Prices

May 14, 2024

SMU price ranges: Sheet nears five-month lows

Written by Brett Linton

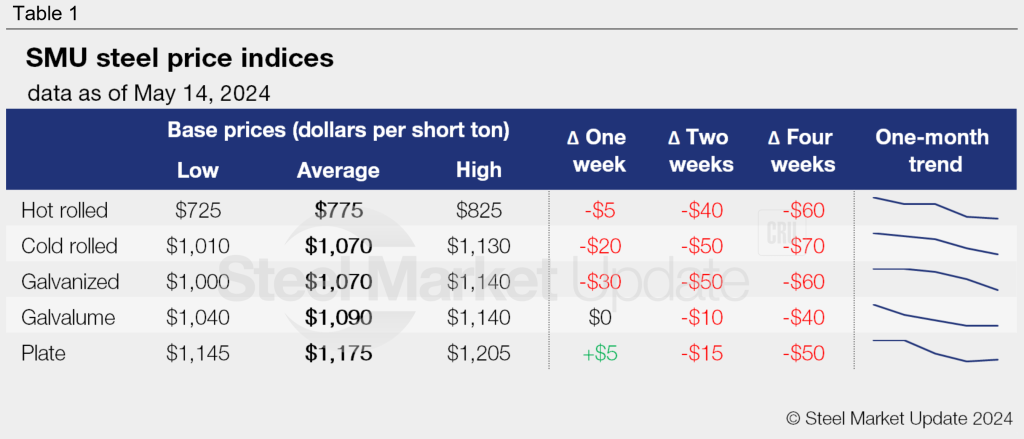

Steel prices were overall mixed this week, according to our latest check of the market. Sheet prices were flat to down, while plate prices inched up. SMU’s indices on hot rolled, cold rolled, and galvanized are now down to the lowest levels seen since November.

SMU’s average hot-rolled coil price slipped $5 per short ton (st) week over week (w/w) to $775/st this week. Our average cold-rolled coil price eased $20 w/w to $1,070/st. Galvanized base prices fell $30 w/w to $1,070/st on average. Our Galvalume price average held steady at $1,090/st. Plate prices ticked up $5/st w/w to $1,175/st; this comes after a drop of $20/st last week following Nucor’s plate price cut.

SMU price momentum indicators for both sheet and plate continue to point to lower prices.

Hot-rolled coil

The SMU price range is $725-825/st, averaging $775/st FOB mill, east of the Rockies. From last week, the lower end of our range is down $10/st, while the top end is unchanged. Our overall average is down $5/st. Our price momentum indicator for HR remains pointing lower, meaning we expect prices to decline over the next 30 days.

Hot rolled lead times range from 3-7 weeks, averaging 4.9 weeks as of our May 8 market survey.

Cold-rolled coil

The SMU price range is $1,010–1,130/st, averaging $1,070/st FOB mill, east of the Rockies. The lower end of our range is down $10/st w/w, while the top end is down $30/st. Our overall average is down $20/st w/w. Our price momentum indicator for CR remains at lower, meaning we expect prices to decline over the next 30 days.

Cold rolled lead times range from 5-9 weeks, averaging 7.2 weeks through our latest survey.

Galvanized coil

The SMU price range is $1,000–1,140/st, averaging $1,070/st FOB mill, east of the Rockies. The lower end of our range is down $40/st w/w, while the top end is down $20/st. Our overall average is down $30/st w/w. Our price momentum indicator for galvanized remains at lower, meaning we expect prices to decline over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,097–1,237/st, averaging $1,167/st FOB mill, east of the Rockies.

Galvanized lead times range from 5-9 weeks, averaging 7.1 weeks through our latest survey.

Galvalume coil

The SMU price range is $1,040–1,140/st, averaging $1,090/st FOB mill, east of the Rockies. The lower and upper ends of our range, and the overall average, are unchanged from last week. Our price momentum indicator for Galvalume remains at lower, meaning we expect prices to decline over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,334–1,434/st, averaging $1,384/st FOB mill, east of the Rockies.

Galvalume lead times range from 6-10 weeks, averaging 7.7 weeks through our latest survey.

Plate

The SMU price range is $1,145–1,205/st, averaging $1,175/st FOB mill. Both the lower and upper ends of our range are up $5/st w/w. Our overall average is up $5/st w/w. Our price momentum indicator for plate remains at lower, meaning we expect prices to decline over the next 30 days.

Plate lead times range from 4-7 weeks, averaging 5.5 weeks through our latest survey.

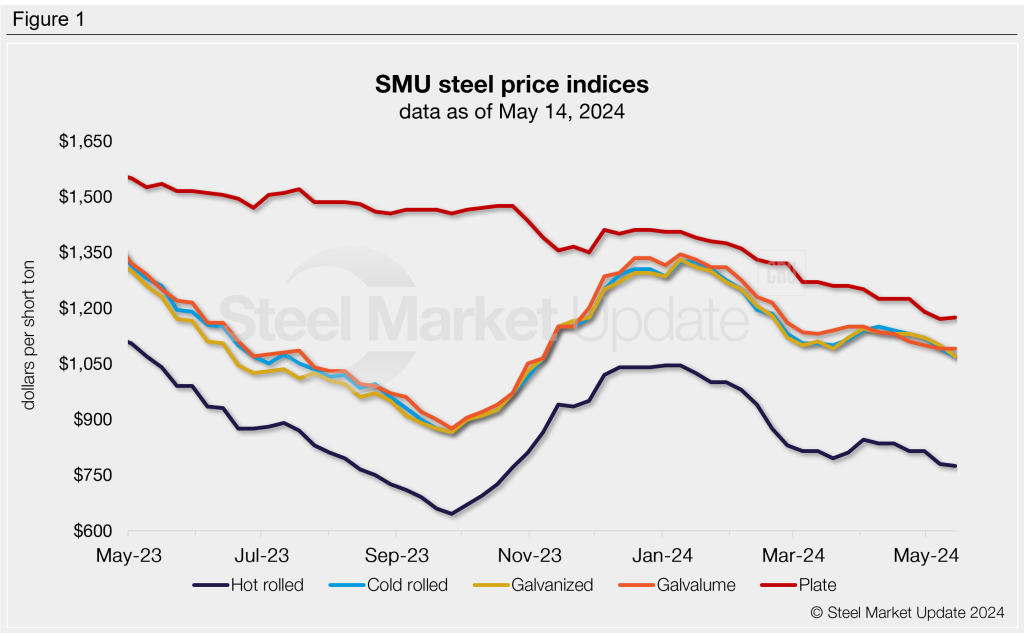

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.