Product

April 1, 2021

Hot Rolled Futures: A Price Pause?

Written by Jack Marshall

The following article on the hot rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Hot Rolled

Hot rolled futures markets have taken a pause from the high velocity upward price moves of last month and the beginning of March as some market price retracement occurred on slightly lower volumes going into the end of the calendar quarter on position squaring.

The HR index, while still creeping higher, has seen the week-on-week price increases decline into the single digits, last at $1,310-$1,320 spot. Market is still out on whether this is a sign or just a pause in the march higher in HR prices. Quarter end and the long Easter/spring break after such a long quarantine and winter of captivity could be cited as reasons for the slowdown in activity.

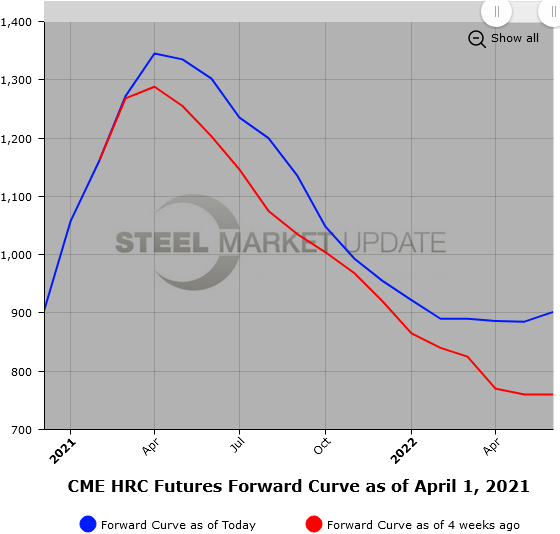

Since our last piece on March 11, the HR futures curve has shifted higher, but on average the quarters have only moved up an average of about 10% of the previous moves. Aug’21 and Sep’21 HR futures have increased the most since our last piece. Up $56/ST and up $44/ST ($1,129/ST to $1,185/ST Aug’21, and $1,059 to $1,103/ST Sep’21).

Continued tightness in HR markets due to short supplies of spot tons and continued long lead times from mills persist, and we are coming into a season of scheduled maintenance outages with a still present backlog of demand. While imports are picking up due to nice discounts to domestic prices, the word has been that supplies are tight as well as supply of transport. Much will depend on supply chain disruptions getting ironed out.

If prices of 1H’22 are any indication in that they are still trading north of $870/ST and offers for Cal’22 are closer to $880/ST, it could be a while before we see prices mean revert significantly. Recent economic indicators suggest stronger future demand backed up by a potentially very large infrastructure package.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

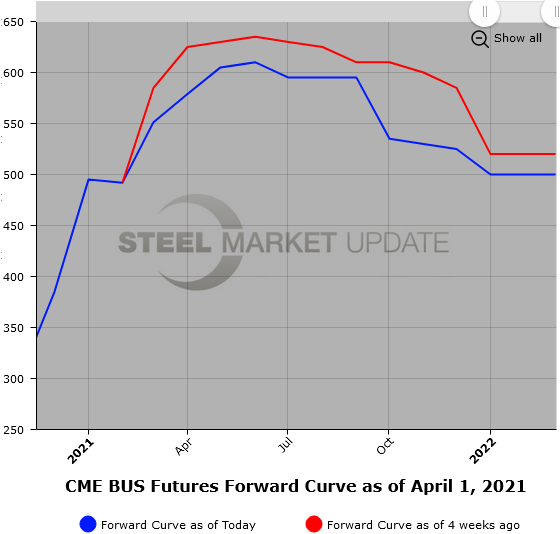

BUS futures prices have retreated from historically elevated levels. Back on March 8, May’21 BUS and Jun’21 BUS traded as high as $690/GT and $675/GT as compared to March 31 settles for May’21 BUS at $605/GT and for Jun’21 BUS at $610/GT. The 2H’21 BUS last traded at a blended average price of $565/GT ($575/GT Q3’21 and $555/GT Q4’21). Front month BUS is offered at $580/GT, but early chatter has Apr’21 BUS likely strong sideways. Mar’21 settle ($551.32). Shred prices are expected to decline some from last month. Soft export demand, expected maintenance outages and a modest pig iron price are a few potential culprits.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

{loadposition reserved_message}