CRU

March 16, 2021

CRU: Fed’s Dovish Song Won’t Soothe the Bond Market

Written by Anissa Chabib

By CRU Economist Anissa Chabib and Principal Economist Alex Tuckett

The Fed’s Jerome Powell has continued to strike a dovish tone, emphasizing that the Fed will continue to support the economy until “substantial progress has been made.” However, he stopped short of any attempt to directly push back against recent rises in bond yields. Furthermore, revisions to the Fed’s forecasts and interest rate projections indicate the difficult decisions to come if the economy rebounds as quickly as many now expect. This will not end the volatility in bond markets.

Powell’s Dilemma

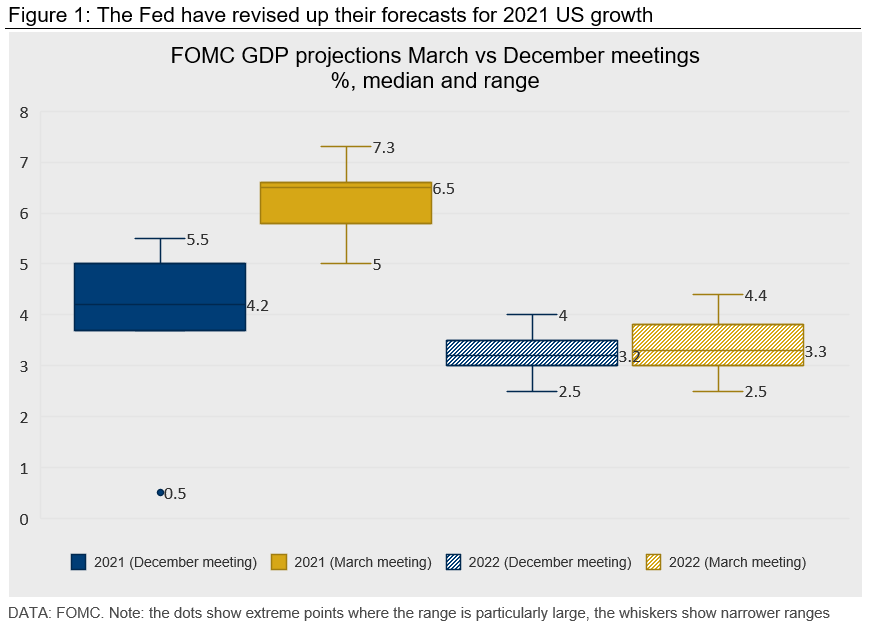

Since the start of January, expectations have been building that 2021 will be a vintage year for U.S. growth. With Biden’s $1.9 trillion stimulus package making it through Congress almost unscathed, and vaccination progressing quickly, economists have been busy marking up their forecasts for U.S. growth. With their latest projections, the Fed has joined the party (Figure 1). They now expect the U.S. economy to grow by 6.5% in 2021 and 3.3% in 2022. This is close to our own forecasts for U.S. growth of 6.5% in 2021 and 3.1% in 2022.

Higher growth expectations have led to a sharp increase in government bond yields; with such a strong economy, markets have begun to speculate that the Fed will begin to scale back monetary stimulus sooner than previously thought. This presents the Fed with a challenge. Although the increase in government bond yields is for “good” reasons (stronger growth expectations), it could still lead to a tightening in financial conditions. For example, higher U.S. Treasury yields have already begun to filter through to higher mortgage and corporate bond rates. Until the recovery has actually taken hold, such a tightening will be unwelcomed to the Fed. In the run-up to the meeting last week, markets had speculated whether the Fed would try to “talk down” the yield curve.

