Analysis

August 7, 2025

SMU's July at a glance

Written by David Schollaert

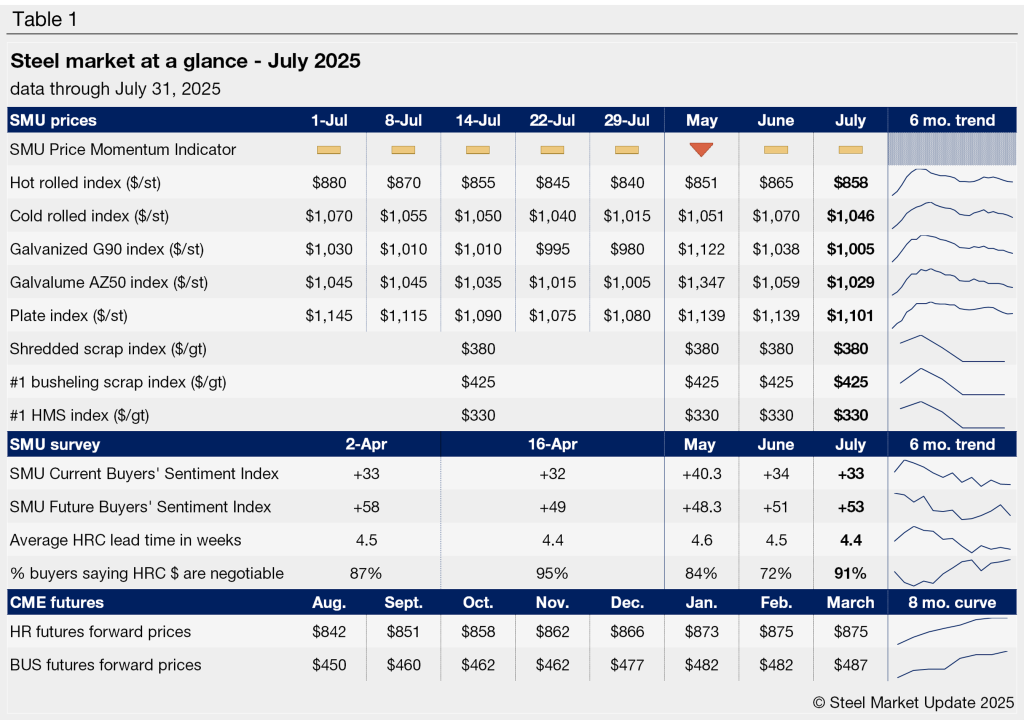

SMU’s Monthly Review provides a summary of our key steel market metrics for the previous month, with the latest data updated through July 31.

Steel prices continued to tick lower throughout July. The rate of decline has been slow, though steady week-over-week (w/w) throughout the month. Overall, sheet and plate prices fell $40-$65 per short ton (st) across July.

SMU’s Price Momentum Indicator remained unchanged throughout the month, remaining at neutral for both sheet and plate products since early June. The slow price move resulted largely from softer demand and increasing domestic capacity, despite 50% Section 232 tariffs remaining in place and limited import competition.

Steel scrap prices have been flat since May due to flat-to-soft demand, ample supply, and sluggish exports. And now that Brazilian pig iron is exempt from a 50% “reciprocal” tariff but still subject to a 10% tariff, the August market once again looks to remain flat.

Movements in our Steel Buyers’ Sentiment Indices varied in July, with Current Sentiment ticking lower, nearing a five-year low, while Future Sentiment recovered a bit at July’s start. Both, however, edged lower to close out the month. Both Indices continue to reflect tempered optimism among steel buyers regarding their companies’ chances of current and future success.

Mill lead times have varied somewhat in July, but have fluctuated in a tight band, mostly pointing lower. As of this week, the average lead time for hot-rolled steel was just over four weeks, cold-rolled and coated products around six weeks, and plate at just over five weeks. Most buyers expect lead times to be steady or shorter through the tail end of summer, citing softening demand and rising supply.

The percentage of buyers reporting that mills are willing to negotiate new spot order pricing rose throughout the month, with mills becoming increasingly more flexible on price. And while tariffs continue to have a recurring impact on prices, declining demand has mills looking to move volume and cut deals.

See the table below for other key June metrics (click here to expand). Historical monthly review tables can be found on our website.