Analysis

November 12, 2023

Final Thoughts

Written by Michael Cowden

Cleveland-Cliffs announced it would seek a minimum base price of $1,000 per ton ($50 per cwt) for hot-rolled coil (HRC) on Nov. 7. Nucor said a day later that it was aiming for $950 per ton.

Why didn’t Nucor follow Cliffs up to $1,000 ton? I think there might be some possible answers in our latest survey results. More on that in a moment.

Let’s first acknowledge those are both high targets compared to where prices are now. (SMU’s spot HRC price stands at $865 per ton on average. We’ll update that figure again on Tuesday.) I wouldn’t be surprised if we saw another week of gains.

$950-$1,000/ton, Here We Come!

Why? As we reported on Thursday, sheet lead times continue to extend and are now the longest they’ve been since late 2021.

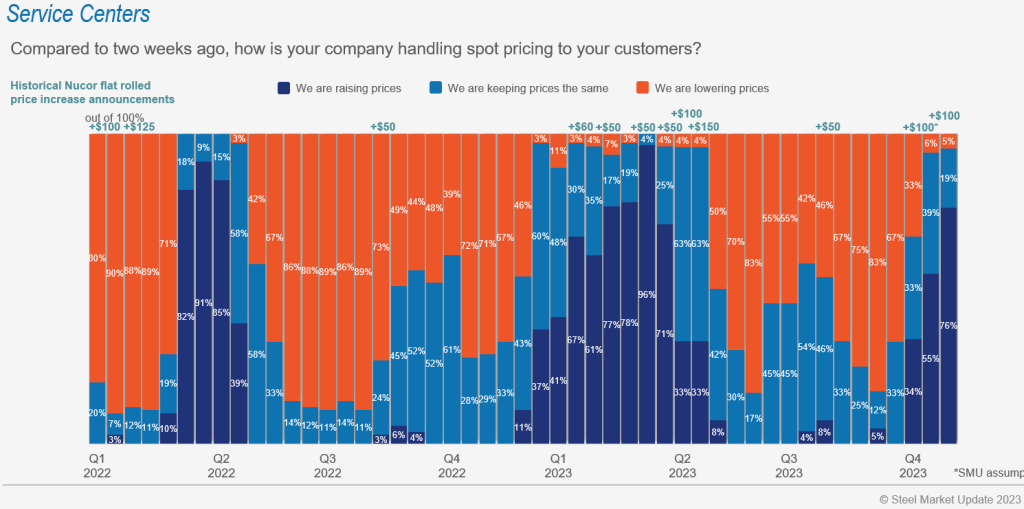

We also continue to see service centers raise prices in tandem with mills:

Seventy-six percent of service centers respondents tell us that they are raising prices along with mills, the highest reading we’ve had since the first quarter – when we also saw a spike in US sheet prices.

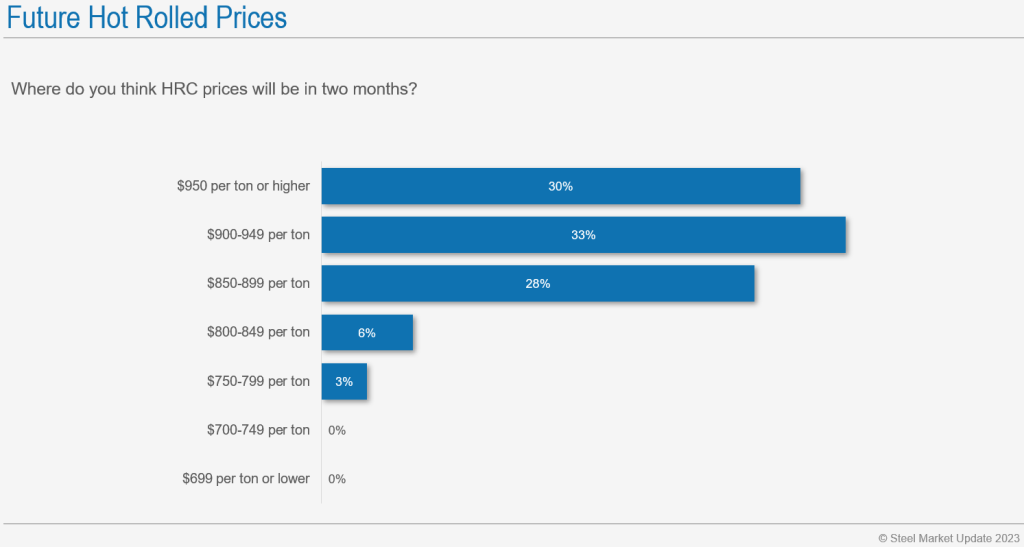

It should come as no surprise, then, that two-thirds of survey respondents think HRC will climb above $900 per ton over the next two months. And 30% think $950 per ton is a foregone conclusion:

Here is what some of those who think prices will go higher have to say:

“The UAW strike is over, and demand has been steady for the last four months. The mills see an opportunity to raise prices as demand should historically increase in the 1st quarter.”

