Prices

December 21, 2021

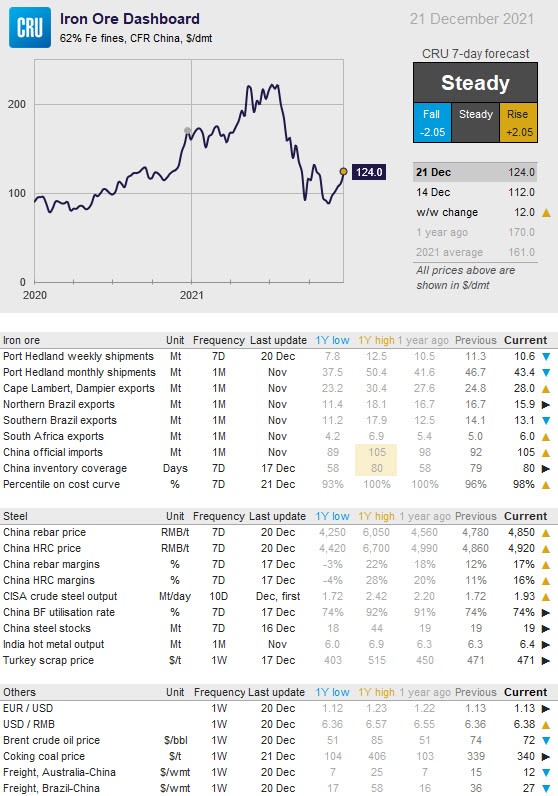

CRU: Iron Ore Continues Its Year-End Rally

Written by Erik Hedborg

By CRU Principal Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor, Dec. 21

Iron ore prices have continued to rise in the past week, a typical year-end development observed in recent years. This is the time when steelmakers start building iron ore stocks in anticipation of restricted transportation of ore from ports to mills during China’s spring festival, which will start at end-January.

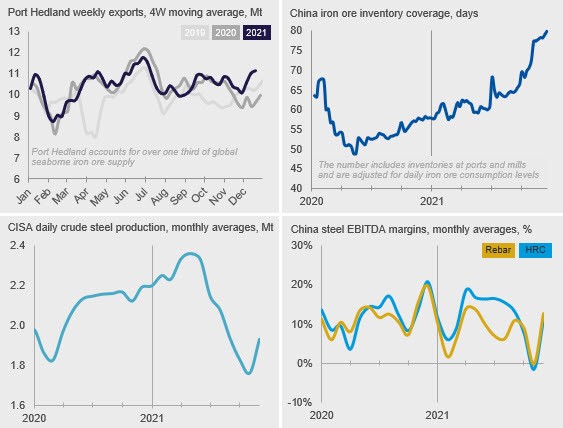

In the Chinese market, there has been little change in supply-demand fundamentals, but steel prices edged up again on speculative trading, pushing modelled steel margins above 16%. This motivated steelmakers to lift hot metal production in many places except for Tangshan due to the imposition of stricter operating restrictions to improve air quality. Regardless of these regional differences, the surveyed BF capacity utilization rate picked up slightly, improving raw materials demand. While iron ore price gained little support from fundamentals, it was pushed up on speculative buying in both physical and futures markets. Such purchases were essentially done by traders with the expectation of hot metal production growth given high steel margins and yet announced steel production targets for 2022.

Seaborne supply has increased in the past week, despite slightly lower exports from Port Hedland. Exports from Rio Tinto and Brazil have jumped in the past week, which is no surprise considering favorable weather conditions and a year-end push from these producers that follows calendar year reporting. Arrivals at Chinese ports and port inflow have both been high, resulting in port stocks jumping to the highest level since early-2018. Our sources have mentioned that the rising port stocks can be explained by increased blending activities by Vale. The volume of Brazilian ore at Chinese ports is now at a new all-time high and exports of blended material to steelmakers in Japan have increased steadily throughout 2021.

As lower iron ore exports are expected for January, demand for Capesize vessels has fallen and freight rates have plummeted in the past week. Another development that will improve availability of vessels is a change to quarantine measures in Queensland, Australia’s main coal-producing region. There will no longer be a mandatory quarantine period for ship crew arriving to the state, which is expected to speed up port operations and free up further vessel capacity.

As we now get into holiday periods, we expect less activity in the market and prices are likely to hold steady at these levels in the coming week.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com