Market Data

August 5, 2025

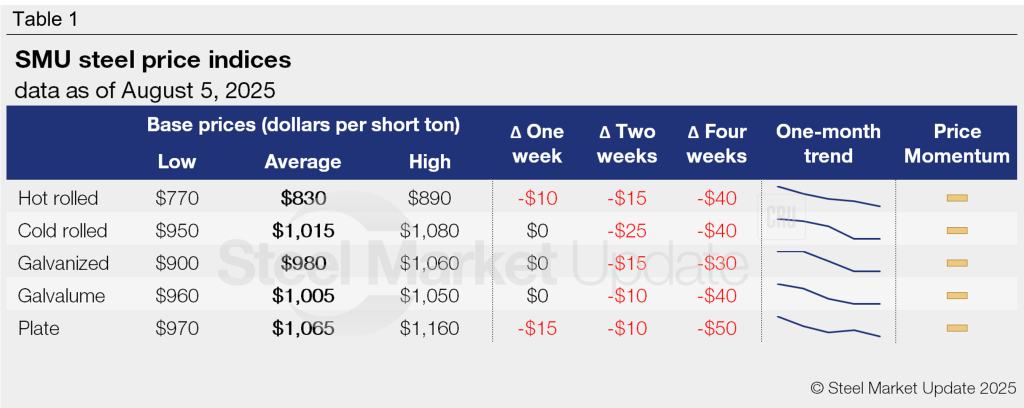

SMU Price Ranges: Sheet and plate move 'soft sideways' to start August

Written by Brett Linton & Michael Cowden

Sheet and plate prices were either flat or modestly lower this week on softer demand and increasing domestic capacity.

The “soft sideways” trend (to borrow a term from scrap) came despite 50% Section 232 tariffs remaining in place and limited import competition.

That said, some market participants said certain import items – such as light-gauge galvanized – remained less expensive than domestic material even with the 50% tariff.

Some also noted that domestic mills have been shipping well ahead of published lead times. (Editor’s note: SMU will update our lead time data on Thursday.)

Meanwhile, fears of a price spike on higher pig iron costs have mostly passed, with Brazilian pig iron exempt from a 50% “reciprocal” tariff, although it remains subject to a significantly lower 10% tariff.

But while steel prices might be mostly shrugging off higher S232 tariffs, the same cannot be said for aluminum. The Midwest premium has exploded to more than 70 cents per pound because of a 50% S232 tariff on imported aluminum – including material from Canada, which is by far the largest foreign aluminum supplier to the US.

A sharply higher Midwest premium could translate into higher coating extras for Galvalume and aluminized products. (Editor’s note: Stay tuned for more reporting on Midwest premium in our new sister publication, Aluminum Market Update.)

By the numbers

SMU’s hot-rolled (HR) coil price now stands at $830 per short ton (st) on average, down $10/st from last week and $50/st from July 1, according to SMU’s interactive pricing tool.

Cold-rolled coil prices were unchanged from last week at $1,015/st on average. But they are down $55/st from the start of last month.

It was a similar story with galvanized. Galv base prices remained at $980/st on average this week but are down $50/st from early July.

Ditto on Galvalume, which was unchanged at $1,005/st versus last week but is down $40/st from a month ago.

Plate meanwhile, stands at $1,065/st on average, down $15/st from last week and down $80/st from the start of July.

SMU’s price momentum indicators remain at neutral for all products.

Refer to Table 1 (click to enlarge) for our latest price indices and trends.

Hot-rolled coil

The SMU price range for HR coil is $770–890/st, averaging $830/st FOB mill, east of the Rockies. Our entire range shifted $10/st lower w/w. Our price momentum indicator for hot-rolled steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

HRC lead times range from 3 to 6 weeks, averaging 4.4 weeks in our July 24 market survey. We will publish updated lead times this Thursday.

Cold-rolled coil

The SMU price range for CR coil is $950–1,080/st, averaging $1,015/st FOB mill, east of the Rockies. The range is unchanged w/w. Our price momentum indicator for CR remains at neutral, meaning we see no clear direction for prices over the next 30 days.

CRC lead times range from 5 to 8 weeks, averaging 6.3 weeks through our latest survey.

Galvanized coil

The SMU price range for galvanized sheet is $900–1,060/st, averaging $980/st FOB mill, east of the Rockies. Our range is unchanged w/w. Our price momentum indicator for galvanized steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $978–1,138/st, averaging $1,058/st FOB mill, east of the Rockies.

Galvanized lead times range from 4–8 weeks, averaging 6.1 weeks through our latest survey.

Galvalume coil

The SMU price range for Galvalume is $960–1,050/st, averaging $1,005/st FOB mill, east of the Rockies. Our range is unchanged w/w. Our price momentum indicator for Galvalume steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,228–1,318/st, averaging $1,273/st FOB mill, east of the Rockies.

Galvalume lead times range from 5–7 weeks, averaging 6.1 weeks through our latest survey.

Plate

The SMU price range for plate is $970–1,160/st, averaging $1,065/st FOB mill. The lower end of our range is down $30/st w/w, while the top end is unchanged. Our overall average is down $15/st w/w. Our price momentum indicator for plate remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Plate lead times range from 3 to 8 weeks, averaging 5.3 weeks through our latest survey.

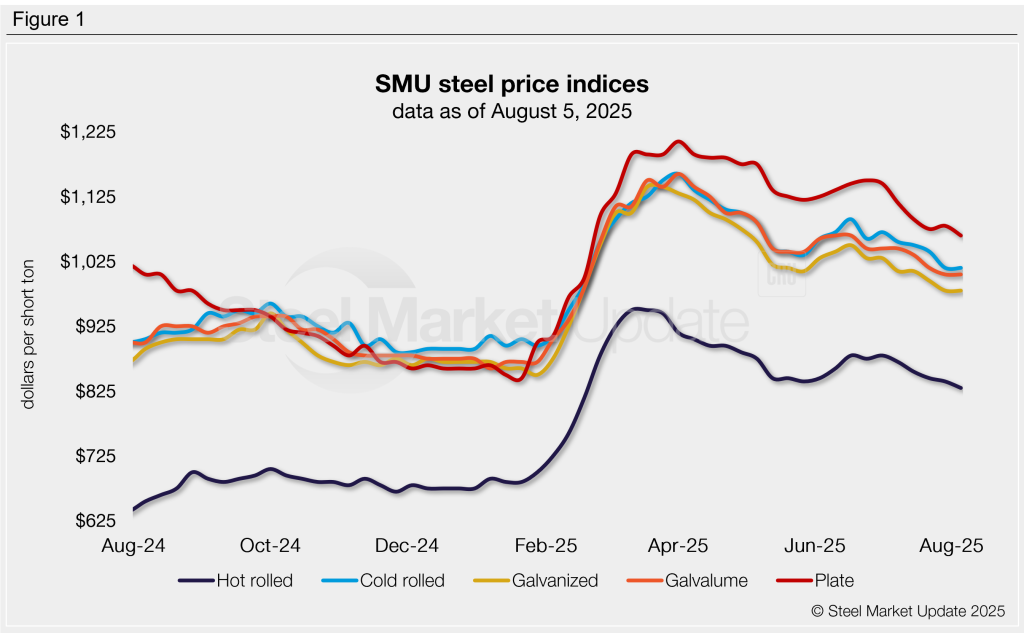

SMU note: The graphic above shows a history of our hot rolled, cold rolled, galvanized, Galvalume, and plate prices. This data is also available on our website with our interactive pricing tool. If you need help navigating the site or logging in, contact us at info@steelmarketupdate.com.

Brett Linton

Read more from Brett Linton