CRU

January 15, 2021

CRU: Iron Ore in Steep Decline as Chinese Buying Interest Cools Off

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

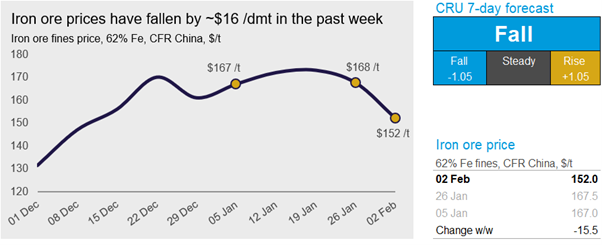

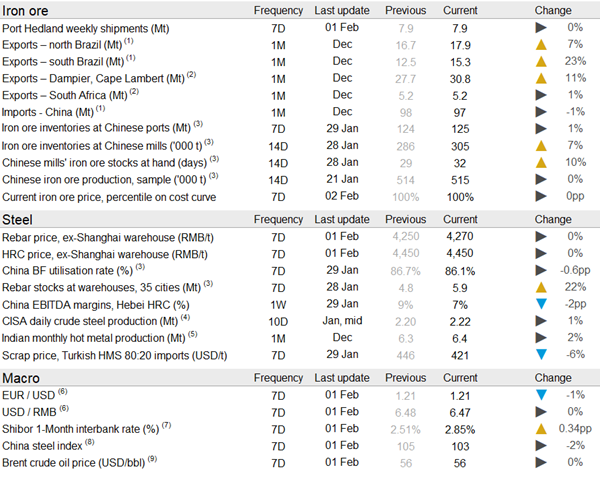

In the past week, iron ore has witnessed its steepest price fall since July 2019. Declining steel margins in China and mills having successfully built up inventories, in combination with an upcoming Chinese New Year (CNY) holiday, resulted in weaker buying interest. Supply side issues failed to stop the price fall, and CRU assessed the 62% Fe fines price at $152.0 /dmt, a $15.5 /dmt decline w/w, on Feb. 2.

With one week until CNY, the Chinese steel industry has largely begun taking holidays with spot transactions diminishing quickly. This resulted in a sharp fall in underlying demand for construction steel, the production of which went to traders’ warehouses instead. Along with diminished spot transactions, price volatility eased with the HRC price changing little last week, while the rebar price edged up by RMB20 /t. Although steel prices have largely stabilized, steel margins continued to fall due to a weaker demand environment. According to CRU’s Steel Cost Model, EBITDA margin for HRC and rebar dropped to 7% and 2%, respectively. This motivated more steelmakers to conduct maintenance that reduced surveyed BF capacity utilization. Having said that, the current BF capacity utilization rates remained elevated at ~86% compared with 79% during the same period last year, and the w/w contraction was also slower than expected.

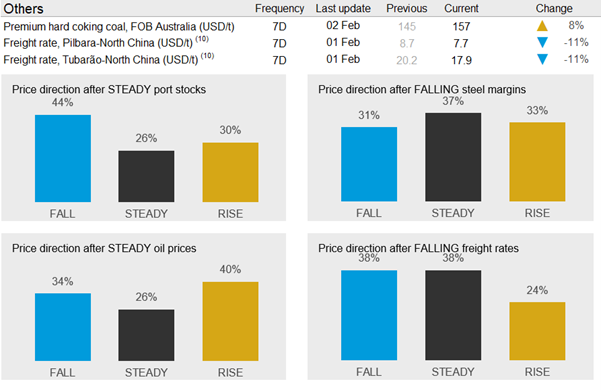

On the supply side, there has been mixed development in the past week. In Australia, a tropical low developed east of Port Hedland and headed west, passing all the major iron ore ports that were forced to halt operations for up to four days. Port Hedland shipments were very strong prior to the tropical low appearing and shipments for the whole week came in at 7.9 Mt, unchanged w/w. Halting the three main Australian ports for four days will result in ~10 Mt of losses of seaborne supply. So, why did prices continue to fall despite this supply disruption? One reason is that the vessel queue in China has grown rapidly in the past weeks and there is now a record number of 200 vessels waiting to offload material at ports. The average for January was 110 vessels in 2020 and 70 vessels in 2019. This long queue means the bottleneck for iron ore supply is now located at Chinese ports rather than at the miners’ ports.

In Brazil, iron ore shipments have been very strong in the past week. In Minas Gerais, there has been almost no rainfall in the past three weeks, which is very unusual for January. Our previous analysis has shown that, during La Niña years, rainfall typically falls in southern Brazil while northern Brazil typically experiences wetter weather. Brazilian export data will be published later this week and we expect southern Brazilian exports to be much higher than the 10.7 Mt registered in January 2020.

In other news, iron ore exports from the Tonkolili mine in Sierra Leone has resumed, although at a low level as the ramp-up of the mine’s production of low-grade fines will be slow. LKAB has reported that the company is still struggling with pellet feed supply from its Kiruna mine after the earthquake in May 2020. However, the company has flexibility in its system and is able to source pellet feed from other mines. The company is expecting to return to full production in the Kiruna mine during 2022 Q1.

In the coming week, we continue to see weak fundamentals in the market. Prices have been in steep decline and we expect the downward momentum to continue. Mills have already built up inventories and port stocks are expected to rise as there are plenty of vessels waiting to offload ore while port outflow (iron ore being delivered from ports to steel mills) is expected to slow.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com