Sheet

April 3, 2025

US, offshore HRC prices differ widely on tariff situation

Written by David Schollaert

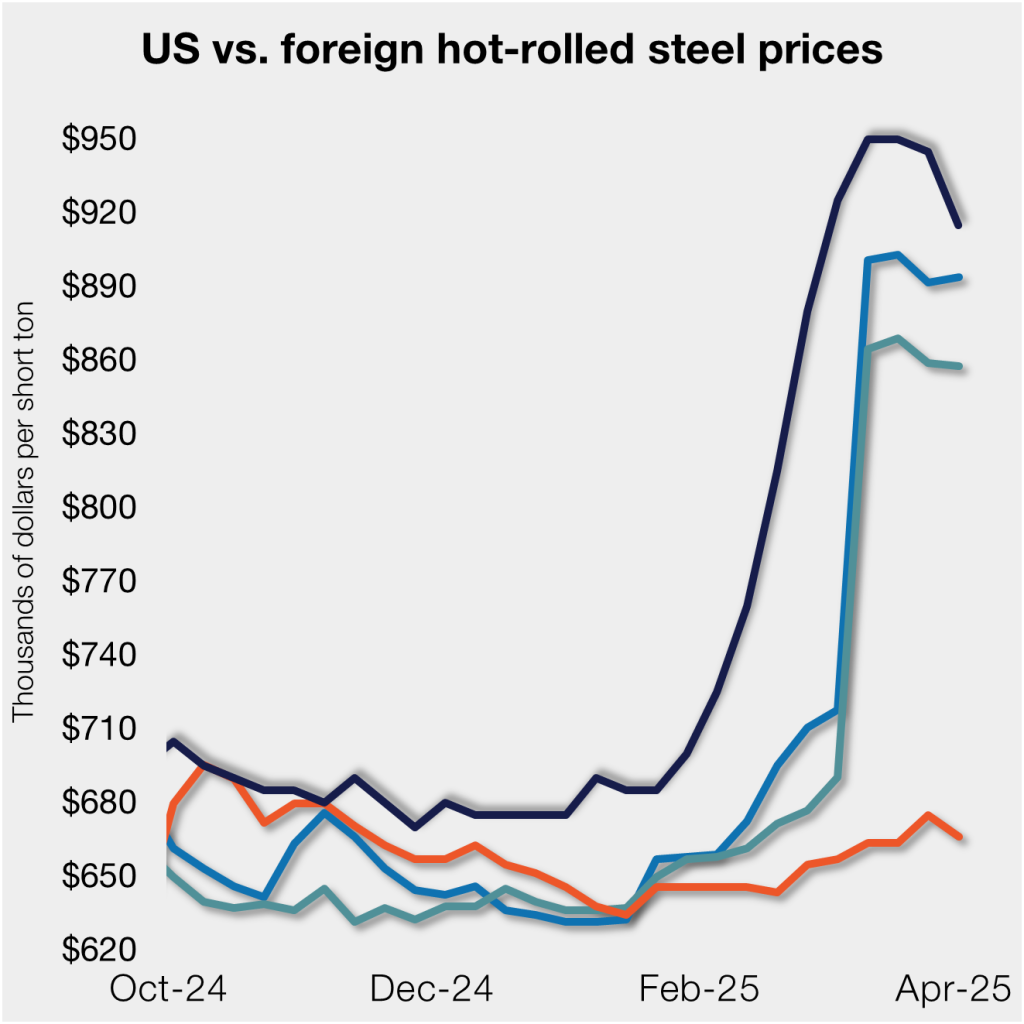

Domestic hot-rolled (HR) coil prices declined this week, a trend again reflected in most offshore markets. Despite similarities, the shifting tariff landscape has made for a wild ride in Q1.

The threat of tariffs over the past two months led to rising US prices. But the re-emergence of Section 232 on March 12, paired with a recoil in buying, narrowed the domestic premium over imports on a landed basis.

