Prices

September 23, 2022

CRU Aluminum: Orders Improve, Early Signs of Destocking Ending?

Written by Greg Wittbecker

Aluminum May Be Approaching the End of Its Long Destocking Cycle

Last week, I described our premise about demand versus real consumption. We talked about the market’s natural tendency to destock when prices take a beating as they have during most of 2022.

The latest Index of Orders from the Aluminum Association offers some early encouragement that that destocking cycle may be reaching its conclusion.

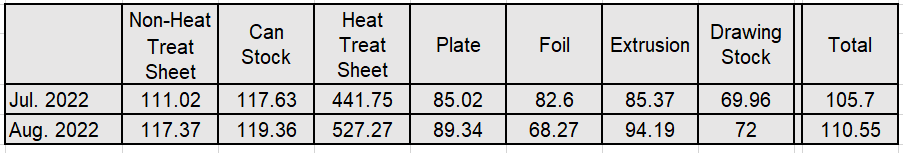

This index is predicated on Jan. 2013 as its baseline of 100. During Aug. 2022, the aggregate Index for all products was 110.55 compared to 105.70 in July. Year-on-year, we are still down, with Aug. 2021 at 115.66. We think it’s unrealistic to expect 2022 run rates to rival 2021, when we saw torrid orders and shipments. There was also a rush to get orders into mills to beat rapidly extending lead times.

Looking at individual sectors, we see a consistent pattern of improvement:

The exception to the rule was foil, where two major mills had operational excursions and we are beginning to see seasonal declines in demand.

One Month Does Not Make a Trend — Higher Interest Rates and Shifts in Consumer Spending are Worrisome

Before anyone pops the champagne thinking we have survived the worse in this economic cycle, we must be cognizant of some factors that could still sabotage the market.

The Federal Reserve has announced another 75-basis point increase in the federal funds rate to 3–3.25% as of Sept. 21, the highest level since 2008. This increase will ripple through the economy on a host of fronts.

This could harm interest rate-sensitive sectors such as autos and construction on the surface:

• Housing affordability could be compromised. Estimates from some lenders suggested that for every 0.5% rise in interest rates, purchasing power may be decreased by 4–5%. A 1% increase could cut purchasing power by 9–11%.

• Auto affordability to retail buyers could be compromised, but the OEMs may have the tools to combat this. We all know that the automakers have major financing facilities to complement their sales. Our view is that the financial arms of the automakers will be extending terms to 10 years to keep the principal and interest payment within striking distance of buyers.

• While the cost of capital is important to wholesale fleet buyers, it may not forestall them having to buy vehicles. Hertz announced a $4.2 billion purchase of 100,000 fully electric vehicles by the end of 2022. Purchases of conventional, more fuel-efficient internal combustion engine vehicles to replenish depleted rental fleets are still required.

• Increases in prime lending rates will ripple through the entire capital market and make financing working capital more expensive. This will function as a brake on any propensity to increase inventories.

Consumers have begun to rotate their spending from durable goods during the depth of the pandemic to more “experience spending,” such as travel, restaurant dining, and live events.

• Anyone who has traveled lately, attempted to book a table at their favorite restaurant, or attended a popular sporting event knows that demand is high.

• This means that appliances, boats, motorcycles, boats, and recreational vehicles are likely going to take a hit when it comes to demand. We are already seeing the slowing in recreational vehicle build rates.

Consumer debt is rising. According to the NY Federal Reserve Bank, consumer debt rose across most key segments as of June 30, 2022:

• Mortgage debt was $207 billion during the quarter and is up 9% year-on-year.

• Credit card balances were up $46 billion in the first quarter, a 13% increase year-on-year and the largest increase in 20 years.

It Will Take At Least 90 Days to Determine If We Have Bottomed Out on Order Rates

We need at least a full quarter’s worth of incoming orders to pass judgement on whether buyers are getting comfortable coming back to the market.

One thing that is putting off those decisions are falling lead times. We opened 2022 with record-long lead times that stretched to a year. Some segments have narrowed to traditional lead times of 4–6 weeks. That tells buyers they need be in no hurry to make the call on new orders as the pressure is off to chase lead times.

Uncertainty about the LME’s price of aluminum is obviously a big deterrent. Buyers worked hard to escape the financial “haircut” of selling off higher-priced inventory before the spot markets caught up to them. They do NOT want to get back on that treadmill again by trying to call the turn in aluminum prices. When in doubt, they will wait.

Another consideration is the hope that the conversion price may be lowered by mills. Conversion prices are the fabrication fees expressed over LME and Midwest aluminum ingots for products. Buyers have faced a steady increase in conversion prices for more than two years. The perception that the economy is weakening and demand for mill products might fall “could” convince buyers to play the waiting game before committing to 2023 volumes. Our discussions with mills suggest this is highly unlikely given the broad cost increases in freight, natural gas, and other raw materials. If anything, conversion fees may go up after Jan. 1. However, hope springs eternal for buyers and we must recognize that this could influence people to wait.

By Greg Wittbecker, Advisor, CRU Group, Gregory.Wittbecker@CruGroup.Com