“Offshore supply is limited until February.”

“CME futures already exceed that ($950/ton).”

Peak in late Q4’23 or late Q1’24?

And yet there are some chinks narrative armor of the prices having nowhere to go but up well into Q1’24. SMU’s current sentiment index is roughly flat. But future sentiment declined.

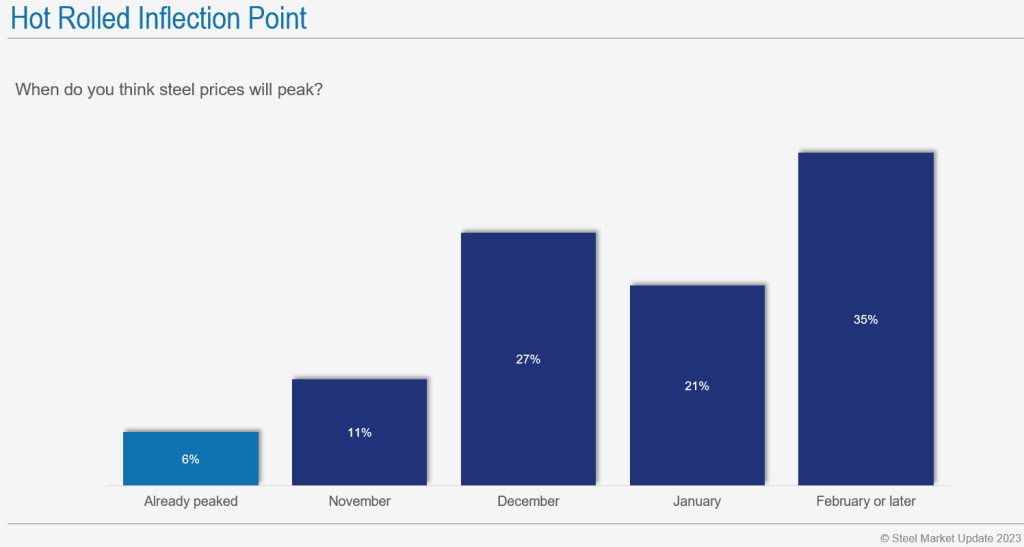

Also, we’re seeing some divergence of opinion on when prices will peak:

Thirty-five percent of survey respondents think that US HRC prices won’t peak until February or later. But 27% think price will peak next month. What gives?

Here is what some who think prices won’t peak until 2024 have to say:

“Too many sat on the sidelines awaiting a collapse due to the auto strike, and the mills collectively did a great job of limiting availability during the short-term impact of the strike. It will take a few more months for inventories to get back in balance and allow prices to settle.”

“Depending on how auto comes back, I can see more upside into the first quarter.”

“Not sure the fundamentals line up for the aggressive increases. I feel the mills are being opportunistic. It will need to come back down in late February or early March. They will make a lot of money between now and then.”

Here is what some of those who think prices will peak sooner have to say:

“We’re in somewhat of a price spike. I feel it will top out next month.”

“We are expecting a few more weeks of hikes and then to see things fizzle out as the holidays start.”

“Once people realize that demand is weaker than expected, they will revert back to keeping lean inventories.”

Durable Demand

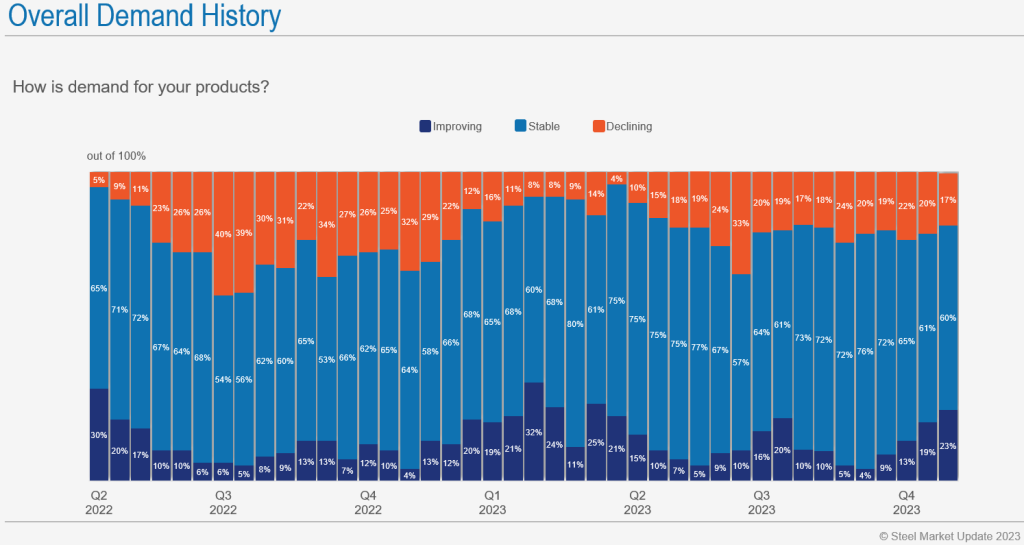

Despite some of the comments above, most of you continue to report back that demand for your products is solid.

