Market Data

February 6, 2025

SMU Survey: Mills less willing to negotiate on prices

Written by Brett Linton

Almost two-thirds of the steel buyers responding to our latest market survey reported that domestic mills were flexible on new order prices this week. Negotiation rates have declined in each of our last two surveys; this week’s rate is the lowest recorded since March 2024.

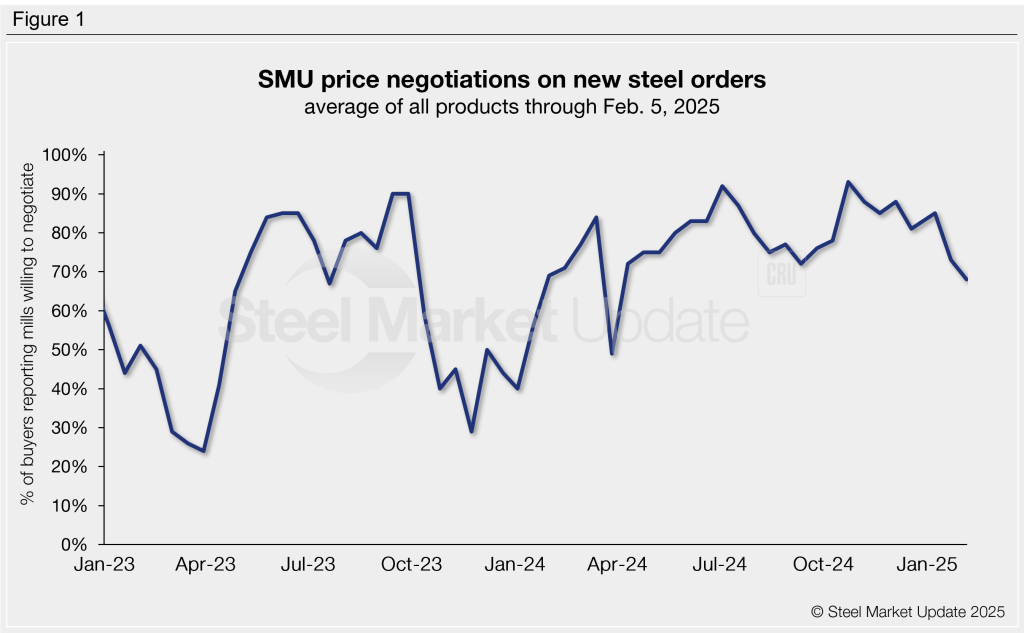

Every other week, SMU polls buyers asking if domestic mills are willing to negotiate lower spot pricing on new orders. As shown in Figure 1, 68% of the participants surveyed this week reported mills were willing to talk price on new orders. This is five percentage points lower than our previous survey. In comparison, the rates witnessed from last October through early January were much higher, ranging from 81% to 93%.

Negotiation rates by product

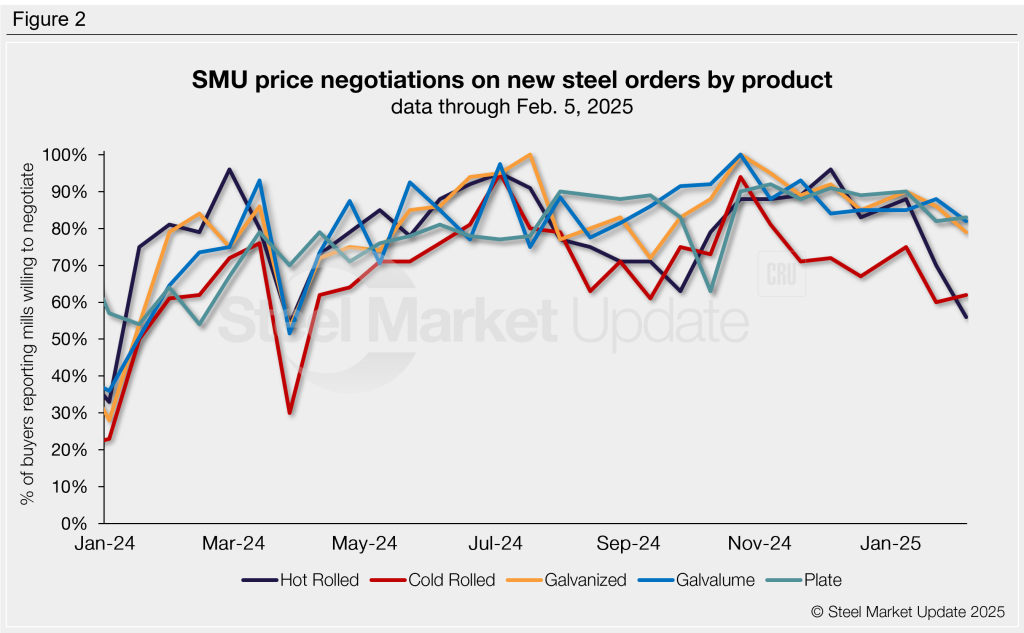

Negotiation rates were highest this week on coated and plate products, while hot-rolled and cold-rates slipped to multi-month lows (Figure 2). Negotiation rates by product this week are:

- Hot rolled: 56%, down 14 percentage points from Jan. 22 and the lowest rate seen in 10 months.

- Cold rolled: 62%, up two percentage points (previously at a 10-month low).

- Galvanized: 79%, down seven percentage points and the lowest rate seen since last September.

- Galvalume: 82%, down six percentage points to a three-month low.

- Plate: 83%, up one percentage point (previously at a two-month low).

Steel buyer remarks:

“EAFs negotiable [on hot rolled], integrated mills are not.”

“Only negotiable on larger coated orders.”

“[Hot rolled] is already at the lowest point and will now start to rise.”

“Dependent on [hot rolled and plate] grade/thickness, still holes out there.”

“Mills seem to be firmer than previous months.”

“Tonnage still moves the needle.”

“Yes [on plate] but with much less wiggle room.”

“I’ll still say negotiable [on plate], but they’re actively in ‘try to raise price’ mode too.”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Visit our website to see an interactive history of our steel mill negotiations data.