HVAC equipment shipments rebound 6% in May

Shipments of heating and cooling equipment bounced back in May, according to the latest data released from the Air-Conditioning, Heating, and Refrigeration Institute (AHRI).

Shipments of heating and cooling equipment bounced back in May, according to the latest data released from the Air-Conditioning, Heating, and Refrigeration Institute (AHRI).

US drill rig activity resumed its downward trend last week, while Canadian counts increased to a four-month high, according to the latest data release from Baker Hughes.

Global Plate prices declined in all regions this week amid slow seasonal demand. With bearish outlooks on demand in the near term, market participants are watching how mills will react to low order entry levels and short lead times. In the US and China, production has been steady, but in Europe, steel mills are contemplating […]

A roundup of CRU aluminum news.

We’ve taken some time to supply you with some handy-dandy production figures for 2024 presented in a unique way.

Renewable energy infrastructure, including wind turbines, solar farms, and electric-vehicle charging stations, requires substantial amounts of steel. The domestic steel industry, with its capacity to produce world-class steel with the world’s smallest carbon footprint, should be at the forefront of this supply chain. Yet the United States is increasingly importing steel from abroad to meet its renewable energy needs.

The volume of finished steel entering the US market, dubbed ‘apparent steel supply,’ ticked up 3% from April to May according to SMU analysis of Department of Commerce and the American Iron and Steel Institute (AISI) data.

The US and Mexico announced measures on Wednesday to prevent tariff evasion and protect North America’s steel and aluminum industries.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to imports and evolving market events.

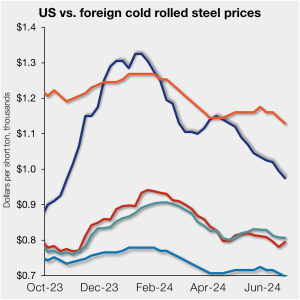

Flat-rolled steel prices have been largely falling since the beginning of the year. Even after a slight bump in early April when mills tried to halt the downtrend, the decrease resumed.

US sheet prices saw a similar pattern this week, customary for much of the year – new week, lower prices. Domestic tags moved lower this week, aligning with the typically slower summer period – but maybe a further indication of dwindling demand.

Domestic raw steel production tumbled last week to the lowest rate seen in five-months, according to the latest release by the American Iron and Steel Institute (AISI).

The volume of steel shipped into Vietnam more than doubled in May to 1.1 million (mt), with China’s share above 70%, according to customs’ statistics. In the first five months, Chinese imports were more than 4.7 million mt, an increase of 91% year on year.

Canada’s industry minister Francois-Philippe Champagne has conditionally allowed a Glencore-led consortium to acquire Teck’s Elk Valley Resources (EVR) metallurgical coal business for $6.9 billion. He also raised the bar for foreign companies wanting to buy into the country’s critical mineral resources.

Nucor has kept its consumer spot price (CSP) for hot-rolled (HR) coil flat this week.

First off, we hope everyone had a safe and happy July 4th holiday, with fireworks seen and BBQs attended. Many parts of the country are quite toasty at the moment, signaling that, yes, summer has indeed arrived. And looking at our most recent survey results, the summer doldrums have arrived as well.

The latest SMU market survey results are now available on our website to all premium members. After logging in at steelmarketupdate.com, visit the pricing and analysis tab and look under the “survey results” section for “latest survey results.”

Data on US industrial production, capacity utilization, new orders and inventories all held steady through the latest figures, indicating a stable and healthy manufacturing sector. The strength of the manufacturing economy has a direct bearing on the health of the steel industry.

SMU’s Steel Buyers’ Sentiment Indices dropped this week, with Current Sentiment plummeting to a level not seen since the Covid-19 pandemic, according to our most recent survey data.

Steel mill lead times remain near some of the lowest levels witnessed in months, according to our latest market canvass to steel service centers and manufacturers.

Sheet steel buyers found mills more willing to negotiate spot pricing this week, according to our most recent survey data.

Most longs prices in the US were unchanged this month, except for rebar, which declined by $1.50/cwt ($30/short ton) m/m. While end-use demand is stable, inventories are well-stocked, keeping purchases limited. Domestic availability is sufficient to meet current demand, hindering the appetite for imported material. Meanwhile, prices for scrap remained under pressure in June, with […]

Steel Market Update’s offices will be closed on July 4th for Independence Day.

US sheet prices moved lower again this week, continuing a trend seen since early April. The slowdown aligns with the typical summer doldrums, when lax demand and shorter lead times often take center stage. The current market is also characterized by ample supply and concerns about restocking – especially with few signs of a bottom […]

It’s been a slow start to the week as far as news goes, something you’d expect ahead of a shortened Independence Day week. That said, it’s not as if transactions have completely ground to a halt. (Prices continue to drift lower.) And while news might be slow, rumors of low-priced deals, price hikes, and trade cases seem to have filled that void.

Domestic plate prices have been on a historic run since they began surging in January 2021. Tags reached an all-time high of $1,940 per short ton (st) in May 2022, though they have mostly trended lower over the past two years.

July is less than a week away, which means SMU’s Steel Summit in August is just around the corner.

Low global sheet demand continued to weigh on prices around the world this week. In the US, mills were forced to remain aggressive to secure orders during this period of demand weakness. And compounded by recent new capacity ramp-ups, has forced US hot rolled (HR) coil prices down closer to levels seen in offshore markets. […]

Offshore cold-rolled (CR) coil remains cheaper than domestic product pricing even as US CR coil prices slip to an eight-month low. Domestic CR coil tags stood at $975 per short ton (st) on average in our check of the market on Tuesday, June 25, down $20/st from the week before. Domestic CR prices are, on […]

A roundup of aluminum news from CRU.