CRU

November 26, 2024

CRU: N. American zinc supply disruption to continue into 2025

Written by Helen O’Cleary

Refined output disruption will continue

CRU now estimates that North America’s refined zinc output will fall by 2.5% y/y this year due to output losses following a recent fire at Teck Resource’s Trail Operations in southern British Columbia and because of planned maintenance at the Valleyfield smelter, Glencore’s CEZInc Refinery in Salaberry-de-Valleyfield, Quebec.

Output in Mexico is forecast to remain flat y/y and also in the US (where we rely on refined output figures from ILZSG, the International Lead and Zinc Study Group).

We understand that Valleyfield is now ramping up after successfully completing the cell house replacement. Meanwhile, we again have a sizeable, unallocated smelter disruption allowance for next year as we expect another year of concentrate tightness and the potential for greater competition for secondary feed to tighten that market too.

Demand remains weak, but a return to growth is expected

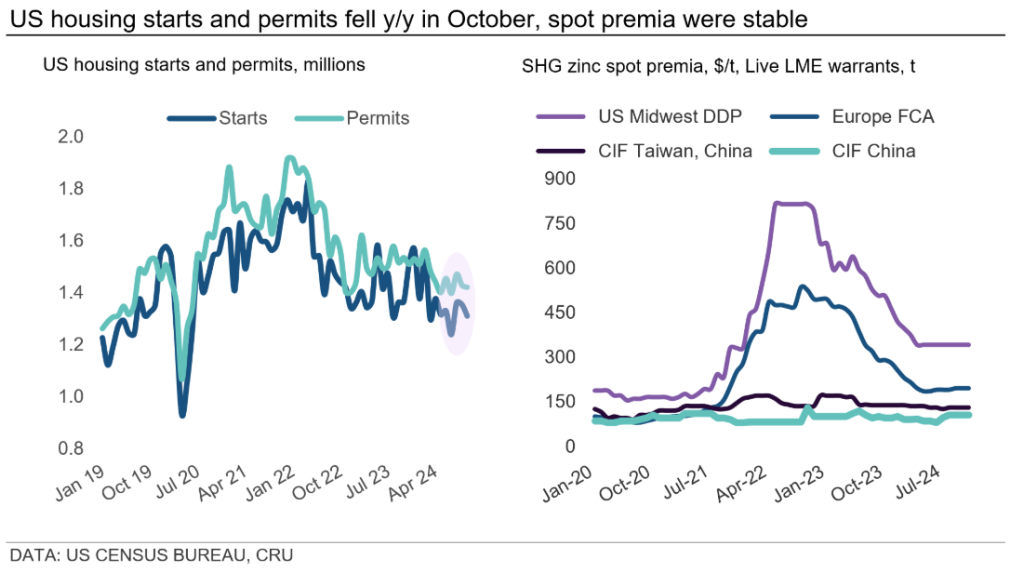

The slowdown in North American zinc demand in recent months has played out across all sectors, and we now expect it to contract by 3.7% y/y. A second US interest rate cut in early November should provide some relief, but the US real estate sector, where starts contracted by 4% y/y in October and permits by 7.4%, is expected to remain weak well into 2025.

Trump’s election victory has brought with it hopes that the promised pro-growth policies, including tax cuts, a focus on cheap energy, and trade tariffs, will boost the US economy next year. Protectionist policies are likely to be inflationary but should benefit US manufacturing as tariffs render low-cost imports uncompetitive.

The Section 232 tariffs imposed in Trump’s first term in office mean that 25% tariffs are still in place on steel products from most countries, and import quotas are still in place for galvanized sheet from South Korea, Brazil, Canada, and Mexico. Galvanized sheet imports into the US have fallen by more than 50% since 2016, from 3.64 million metric tons (mt) to 2.1 million mt in 2023. However, there may still be scope for the existing quotas to be reduced or removed entirely. Mexico could also be in the firing line regarding tariffs, which can potentially disrupt the flow of raw materials and manufactured goods and impact the US auto sector.

US spot premia remain unchanged

We understand that some progress has been made on contract negotiations for 2025 and that premia are a little below the average 2024 contract terms, which we estimate were 18 ¢/lb. The structural North American deficit was not felt this year due to the stock overhang in H1 and slowing demand in H2. With very little tonnage being carried over from 2024 into 2025 and pipeline stocks much thinner than they were at this time last year, there is an argument for annual contract premia to remain stable in 2025. However, the slowdown in demand in H2 means that consumers are cautious about the outlook for 2025, and some are holding out for a decent decrease in this year’s long-term premia.

The US spot market has remained stable over the past month, and we are rolling over our assessment for November at 15.5 ¢/lb.

This analysis was first published by CRU. To learn about CRU’s global commodities research and analysis services, visit www.crugroup.com.