Market Data

October 6, 2020

Steel Product Shipments and Inventories Through August

Written by Peter Wright

Downstream steel product shipments are recovering from the COVID-driven panic that began in April.

The Census Bureau provides monthly data on inventories, shipments and new orders for total U.S. manufacturing and for individual industries, one of which is steel products. Every two months, Steel Market Update extracts data from the Census Bureau to provide a reality check for steel industry trade association data, which is most widely used to assess the state of the industry.

![]()

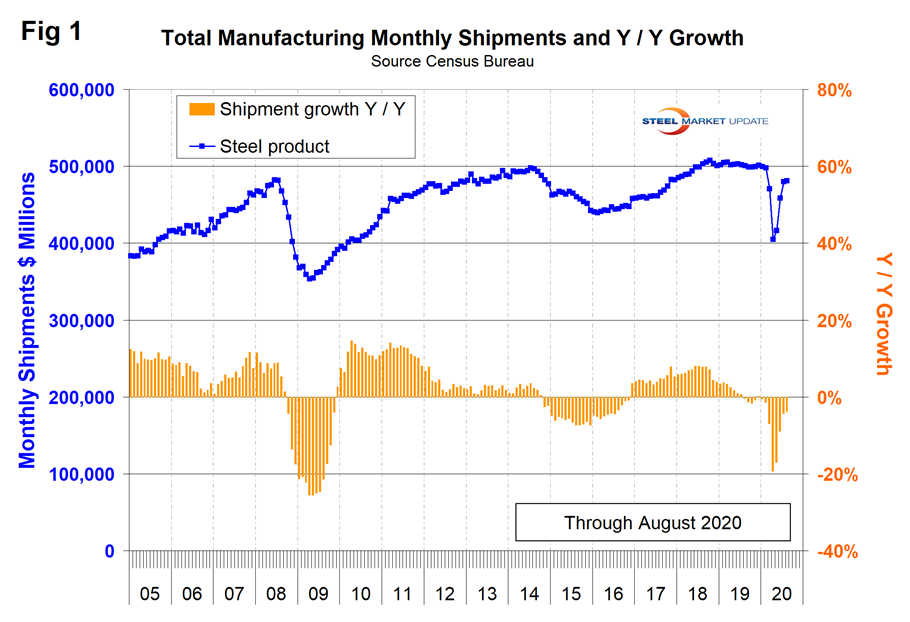

Total shipments and inventories are reported in millions of dollars seasonally adjusted. Year over year through August, total manufactured product shipments were down by 3.9 percent as steel product shipments were down by 8.2 percent. Figures 1 and 2 show the history of both since 2005. In April year over year, total manufacturing shipments were down by 19.4 percent and steel product shipments were down by 21.4 percent, therefore this data confirms that steel is recovering more slowly than the overall manufacturing economy.

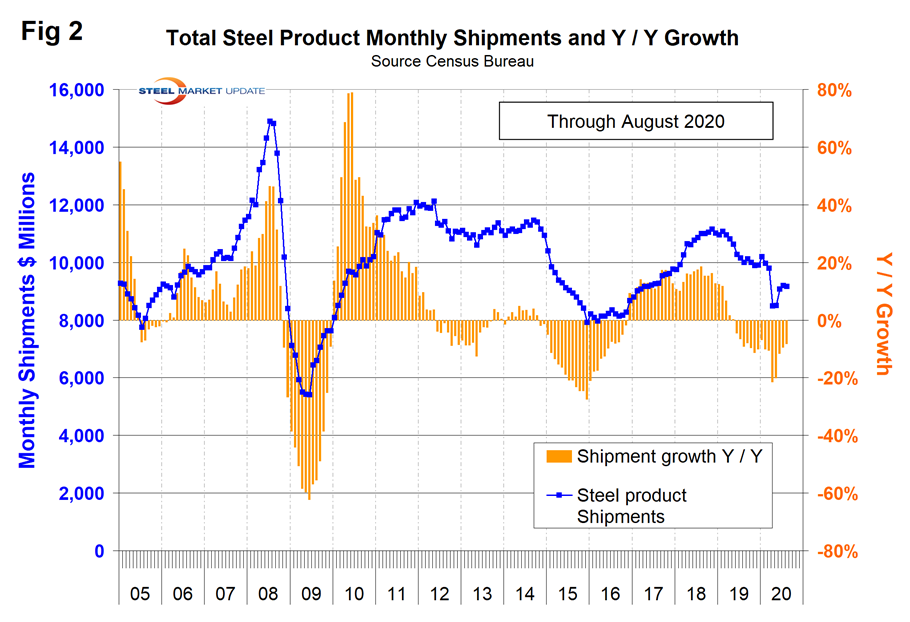

Figure 2 shows monthly steel product shipments in millions of dollars with the year-over-year growth through August. Shipments of steel products had a recent peak in November 2018 with the pandemic-driven decline evident in April. The year-over-year growth rate has declined from 18.6 percent in August 2018. The Census Bureau defines shipments as: “Manufacturers’ shipments measure the dollar value of products sold by manufacturing establishments and are based on net selling values, f.o.b. (free on board) plant, after discounts and allowances are excluded. Freight charges and excise taxes are excluded. Multi-industry companies report value information for each industry category as if it were a separate economic unit. Thus, products transferred from one plant to another are valued at their full economic value.”

