Sheet

May 11, 2025

Final Thoughts

Written by David Schollaert

For those who don’t know, we have a monthly scrap survey. It’s very similar to our industry-leading flat-rolled steel survey. We cover market trends, pricing, and sentiment – which helps us keep our finger on the pulse of the scrap market.

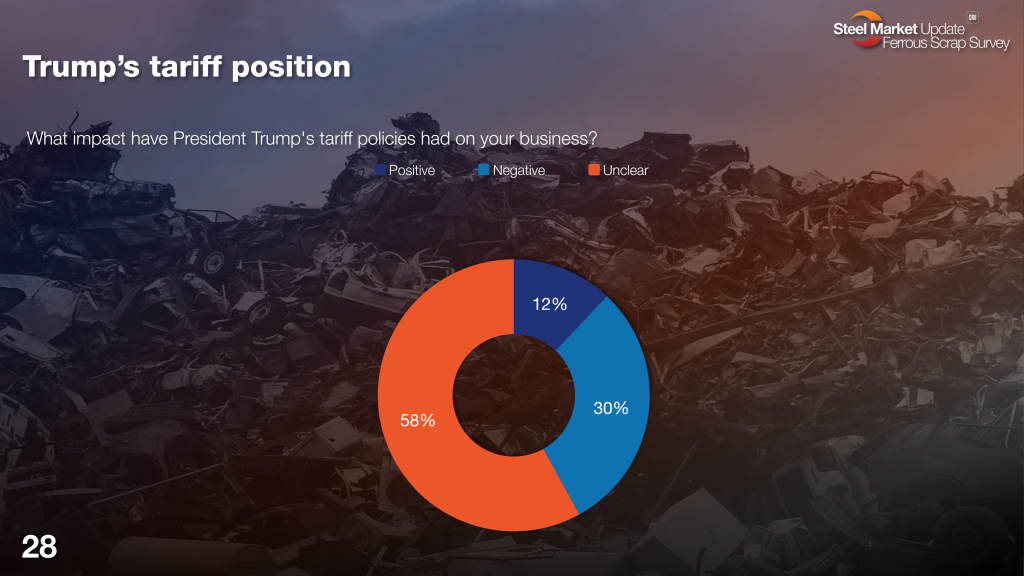

One thing we’ve learned lately from our surveys here at SMU: The lack of clarity from Trump’s tariffs are leaving the market in flux.

One survey respondent said it this way, and it’s a sentiment shared by others.

“Uncertain who is paying the tariff – the shipper or the consumer – or if it will be enforced.”

This sentiment is felt across the steel supply chain – from raw materials and finished steel to fabricators and manufacturers. And yet there’s also a collective feeling that the market will improve once the tariff storm clouds clear.

Here’s how another survey participant put it:

“Mills will continue to find ways to minimize the impact over time. But until bilateral deals are made and/or exemptions are made, tariffs will have an impact.”

We’re seeing it play out in real time.

Tariffs or the implications of tariffs have produced a whiplash of sorts. Buying ahead of the tariffs drove prices higher through Q1. Buyers then moved to the sidelines, waiting to see where the proverbial dust would settle. We’ve seen this play out in finished steel, and similar dynamics have been at play in scrap and metallics.

Survey says

Respondents got it mostly right this month. (We received responses before May prices settled.) Roughly three-fourths of respondents thought May prime scrap tags would be down. Another 23% said sideways. Almost no one thought prices would rise.

But while most got the direction right, few expected prices to move as low as they did.

The future doesn’t look all that bright either, according to survey responses. The trade is mostly calling it sideways for June. But some think next month could be down again.

Anyway, enough from me. Let’s let the slides and the comments from survey participants do the talking.

The impact of Trump’s tariff policies

Here’s just some of what survey respondents had to say:

“Impact on finished steel products; no impact on scrap.”

“Destroying motivation.”

“Too much uncertainty.”

“Supported steel production, but scrap is pouring into the US.”

“Negative currently, but waiting for a swing.”

“Negative to unclear.”

“So far, negative, but in full support of his efforts. It’s time to rebalance our relations with other countries.”

“Too soon to tell.”

“Short-term will be negative. Long term is still to be determined.”

“Tariffs for imports of scrap are hurting us.”

“We have cut our sales forecast by 25% due to tariffs.”

“Hurt export. Too much uncertainty in the marketplace.”

“The tariffs are driving uncertainty and causing customers to look short-term.”

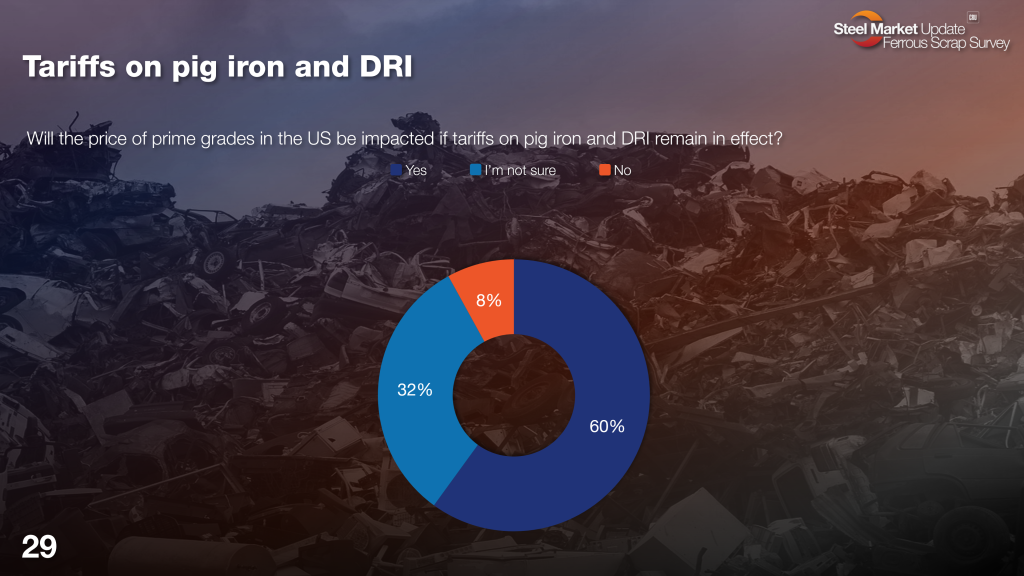

Prime vs. pig iron and DRI in light of tariffs

Here is what some survey respondents had to say about the impact of tariffs on metallics:

“Will raise price of low-residual scrap.”

“There is not much prime scrap available.”

“Tariffs will keep prime closer to even.”

“Currently, no effect. If pig Iron does not get on the exempt list, then the price of prime will go up to stabilize the pig-to-prime gap.”

“Math and economics.”

“It’s their only alternative.”

“Pig iron costs will rise, which will affect overall market pricing.”

There you have it. And that’s just two survey questions out of the dozens we explore. Our premium-level subscribers can find the full scrap survey results here.

If this has piqued your interest, and you’re not a premium member yet, what are you waiting for? To upgrade from executive to premium, please contact SMU sales executive Luis Corona at luis.corona@crugroup.com.

Also, be on the lookout for April’s service center inventories later this week. (We post service center inventories around the 15th of each month for the prior month.) Also, results from our next steel market survey will be released next week.

Chances are, we’ll see a great deal of insightful data. We can’t wait to dig through it. We hope you find value in it too. And, as always, we appreciate all your support.