CRU

March 16, 2021

CRU: Asian Sheet Prices Pause, But USA and Europe Rise Again

Written by George Pearson

By CRU Prices Analyst George Pearson, from CRU’s Steel Sheet Products Monitor 21

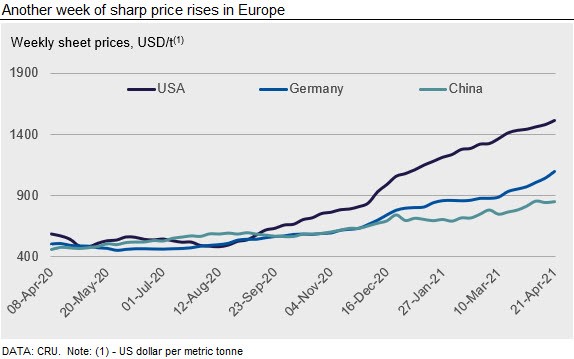

Sheet prices in China and the Vietnamese import market paused this week as buyers slowed their pace of restocking. European prices continued to rise very sharply by historical standards, particularly for CR and HDG coil, for which the material shortage has become worse. In the USA prices are still also going up, despite being far above other regions.

USA

The HR coil index in the U.S. Midwest increased by $31 /s.ton w/w. Demand has continued to outpace supply. With lead times remaining past most of the planned maintenance, there has been an increase in the volume of new orders. Mills are making progress on clearing backlogs but are still producing and shipping past-due orders. Fresh import offers have been sporadic, and pricing has increased, making them less attractive now because long lead times increase the risk of material arriving in a falling market. However, we continue to expect import arrivals for orders booked in previous months to increase at a significant rate over the next several months.

The U.S. West Coast HR coil price increased to $1,440 /s.ton as mills began accepting orders for July delivery. Mill order books are expected to fill quickly since tonnage is still restricted. Demand remains strong with many companies reporting improved sales and expect numbers to continue to grow over the near term.

Europe

European sheet prices have sharply risen again this week by €27–64 /t w/w across all products. CR coil and HDG coil, which have been in tight supply for months, have been in even shorter supply in recent weeks. This can be seen in the differential between these two products and HR coil, with CR coil €111 /t higher than HR coil in Italy and €162 /t higher in Germany. Normally this differential is €80-100 /t.

Domestic mills have continued to raise prices on an almost fortnightly basis. The high number of bidders in the market has increased mills’ pricing power, allowing them to reject enquiries from those that try to bid below offer prices. Lead times from large German mills are in September-October for all sheet products. There is no clear signal to suggest that prices will stop rising at this point.

China

Chinese domestic sheet prices were broadly unchanged over the past week. Domestic supply is still tight given restrictions in Tangshan, but buying interest has slowed. Expectations of a short-term price correction due to additional slab supply outside the region have caused some buyers to hold off spot purchases. Some end-use manufacturers have slowed their pace of restocking for less urgent orderbooks and are waiting until the market becomes clearer. Having said that, demand is still steady, and we observed a continuous fall in sheet inventories though at a slower drawdown pace than last week. We expect sheet prices to stay strong as supply tightness is not likely to ease in the short term.

Asia

Prices of imported sheet products were stable last week after continuously increasing for eight consecutive weeks. CRU assessed HR coil prices at $920 /t, CFR Far East Asia, CR coil at $1,070 /t and HDG coil at $1,090 /t.

For HR coil SAE1006, a deal for Chinese material was heard at $930 /t CFR Vietnam and several position cargoes were sold at $910 /t for May shipment by traders to end users. Buying indications from pipe makers were below $900 /t.

For HR coil/sheet SS400, a major Chinese mill was offering at $905-915 /t CFR Vietnam and position cargoes were offered at $880-890 /t.

In addition, Hoa Phat steel mill announced HR coil offers for their domestic buyers and the new price was equivalent to $896-901 /t CFR Vietnam. Despite being a $136 /t increase from their most recent offer, this is the most competitive offer in the current market.

India

Following a price hike of INR4000-6000 ($54-80) /t during the first week of April, Indian steelmakers have increased sheet prices by a further INR2000–3500 ($27–47) /t for April delivery. The key driver for these sharp price upswings continues to be trends in the Asian import market.

The latest Indian HR coil export offers to Vietnam have been heard at $910-920 /t FOB, while Japanese origin HR coil is being offered to Indian buyers at $1,000-1,050 /t CFR. In contrast, Indian domestic prices for HR coil are in the range of $840-850 /t, delivered Mumbai (excluding GST). It is due to this widening gap between Asian import and domestic Indian prices that Indian mills are successfully raising domestic prices, despite the demand disruption caused by re-imposition of COVID-19 restrictions in the country. CRU understands from contacts that mills intend to increase domestic prices to match their export offers to SE Asia, which effectively leaves room for at least another $50 /t increase in domestic prices.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com