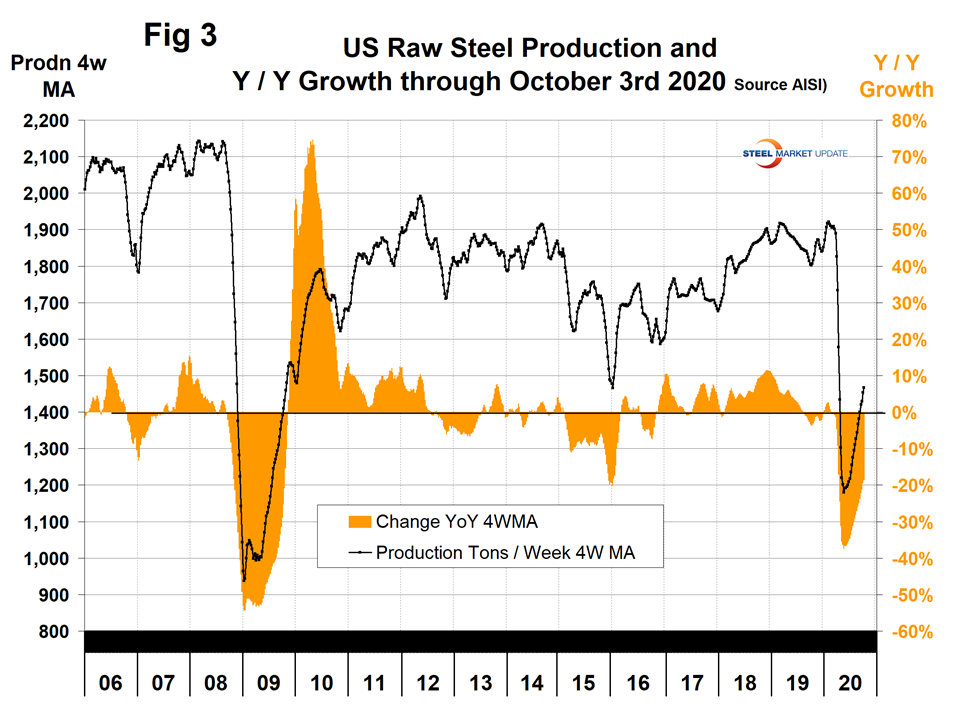

Steel Market Update aims to provide information on the same subject from different sources for verification. The data in Figure 2 compares well over the long term with the AISI weekly crude steel production shown in Figure 3, which is more current than the Census data. Figure 2 is in dollars and Figure 3 is in tons, but the shape of the curves is comparable. The AISI weekly tonnage had a recent bottom in the week ending May 9 on a four-week moving average basis as shown in Figure 3, and has steadily improved since, was still down 18.6 percent in the week ending Oct. 3 year over year.

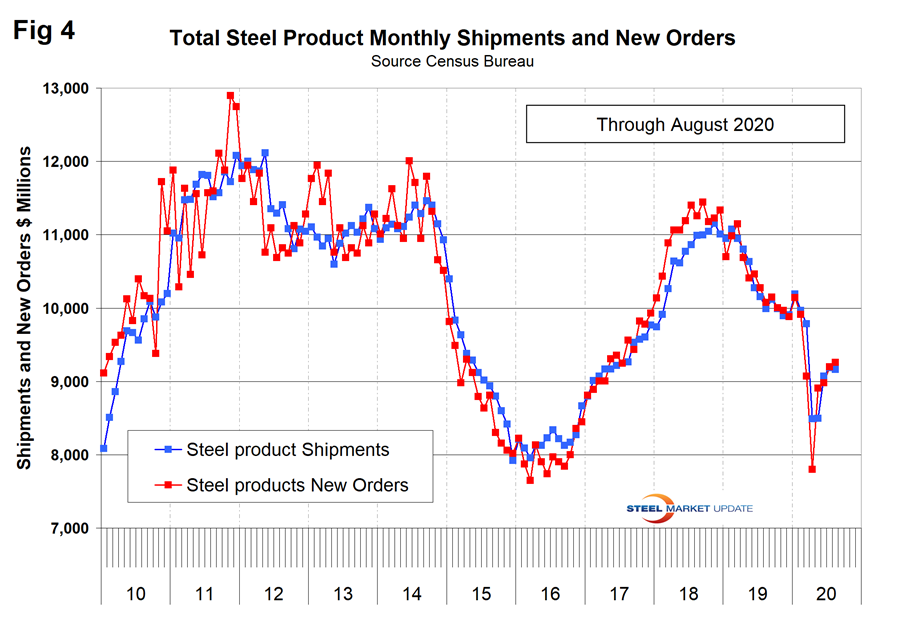

Figure 4 shows shipments and new orders on a monthly basis for all steel products since 2010. New orders declined much more than shipments in April, but by June were back in balance where they have stayed.

