Analysis

May 9, 2024

SMU's April at a glance

Written by Brett Linton

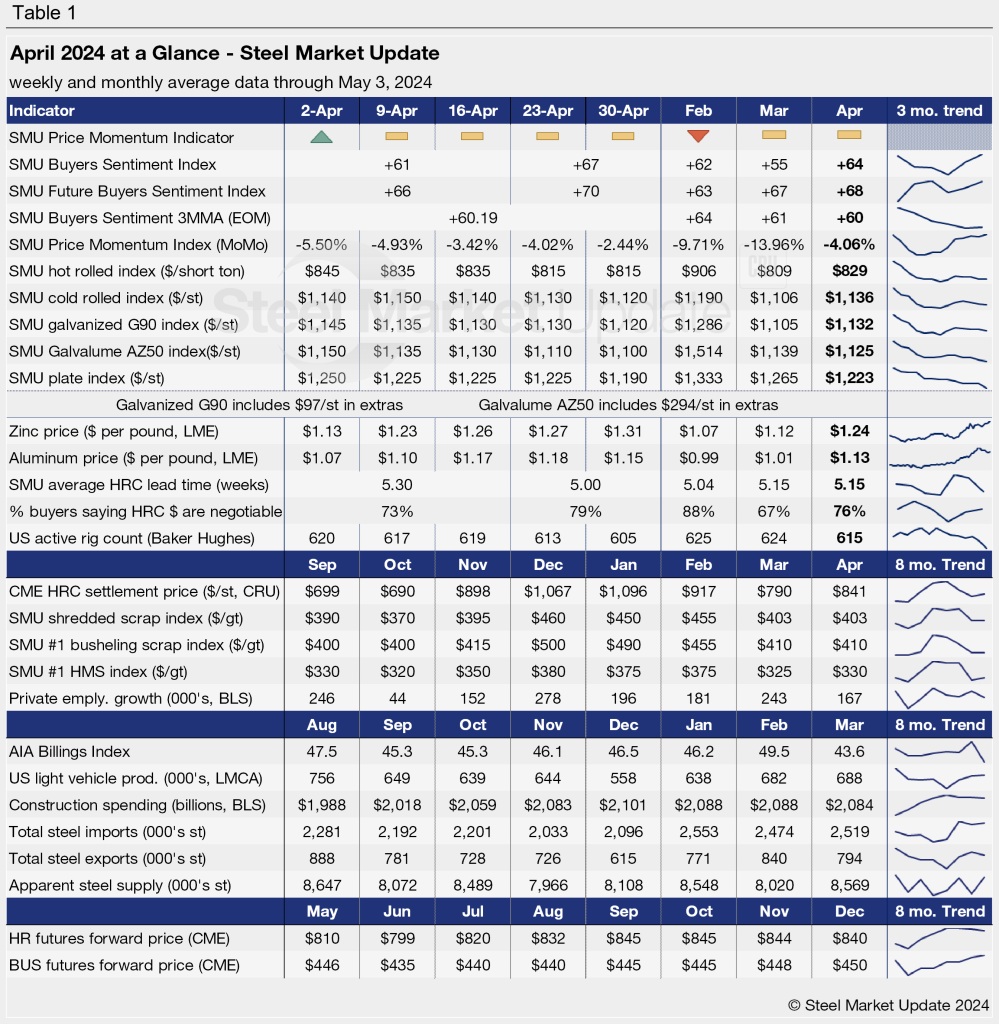

SMU’s Monthly Review articles summarize important steel market metrics for the prior month. This April report contains data updated through May 3.

Steel prices trickled lower across the month of April for both sheet and plate products. The SMU Price Momentum Indicator was adjusted from Higher to Neutral in the beginning of the month. (We adjusted it to Lower this past Tuesday).

We saw an improvement in Steel Buyers’ Sentiment, with the Index rising to a 3.5-month high by the end of April. Steel mill lead times inched down across the month, while the percentage of buyers reporting that mills were willing to negotiate grew larger.

Raw material prices were flat to up last month; scrap products were flat from March to April, while zinc and aluminum prices strengthened throughout the month.

We also saw a mixed bag regarding economic indicators. Employment figures declined in April to a five-month low. The AIA Billings Index remained in contraction territory, shrinking to the lowest level seen in over three years. Construction spending has flattened out but is overall strong historically. Steel trade is up, with imports and exports both near multi-month highs.

See the chart below for other key metrics for April. Note our new ‘trend’ column showing mini-graphs for each item (click here to expand).