Prices

November 10, 2020

Final September Imports Decline Further

Written by Brett Linton

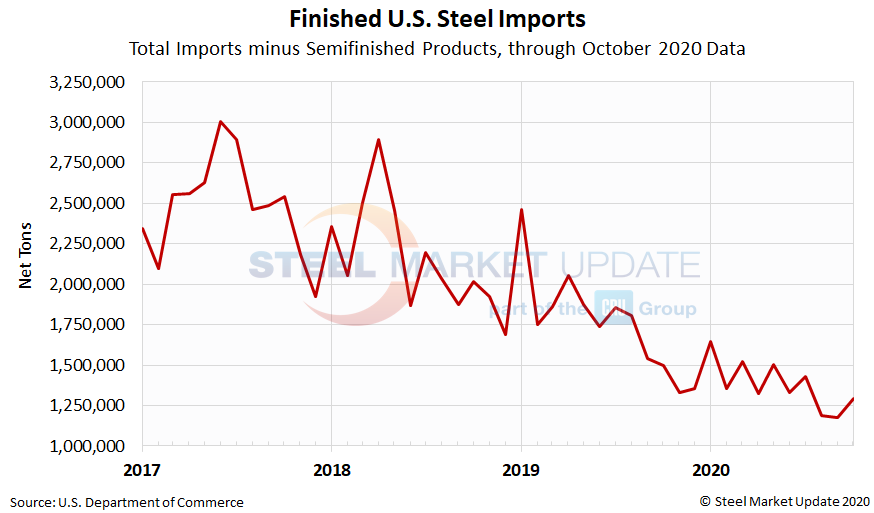

Final Commerce data shows steel imports totaled 1.26 million net tons in September, surpassing last month’s low by 33,000 tons. September imports are now at the lowest levels seen in 11 years, with the previous low occuring in September 2009 at 1.21 million tons. Recall that the lowest monthly import level in the past two decades occured in June 2009 at 862,000 tons.

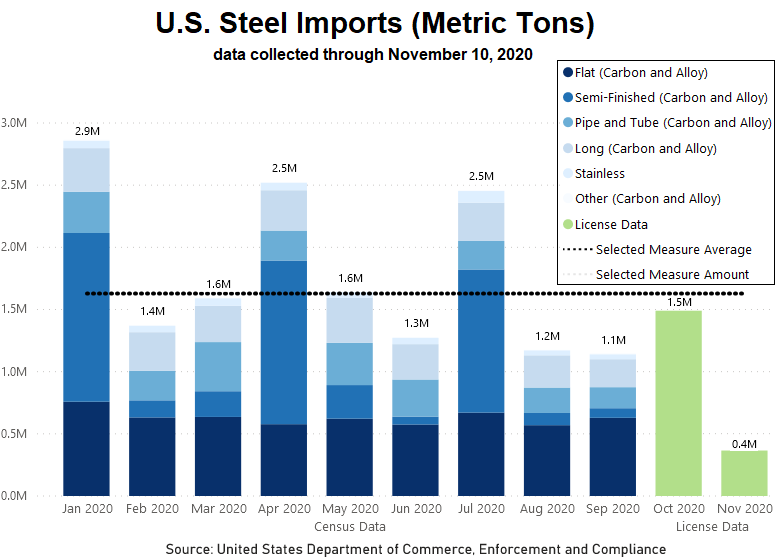

The U.S. International Trade Administration recently updated its Steel Import Monitoring and Analysis (SIMA) System and now includes more detailed import information. Their below graphic shows recent monthly steel imports by product category. Note that this data is presented in metric tons, not net tons as SMU normally reports import data. SMU plans to expand our Executive level imports analysis in the coming weeks to include these expanded product categories.

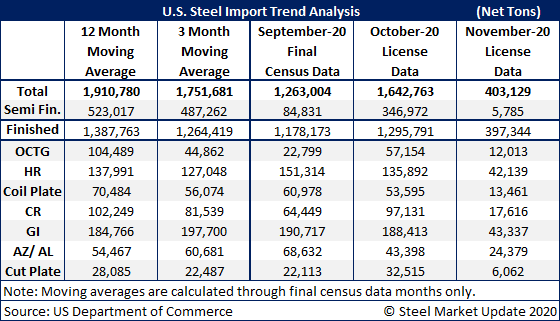

Total finished imports in September were relatively unchanged over the prior month, down 9,500 tons to 1.18 million tons. Imports of semifinished products (mostly slabs) were 85,000 tons, down from 108,000 tons in August, and down from 1.27 million tons in July.

October import licenses are now at 1.64 million tons, with 347,000 tons being semifinished and 1.30 million tons being finished products.

Import licenses continue to be collected for October and November; the current total import figure for November is just over 400,000 tons but will grow as more licenses come in.

SMU Note: The January, July, August and October import figures are unusually high as a result of buyers seeking to max out quarterly quota limits on semifinished products. For the remainder of each quarter, final semifinished imports are significantly lower. Due to these month-to-month swings, SMU has ceased monthly import “trending” projections and now only shows unadjusted figures as reported by the Commerce Department.

As shown in the figure below, finished steel import levels are much less volitile and more accurately display the U.S. steel import trend month-to-month. August, September and October finished imports remain well below levels seen earlier this year.