Overseas

May 1, 2022

CRU: Ukrainian Steel Production Returns as The War Continues

Written by Chris Bandmann

By CRU Analysts Chris Bandman and Christopher Dix, from CRU’s Steel Monitor, April 29

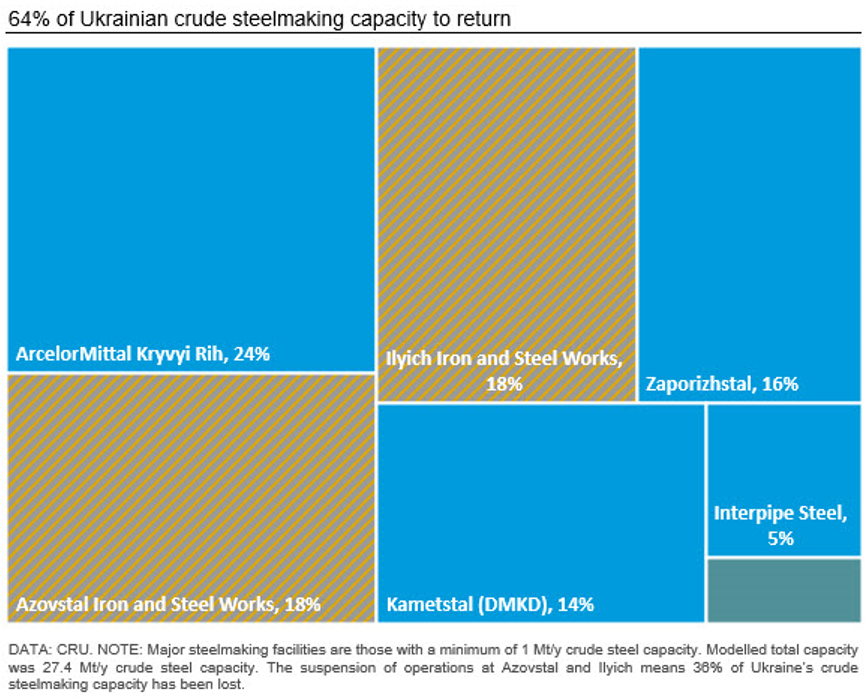

Over two months ago, the Russian invasion of Ukraine quickly resulted in the suspension of effectively all Ukrainian steelmaking operations. Since late March, several steelmakers have begun to return to production. Currently, the following operations have partially returned to production:

- ArcelorMittal Kryvyi Rih: Kryvyi Rih is an integrated iron ore mining and steelmaking operation. Kryvyi Rih has six blast furnaces, which account for 6.5 million metric tons per year of crude steel capacity. The asset includes facilities for the production of bloom, billet, rebar, wire rod, and pig iron. In 2021, this facility produced 5.3 million tons of crude steel.

- Metinvest, Zaporizhstal: Zaporizhstal is an integrated steelmaker, host to four blast furnaces that have a combined crude steelmaking capacity of 4.3 million tons per year. Zaporizhstal has integrated hot-rolling facilities capable of producing 3.7 million tons per year, and cold-rolling facilities capable of producing 1.1 million tons per year. Zaporizhstal produced 3.8 million tons of crude steel in 2021.

- Interpipe Steel: An integrated, semi-finished steel billet and finished steel pipe producer, which utilizes an electric-arc furnace (EAF) production route. Interpipe’s operations based in Dnipro have a crude steel production capacity of 1.3 million tons per year. Interpipe’s operations are integrated with two billet casting facilities.

- Centravis – private ownership: Centravis suspended operations at the start of the war, but it restarted in mid-March with limited operations. Centravis has restarted two bright annealing furnaces, more than 12 rolling mills, one drawing line, and three finishing units.

Despite the impact of the war, several Ukrainian steelmakers, have maintained limited operations. These are as follows:

- Metinvest, Kametstal: Acquired by Metinvest in June 2021, when it was known as Dneprovsky Iron & Steel Integrated Works, Kametstal has 3.9 million tons per year of crude steel capacity. Kametstal produces billet and finished long products, such as rebar and wire

- Dneprovsky Metallurgical Plant (DMZ): DMZ suspended operations in January due to maintenance. According to company announcements, DMZ continues limited operations to support the war, although no statements have been made regarding commercial action. DMZ, which is based in central Dnipro, has 1.2 million tons per year of crude steelmaking capacity, 1.2 million tons per year of billet casting capacity, and 300,000 tons per year of rod and bar rolling capacity.

Three Ukrainian steelmaking operations, Dneprospetsstal, Azovstal, and Ilyich have seen their operations suspended due to the Russian assault on the region. Dneprospetsstal, which produced 200,000 tons of crude steel last year, has not made any official announcements since the war began. Azovstal and Ilyich are both based in Mariupol, which has been a central focus of Russia’s assault in eastern Ukraine. Azovstal has received considerable media attention in recent weeks due to the intensity of fighting over this facility and the resultant damage the plant has sustained. Azovstal and Ilyich have a crude steel production capacity of 5 million tons per year each.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com