Market Data

September 2, 2025

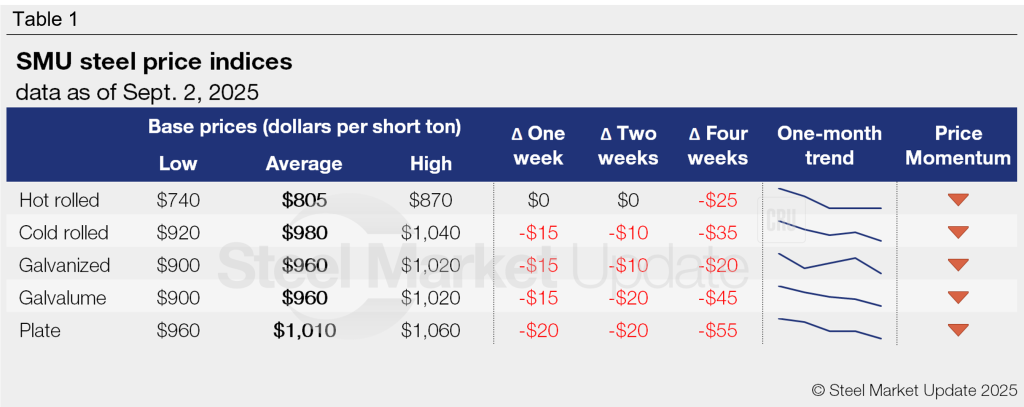

SMU Price Ranges: Tags mixed as uncertainty weighs on market

Written by Brett Linton & Michael Cowden

SMU’s hot-rolled (HR) coil price held steady this week while prices for other sheet and plate products declined.

Our HR price was unchanged compared to last week at $805 per short ton (st) on average. Our price range expanded on both the high end and the low end.

The low end of our range, the mid-$700s, represented prices to larger buyers (thousands of tons). The high end of our range, the mid/upper $800s, represented prices to smaller buyers (truckload quantities).

SMU’s cold-rolled price, meanwhile, fell to $980/st on average, down $15/st from last week. Our galvanized and Galvalume prices also fell $15/st week over week (w/w). Both now stand at $960/st on average. On the plate side, our price is at $1,010/st on average, down $20/st compared to a week ago.

Broadly speaking, sources remained divided on the direction of the market.

Some pointed to uneven lead times among domestic mills as evidence that prices could remain under pressure. They also noted that fall maintenance outages were not as extensive this year as in prior years. And some said a potentially lower scrap settlement in September could make it difficult for mills to raise prices in the short term.

But others said activity should improve as more companies return to the market after Labor Day, which typically happens in the fall. They also said that mills should have a stronger hand in the weeks ahead because there should be less competition from imports. Recall that President Donald Trump raised Section 232 tariffs on imported steel to 50% in June. The impact of that move is widely expected to be felt more keenly as the mercury drops.

“Uncertainty” continues to be a key theme in conversations with market participants. They said it remained difficult to forecast as key aspects of US trade policy are unclear. Case in point: whether Section 232 will remain in place against Canada, the largest supplier of foreign steel to the US market.

Our sheet and plate momentum indicators continue to point toward downward in the absence of a clear catalyst that might send prices higher again.

Refer to Table 1 (click to enlarge) for our latest price indices and trends.

Hot-rolled coil

The SMU price range is $740–870/st, averaging $805/st FOB mill, east of the Rockies. The lower end of our range is down $10/st w/w, while the top end is up $10/st. Our overall average is unchanged w/w. Our price momentum indicator for hot-rolled steel remains at lower, meaning we expect prices to decline over the next 30 days.

Hot-rolled lead times range from 3–6 weeks, averaging 4.4 weeks as of our Aug. 21 market survey. We will publish updated lead times on Thursday.

Cold-rolled coil

The SMU price range is $920–1,040/st, averaging $980/st FOB mill, east of the Rockies. The lower end of our range is down $10/st w/w, while the top end is down $20/st. Our overall average is down $15/st w/w. Our price momentum indicator for cold-rolled remains lower, meaning we expect prices to decline over the next 30 days.