Same Policy, Changing Outlook

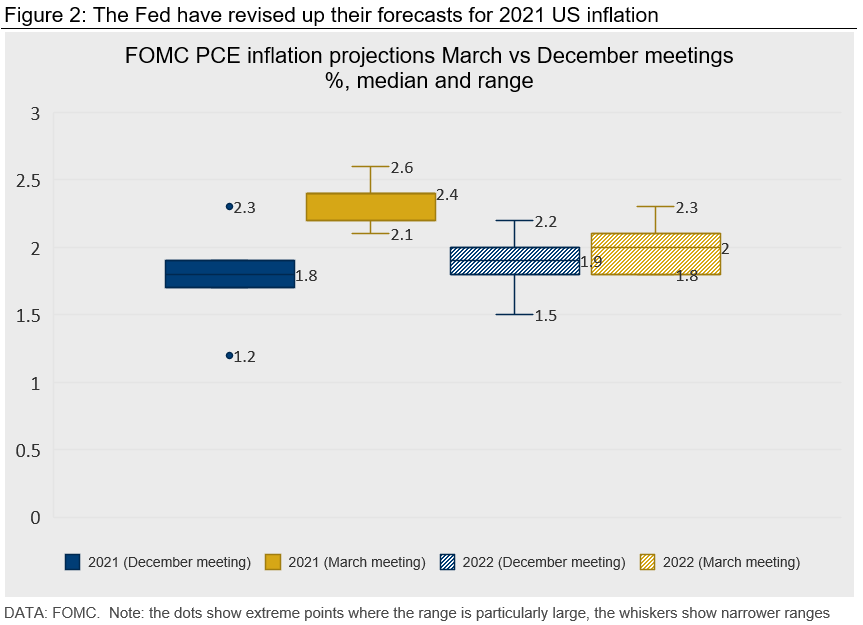

The Fed decided to maintain an accommodative monetary policy despite the stronger outlook for growth and inflation. Chair Jerome Powell explained that persistent progress—in actual data as well as expectations—needed to be seen before the Fed would taper asset purchases, let alone raise interest rates. The upholding of this dovish line was expected.

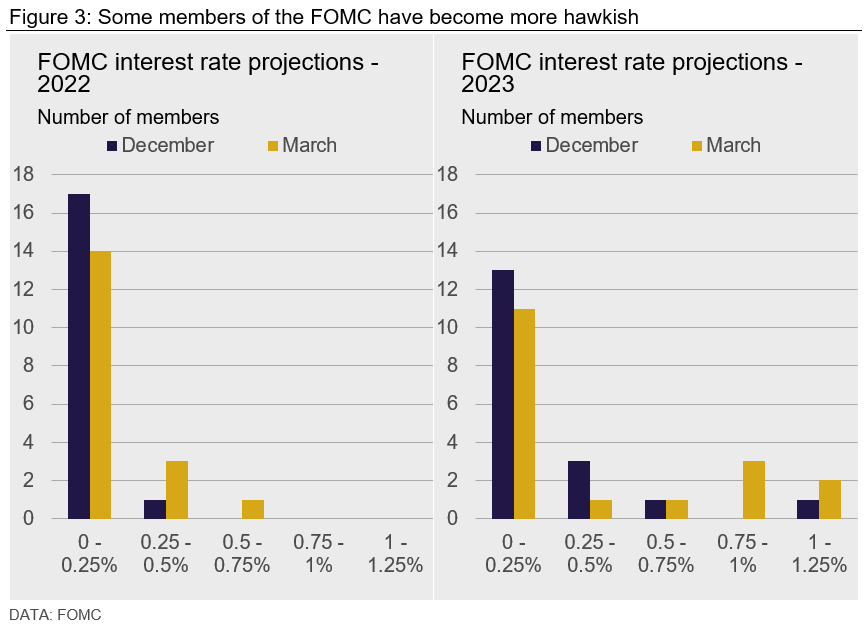

Nonetheless, reflecting the stronger outlook for growth and inflation, some members of the FOMC brought forward their expectation of when the Fed Funds Rate will begin increasing (Figure 3). However, an absolute majority still expect no increase before 2024, and Powell played down the significance of the change.

Of more immediate importance was the fact that Powell did not make any attempt to directly push back against the sharp rise in bond yields seen in recent weeks. This contrasts with the recent ECB meeting, which saw a decision to increase the pace of asset purchases (within the existing PEPP envelope) in response to the rise in sovereign yields.

Volatility in Bond Markets Will Continue

This statement underlines the Fed’s determination to continue providing strong support to the economy. Powell made it clear that support won’t be derailed by the higher inflation in the pipeline this year—providing that continues to look transient. However, they have acknowledged the stronger outlook, and refused to follow the ECB in actively pushing back against the rise in yields. This means bond volatility is likely to continue as the U.S. recovery takes hold, and markets try to second-guess the point at which the Fed will switch from worrying about growth and employment to worrying about inflation.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com