Buyers appear to have moved to the sidelines, taking a wait-and-see approach, monitoring closely the effects of Trump’s “Liberation Day” tariffs. This week, SMU’s average domestic HR price was $915 per short ton (st), down $30/st vs. the previous week.

Domestic HR is now theoretically 11.9% more expensive than imported material, down from 14.4% last week.

The widest margin stateside hot band had over imports in over a year came just a month ago. The margin immediately shrank once S232 took effect on March 12 and was little moved until spot prices fell as trade uncertainty gripped the market.

In dollar-per-ton terms, US HR is now, on average, $109/st more expensive than offshore product (see Figure 1). That’s roughly $27/st lower than the previous week.

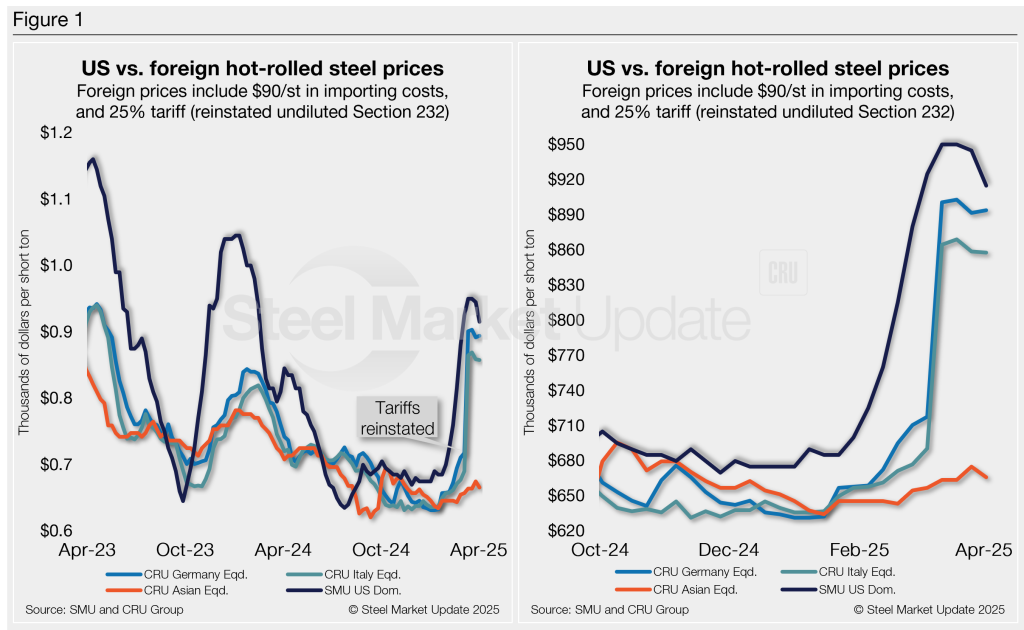

The charts below compare HR prices in the US, Germany, Italy, and Asia. The left side highlights prices over the last two years and the right side zooms in to show more recent trends.

Methodology

SMU calculates the theoretical spread between domestic (FOB mill) and foreign (delivered to US ports) HR coil prices by comparing its weekly US HR assessment to CRU’s weekly HR indices for Germany, Italy, and East and Southeast Asian ports. This calculation is purely theoretical, as actual import costs can vary significantly, affecting the true market spread.

To estimate the CIF price at US ports, we add a $90/st charge to all foreign prices to account for freight, handling, and trader margins, along with the 25% blanket tariff. This $90/st figure serves as a general benchmark — buyers should adjust it based on their specific shipping and handling expenses.

If you import steel and have insights on these costs, we’d love to hear from you. Contact the author at david@steelmarketupdate.com.