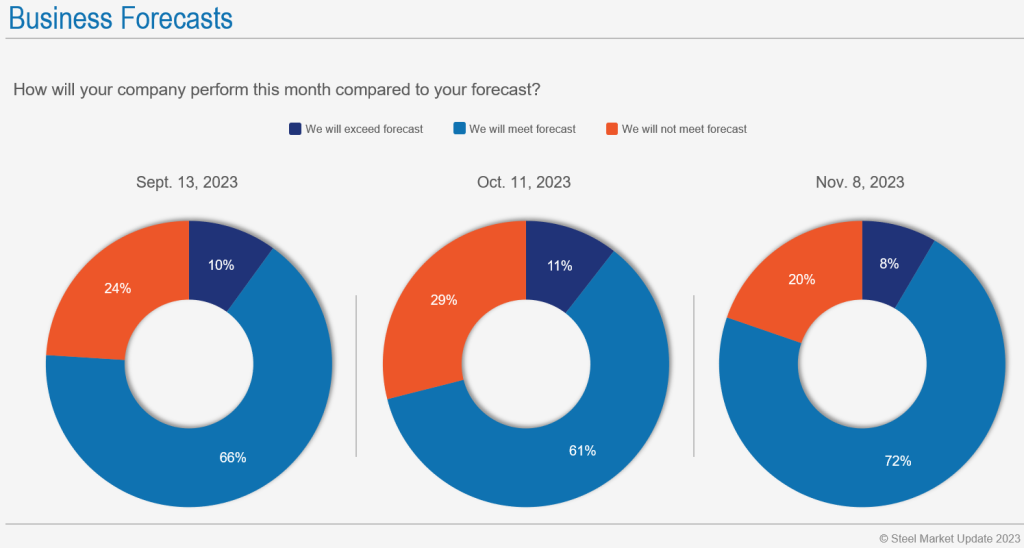

We’ve seen huge swings in sheet prices this year. We’ve also consistently seen 70-80% of survey respondents say that they expect to meet or exceed forecast for the month. It’s no different for November:

It probably doesn’t hurt that 23% of respondents tell us that demand is improving, the highest reading we’ve seen since the first quarter.

Here is what respondents have to say about demand and forecasts for November:

“Our customers sense pricing has bottomed out and are now trying to replenish stock and they want to get ahead of future price increases.”

“Autos rebounding and good early 2024 order book coming in.”

“With auto coming back, buyers are willing to build inventory again.”

Imports Gain Appeal

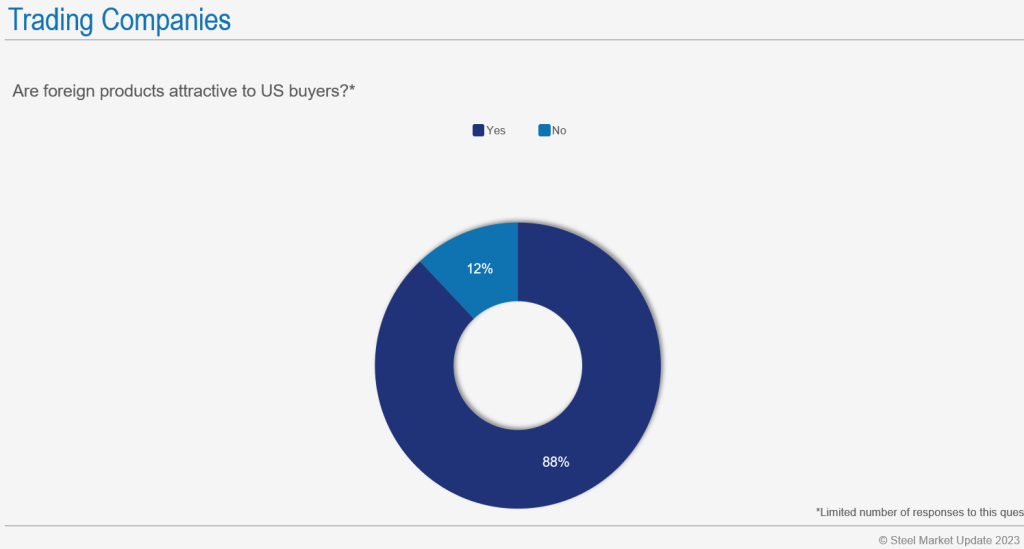

It’s not just domestic steel buyers who tell us they’re seeing more activity – so too are steel traders.