Cold-rolled lead times range from 4–9 weeks, averaging 6.1 weeks through our latest survey.

Galvanized coil

The SMU price range is $900–1,020/st, averaging $960/st FOB mill, east of the Rockies. The lower end of our range is up $10/st w/w, while the top end is down $40/st. Our overall average is down $15/st w/w. Our price momentum indicator for galvanized steel remains lower, meaning we expect prices to decline over the next 30 days

Galvanized .060” G90 benchmark: SMU price range is $978–1,098/st, averaging $1,038/st FOB mill, east of the Rockies.

Galvanized lead times range from 4–9 weeks, averaging 6.2 weeks through our latest survey.

Galvalume coil

The SMU price range is $900–1,020/st, averaging $960/st FOB mill, east of the Rockies. The lower end of our range is up $10/st w/w, while the top end is down $40/st. Our overall average is down $15/st w/w. Our price momentum indicator for Galvalume steel remains lower, meaning we expect prices to decline over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,168–1,288/st, averaging $1,228/st FOB mill, east of the Rockies.

Galvalume lead times range from 4–8 weeks, averaging 6.2 weeks through our latest survey.

Plate

The SMU price range is $960–1,060/st, averaging $1,010/st FOB mill. Our entire range is down $20/st w/w. Our price momentum indicator for plate remains lower, meaning we expect prices to decline over the next 30 days.

Plate lead times range from 3–7 weeks, averaging 5.4 weeks through our latest survey.

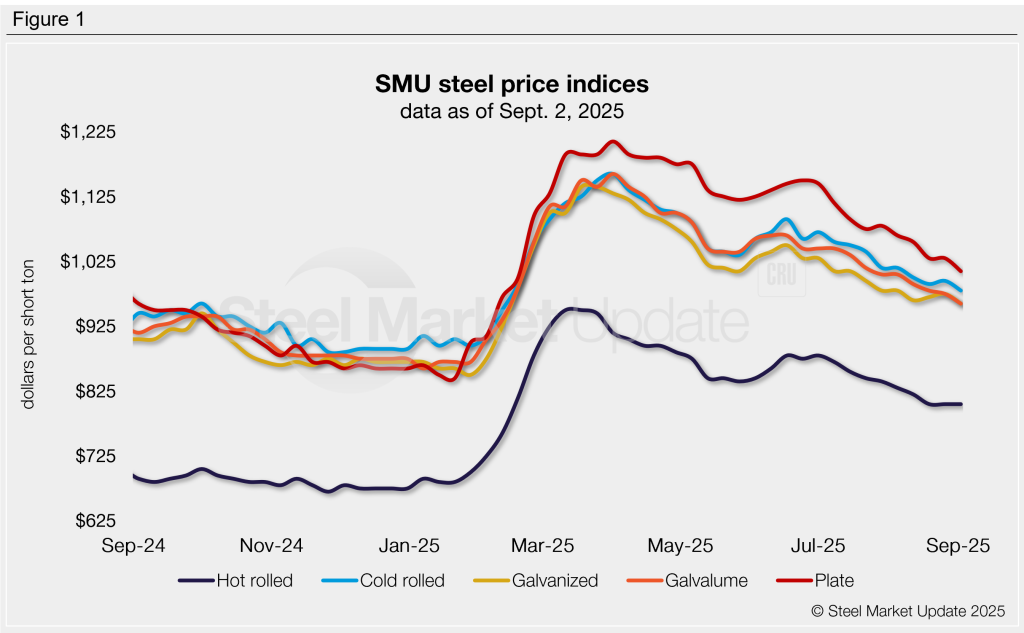

SMU note: The graphic above shows a history of our hot rolled, cold rolled, galvanized, Galvalume, and plate prices. This data is also available on our website with our interactive pricing tool. If you need help navigating the site or logging in, contact us at info@steelmarketupdate.com.

Brett Linton

Read more from Brett Linton