Prices

February 6, 2024

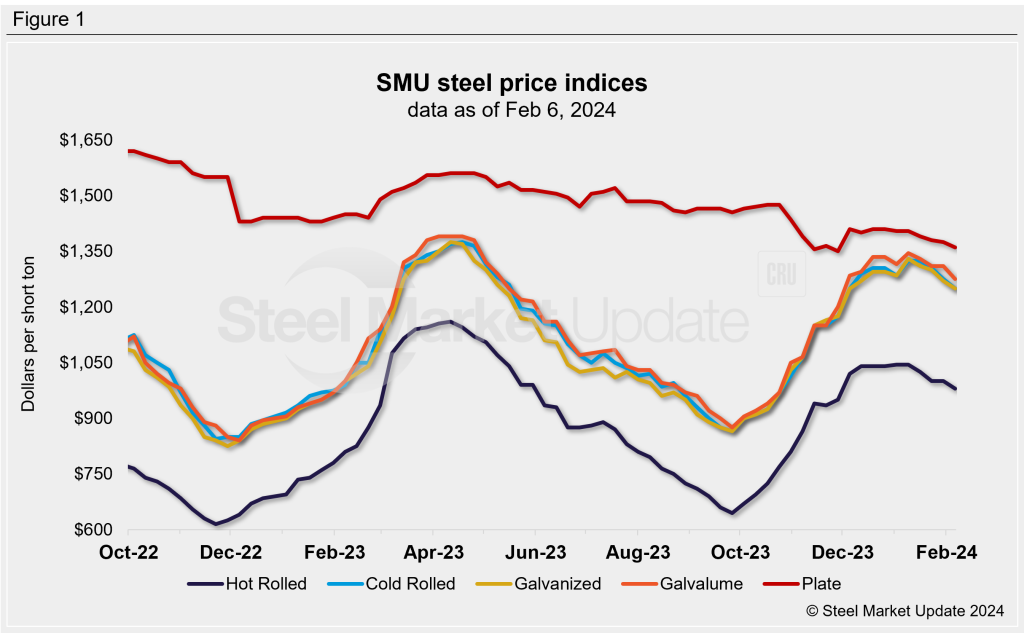

SMU price ranges: Sheet prices slip, HR dips below $1,000/st on average

Written by David Schollaert & Michael Cowden

Sheet prices fell across the board this week as SMU’s hot-rolled (HR) coil price slipped below $1,000 per short ton (st) on average for the first time since November.

SMU’s HR price stands at $980/st on average, down $20/st week over week (w/w) and off $45/st month over month.

It was a similar story for tandem products. CR and galvanized base prices were both at $1,250/st on average – down $25/st and $20/st, respectively, compared to last week. Our Galvalume base price stands at $1,275 per ton on average, down $35/st from a week ago.

Plate prices also slid following Nucor’s price decrease announcement. SMU’s plate price is now at $1,360/st on average, down $15/st vs. last week.

Some sources said that sheet price declines could accelerate in the weeks ahead on low-priced offers for foreign steel, with buyers sit on the sidelines until prices bottom, and should mills struggle to fill March books as a result.

Others said that mill would manage the declines, with some EAF producers already said to be quietly dialing back production. They also warned that consumers tend to exit and re-enter the market at the same time – something that could lead prices to pop when buyers need to restock again.

Our price momentum indicators for all products in the meantime continue to point lower not only on the dip in prices but also on shorter lead times and on buyer feedback that more mills are willing to negotiate lower spot prices.

Hot-rolled coil

The SMU price range is $920–1,040/st, with an average of $980/st FOB mill, east of the Rockies. The bottom end of our range and the top end of our range were down $20/st vs. one week ago. Thus, our overall average, was $20/st lower w/w. Our price momentum indicator for HRC remains lower, meaning SMU expects prices will move lower over the next 30 days.

Hot rolled lead times: 3–8 weeks

Cold-rolled coil

The SMU price range is $1,200–1,300/st, with an average of $1,250/st FOB mill, east of the Rockies. The lower end of our range was $40/st lower vs. the prior week, while the top end of our range was down $10/st. Our overall average is down $25/st from last week. Our price momentum indicator for CRC remains lower, meaning SMU expects prices will move lower over the next 30 days.

Cold rolled lead times: 6–9 weeks

Galvanized coil

The SMU price range is $1,200–1,300/st, with an average of $1,250/st FOB mill, east of the Rockies. The lower end of our range was down $40/st vs. the prior week, while the top end of our range was unchanged w/w. Our overall average is $20/st lower than the week prior. Our price momentum indicator for galvanized remains lower, meaning SMU expects prices will move lower over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,297–1,397/st with an average of $1,347/st FOB mill, east of the Rockies.

Galvanized lead times: 5–10 weeks

Galvalume coil

The SMU price range is $1,250–1,300/st, with an average of $1,275/st FOB mill, east of the Rockies. The lower end of our range was $10/st lower w/w, while the top end of our range was down $60/st from the prior week. Our overall average was down $35/st when compared to the previous week. Our price momentum indicator for Galvalume remains lower, meaning SMU expects prices will move lower over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,544–1,594/st with an average of $1,569/st FOB mill, east of the Rockies.

Galvalume lead times: 7–8 weeks

Plate

The SMU price range is $1,320–1,400/st, with an average of $1,360/st FOB mill. The lower end of our range was unchanged vs. the week prior, while the top end of our range was down $30/st w/w. Our overall average is down $15/st vs. one week ago. Our price momentum indicator for plate remains lower, meaning SMU expects prices will move lower over the next 30 days.

Plate lead times: 4-7 weeks

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert