in Tangshan, mainly in sintering activities, surveyed BF capacity utilization only dipped slightly and remained close to 90 percent. Strong buying activity from mills led to an increase in iron ore port outflow, which bounced back to 3.25 Mt. Despite this, iron ore inventories at ports increased w/w as offloading accelerated and the vessel queue fell to 169 from 188 in the previous week.

On the supply side, shipments from Australia and Brazil declined w/w. While Australian exports dropped due to lower shipments from BHP and FMG, which brought Port Hedland shipments down to 9.2 Mt from 11.2 Mt last week, Brazilian exports fell both from the north and from the southeast. In August, Brazilian exports were lower m/m mainly due to a weaker-than-expected performance at the S11D mine in Vale’s Northern System. The mine exported 7.5 Mt to the seaborne market compared to 9.0 Mt in July. If such a run rate persists, S11D will not reach the 85 Mt/y guidance set forth by Vale in its latest report.

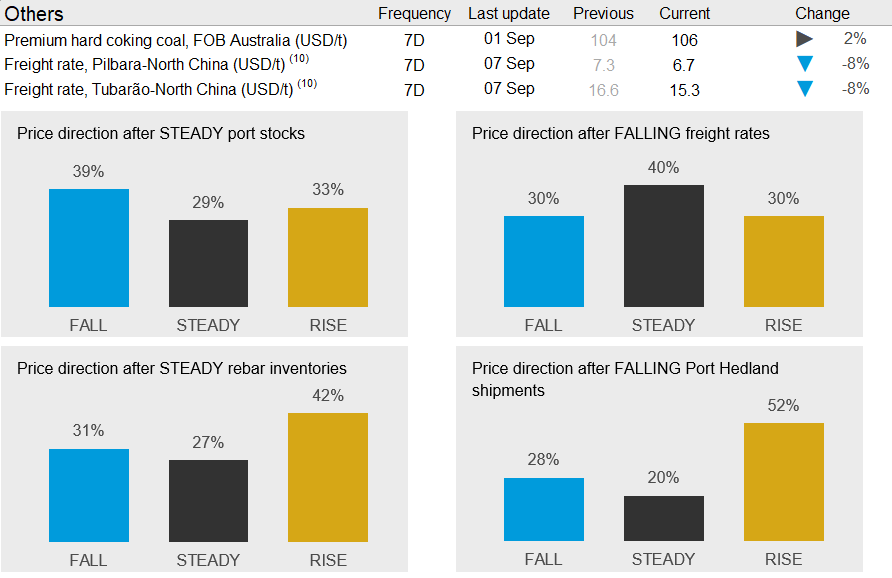

Despite the recent w/w decline in the seaborne supply and the optimism around the Chinese long steel market, we maintain our view that iron ore prices should fall in the coming week based on market fundamentals and on rising iron ore inventories at ports as the vessel offloading process accelerates.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com