Prices

April 11, 2025

HRC, prime scrap spread narrows in April

Written by Ethan Bernard & Stephen Miller

The price spread between hot-rolled coil (HRC) and prime scrap narrowed in April after widening since January, according to SMU’s most recent pricing data.

SMU’s average HRC price is down week over week (w/w) and month over month. The April price for busheling also declined from March.

Our average HRC price as of April 8 stands at $905 per short ton (st) FOB mill, east of the Rockies. That’s off $10/st from a week earlier and down $45/st m/m.

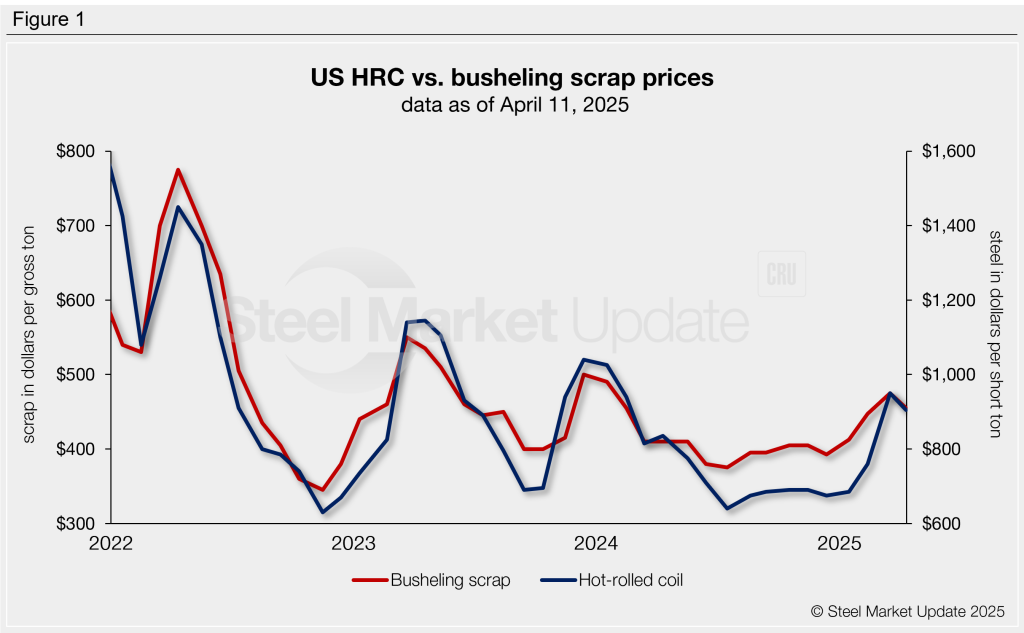

At the same time, busheling tags also fell m/m in April. They are down $20.00 per gross ton (gt) from last month, with an average of $455/gt. Figure 1 shows price histories for each product.

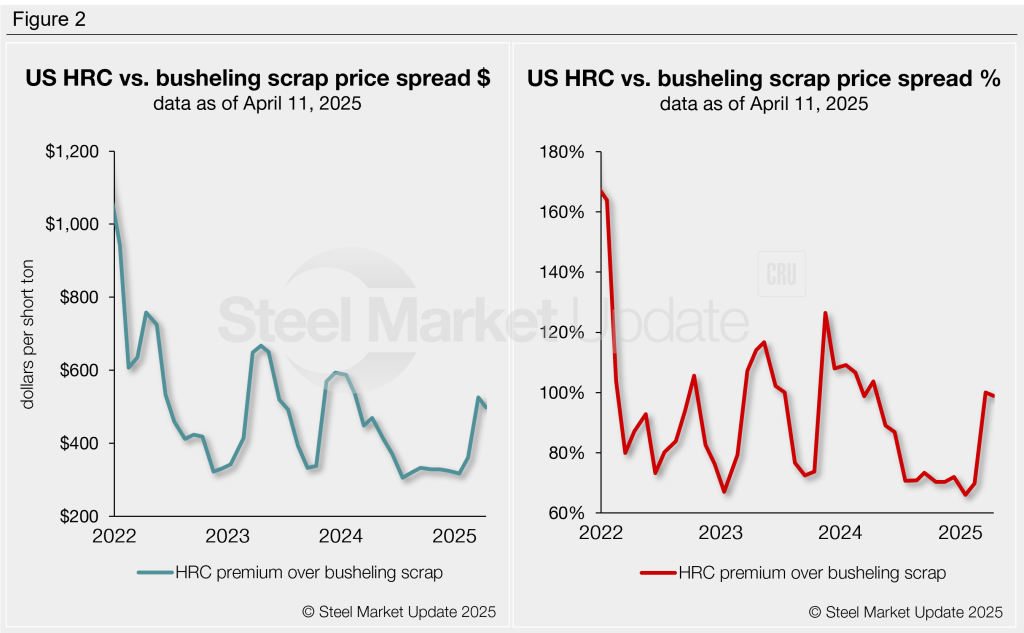

After converting scrap prices to dollars per short ton for an equal comparison, the differential between HRC and busheling scrap prices was $499/st as of April 11. That’s a decrease of $27/st from a month earlier (Figure 2). The spread had continually widened since standing at $317/st in mid-January.

What’s going on?

It’s no secret that #1 busheling dropped by $20/gt for April. This was less of a decrease than many expected.

The news on tariffs on direct-reduced iron (DRI) and pig iron bolstered busheling prices since these low-residual additives replace busheling in the EAFs. Going forward, busheling should stay firm.

If HRC goes back up in price, we can expect further narrowing of the spread..

HRC premium as a percentage

The chart on the right-hand side below shows the spread relationship differently: We have graphed HRC’s premium over busheling scrap as a percentage. HRC prices now have a 99% premium over prime scrap, edging down from 100% a month ago.

Ethan Bernard

Read more from Ethan Bernard