Plate

March 8, 2024

Hot rolled vs. plate price spread climbs on slumping HRC tags

Written by David Schollaert

The premium plate prices have held over hot-rolled coil (HRC) are nowhere near recent highs seen in 2022 but remain higher compared to historical levels.

The current spread between the two products had recently been close to its narrowest point since it began ballooning early in 2022. And while the gap had been narrowing, it swelled of late as hot band prices have moved down in a hurry midway through January.

Pricing levels

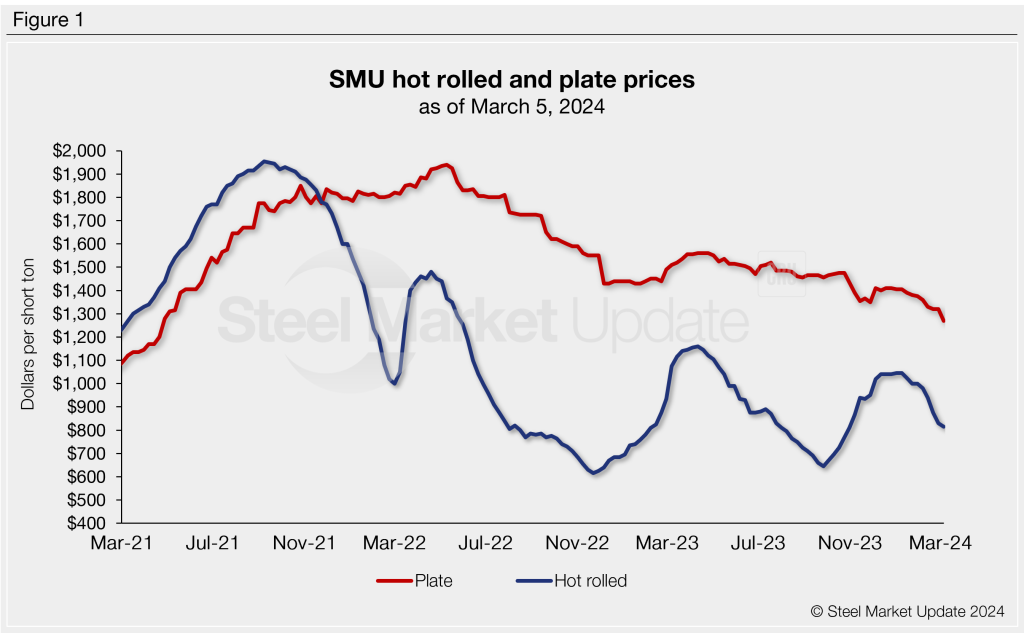

Prices for both HRC and plate have come down from the highs experienced in 2021 and 2022 but remain high compared to pre-2021 levels (Figure 1).

HRC prices hit a five-month low of $815 per short ton (st) on average in SMU’s latest check of the market on March 5, after beginning 2024 at $1,045/st. But mills have since responded with price notices – likely trying to stop the eight-week hemorrhaging.

Plate prices, meanwhile, hit an all-time high of $1,940/st during the week of May 10, 2022. And while they have declined by nearly $700/st since, they remain much higher when compared to historical pricing levels.

SMU’s plate price stands at $1,270/st on average, down $50/st from last week and down $140/st from a recent high of $1,410/st in late December.