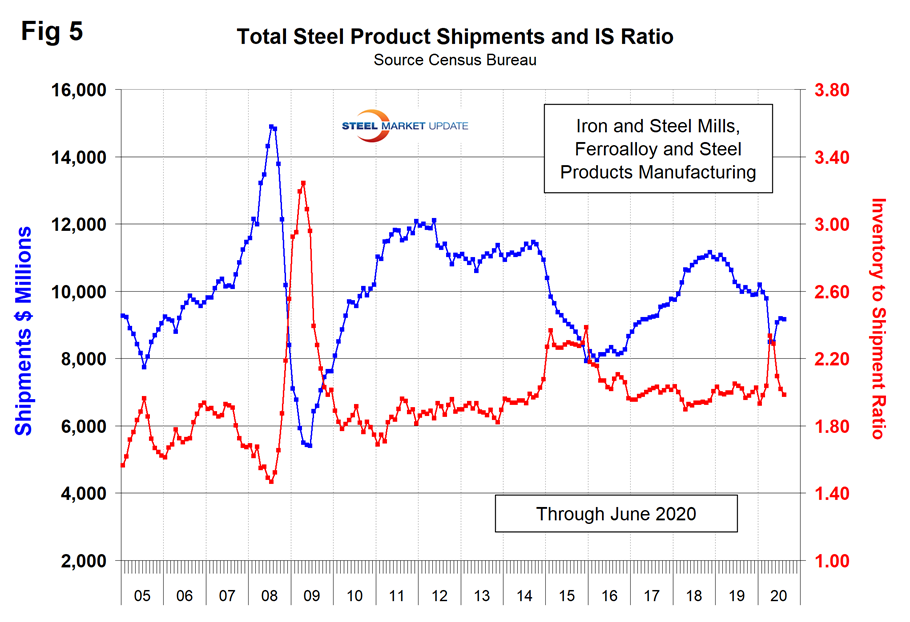

Figure 5 shows the same total shipment line as Figure 2, but now includes the inventory-to-shipment ratio. The IS ratio shot up in April, but has since declined to the recent norm. Shipments improved by 7.9 percent between May and August.

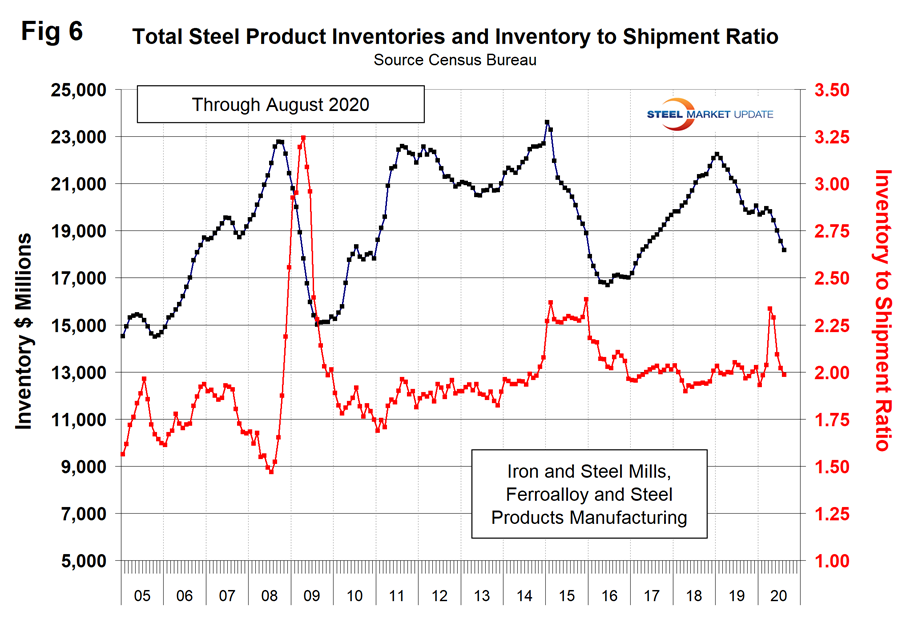

Figure 6 shows total inventory in millions of dollars and repeats the inventory-to-shipment ratio shown in Figure 5.

SMU Comment: The decline in both manufactured and iron and steel product shipments has been nowhere near as severe or prolonged as was the case during the Great Recession of 2009. Data from the Census Bureau for steel product orders, shipments and inventories indicates that steel product shipments were hit harder than total manufacturing in April and May. The IS ratio of both total manufactured goods and products made from iron and steel peaked in April and declined through August.