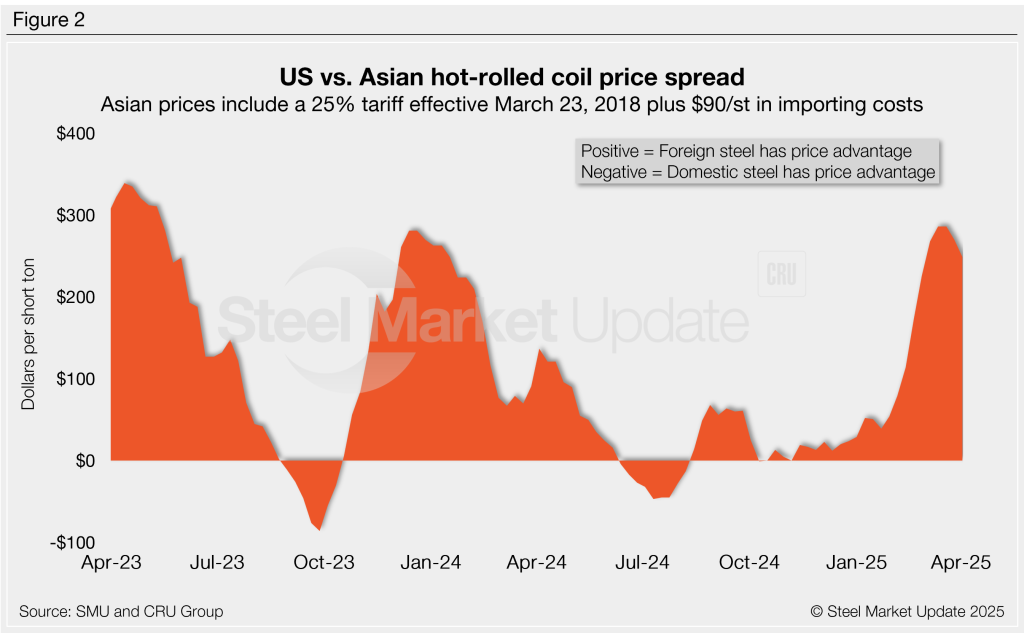

Asian HRC (East and Southeast Asian ports)

As of Wednesday, April 2, the CRU Asian HRC price was $461/st, down $7/st vs. the week prior. Adding a 25% tariff and $90/st in estimated import costs, the delivered price of Asian HRC to the US is ~$666/st. As noted above, the latest SMU US HR price is $915/st on average.

The result: Prices for US-produced HR are theoretically $249/st higher than steel imported from Asia – $21/st lower week over week (w/w). The premium remains not far from recent highs seen in 2023 when stateside tags were ~$300 /st more expensive than Asian products.

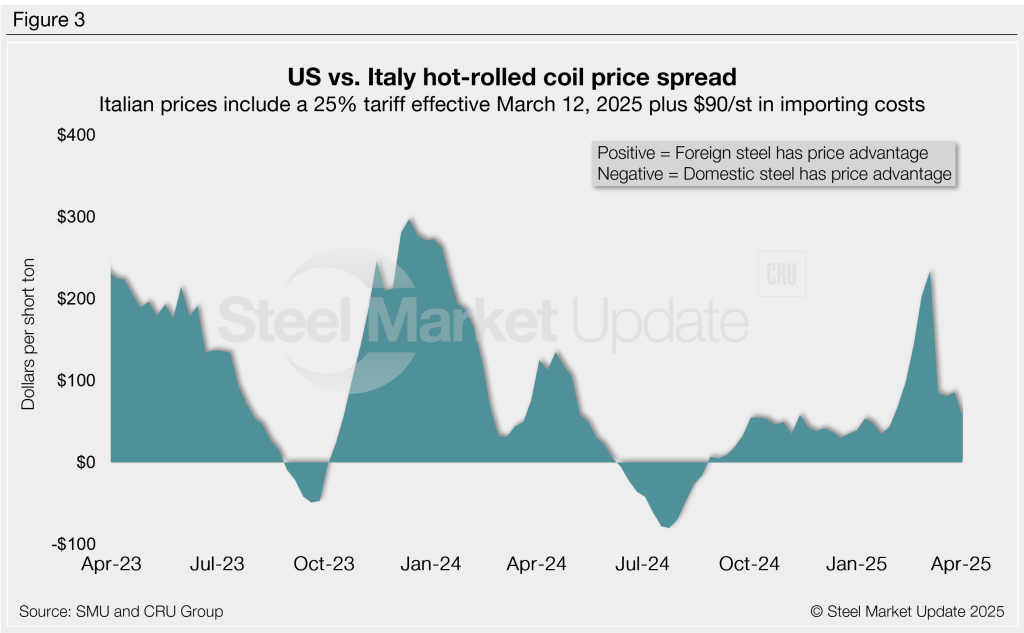

Italian HRC

Italian HR prices were just $1/st lower this week at $614/st, according to CRU. After reintroducing a 25% tariff and $90/st in estimated import costs, the delivered price of Italian HR is, in theory, $858/st.