Plate’s premium over hot rolled

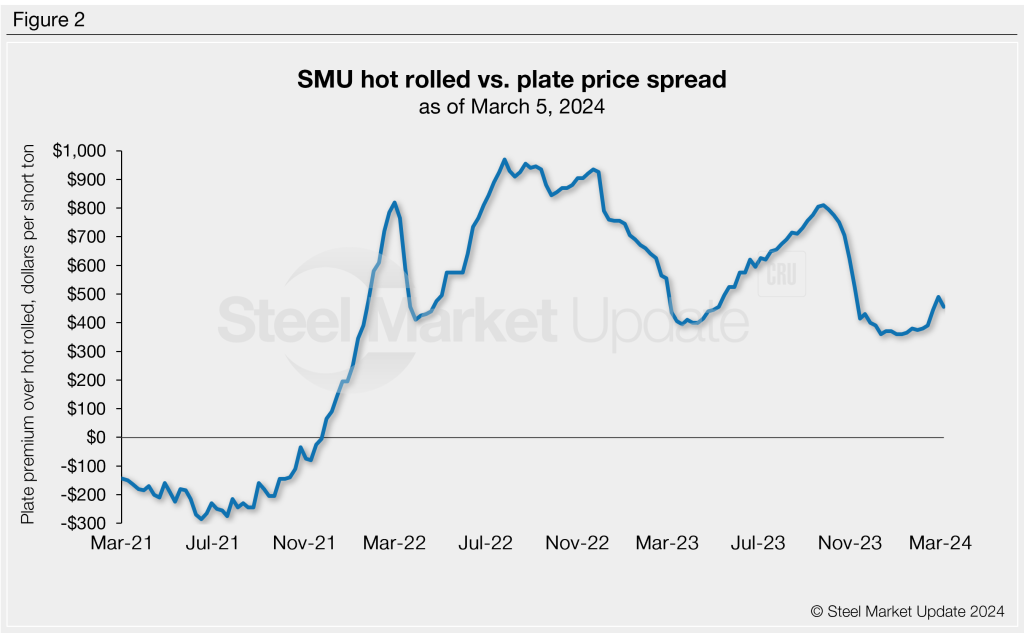

Steel plate has traditionally held a premium over hot rolled, but that changed in October 2020 when hot rolled began selling at a higher price than plate. The spread between HRC and plate remained negative through the middle of November 2021. When HRC prices began to fall, plate prices remained elevated, leaving plate with a significant premium over hot rolled – much higher than historical levels.

The spread in pricing hit a 2023 peak of $810/st at the end of September before plummeting to $360/st by mid-December (Figure 2). It had held largely stable before swelling back up to $455/st as of March 5 because of HRC’s Q1 price slump.

The spread has not been below $360/st since January 2022.

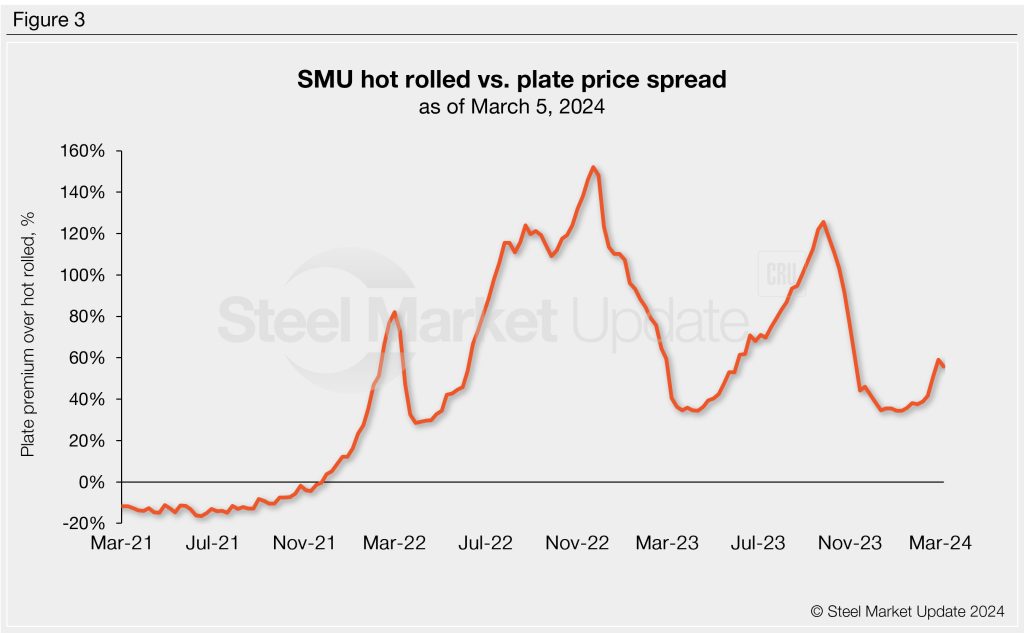

It’s been nearly two years now since plate prices decoupled from HRC. As a percentage basis, plate’s premium over HRC had ballooned to 126% late last September (Figure 3), reaching a 10-month high, not far from the all-time high of 152% in November 2022. It had reached as low as 34% at the beginning of the year, but HRC’s recent decrease has edged the premium up to 56% as of the week of March 3.

You can graph the relationship between HRC and plate prices, as well as the other steel prices SMU tracks, using the interactive pricing tool on our website.