Nearly 90% of steel traders we surveyed say that their products are competitive in the US market:

That’s a big change from late September – when domestic prices bottomed and when only half of trader respondents said their offers were appealing to US buyers.

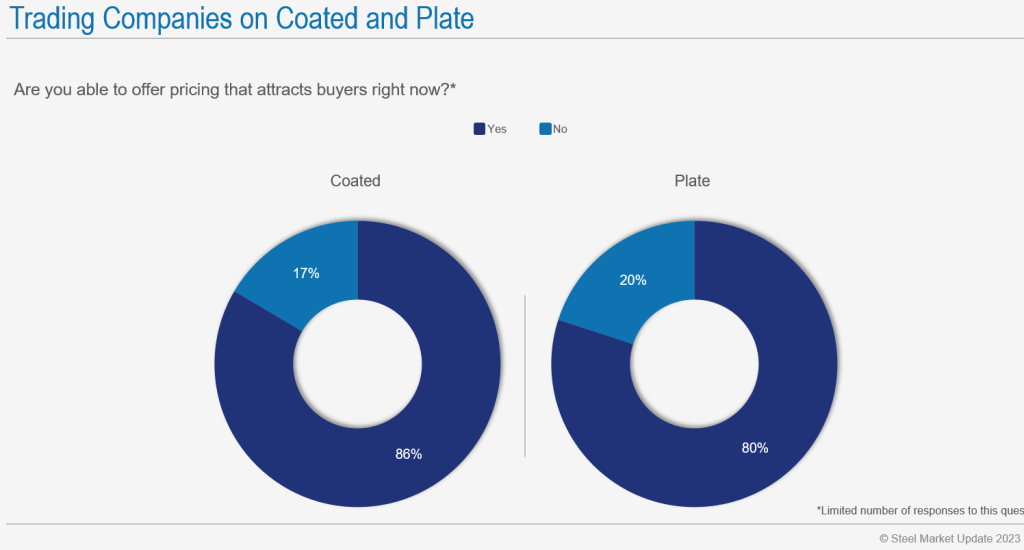

Breaking it down by product, traders report that imports are most competitive when it comes to coated sheet and discrete plate:

We probably shouldn’t expect a flood of imports. One trader source said US buyers were ordering imports to hedge against higher domestic prices. But he also noted that it was specialty items – certain thicknesses and grades – that were competitive. And, even then, it was material from countries not subject to Section 232 tariffs – i.e., South Korea, Australia, Mexico, and Canada.

Recall that South Korea and Brazil are subject to an absolute quota rather than the 25% tariff. Australia, Mexico, and Canada are not subject to Section 232.

(PS – We’d love to see more traders participate in our survey. Email us at info@steelmarketupdate.com to do so.)

X-Factors: UAW and Sheet-Plate Spread

You’ve probably noticed a theme in some of the survey comments: Namely, that the end of the UAW strike should result in a rebound in steel demand as automakers return to pre-strike production levels.

Yes, UAW workers have returned to work pending ratification votes. But it’s not a slam dunk that they will ratify even a record new contract. Case in point: Union members at a General Motors assembly in Flint, Mich., last week rejected the new contract. Is Flint an outlier, or will UAW members in other places vote “no” to the new contract as well?

Here is another to watch: Prices for discrete plate have carried a hefty premium over hot-rolled coil since early 2022. That gap, while still wide, is narrowing. And I would expect it to continue to do so.

HRC lead times rose by roughly a week to nearly seven weeks. Plate lead times, meanwhile, slipped by a few days to approximately 5.5 weeks on average. It’s probably no coincidence that sheet mills have announced $200/ton in price increases over the last month even while Nucor has cut plate prices by $140/ton.

We had seen a trend of customers shifting plate orders, where possible, to sheet because discrete plate was so expensive. Could we see that trend reverse, with sheet losing ground to plate, should plate prices continue to fall while HRC prices rise?

Tampa Steel Conference

We typically see registrations for the Tampa Steel Conference, which SMU puts on with Port Tampa Bay, rise sharply in November. This year is no exception.

Tampa Steel runs Sunday-Tuesday, Jan. 28-30, 2024, at the JW Marriot Tampa Water Street. You can register here.

Pro tip: Consider arriving on Saturday so you can take in Tampa’s Gasparilla Pirate Festival. Learn more here about Ye Mystic Krewe’s plans to invade and take the key to the city.