That means domestic HR coil is theoretically $57/st more expensive than imports from Italy. That’s down $29/st w/w and still a $177/st swing before S232 was reinstated when stateside prices were, in theory, $234/st above Italian imports.

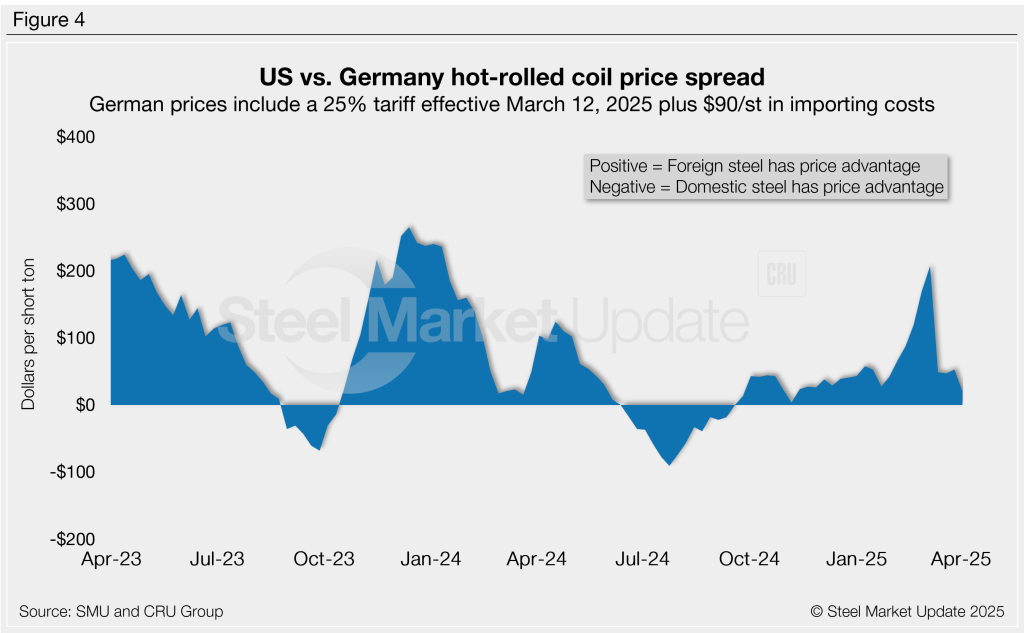

German HRC

CRU’s German HR price was up $2/st to $643/st this week. After adding a 25% tariff and $90/st import costs, the delivered price of German HR coil is, in theory, $894/st.

The result: Domestic HR is theoretically $21/st more expensive than HR imported from Germany, down $32/st from last week. Stateside hot band held a $207/st premium just a month ago – the widest margin in 14 months.

Editor’s note

Freight is important when deciding whether to import foreign steel or buy from a domestic mill. Domestic prices are referenced as FOB the producing mill. Foreign prices are CIF, the port (Houston, NOLA, Savannah, Los Angeles, Camden, etc.). Inland freight, from either a domestic mill or from the port, can dramatically impact the competitiveness of both domestic and foreign steel. It’s also important to factor in lead times. In most markets, domestic steel will deliver more quickly than foreign steel. Effective March 12, 2025, undiluted Section 232 tariffs were reinstated on steel. All steel imports and many derivative products now face a 25% tariff. Therefore, the German and Italian price comparisons in this analysis now include a 25% tariff. We do not include any antidumping (AD) or countervailing duties (CVD) in this analysis.