Analysis

July 7, 2024

Final thoughts

Written by David Schollaert & Ethan Bernard

First off, we hope everyone had a safe and happy July Fourth holiday, with fireworks seen and BBQs attended. Many parts of the country are quite toasty at the moment, signaling that, yes, summer has indeed arrived. And looking at our most recent survey results, the summer doldrums have arrived as well.

We’re going to highlight a couple of signals in the doldrums, and finish positive. And we feel it’s best to let the results and comments of your peers speak for themselves.

Doldrums

Speaking of feelings, our Current Steel Buyer’s Sentiment Index tumbled 13 points to a four-year low of +34. This is territory not seen since August 2020. Future Sentiment also fell, dropping eight points to +61 from the previous market check. So, while many are seeing a rough patch currently, buyers are more optimistic about the situation three to six months from now.

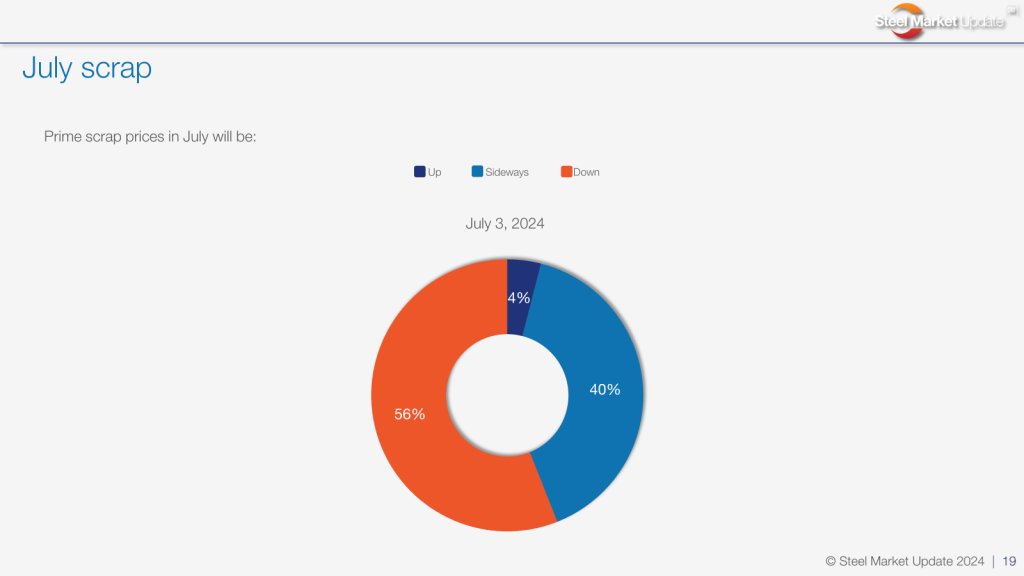

Another sign we are in the doldrums could be with our July scrap outlook. For survey respondents, 56% expect prime scrap prices to fall this month while 40% thought they would be sideways. Recall that busheling tags fell $30 month over month in June to an average of $380 per gross ton.

Prime scrap prices in July will be:

“I hear down but I think flat.”

“Everything we hear/read points to lower scrap numbers this month, maybe even showing a major dip.”

“Sounds like down $20 on prime.”

“Down. Same as HR coils.”

“With lack of domestic steel demand, we could see another drop. Those closer to coasts might see less impact if export market stay stable.”

“Soft sideways.”

Forecast, a tougher proposition

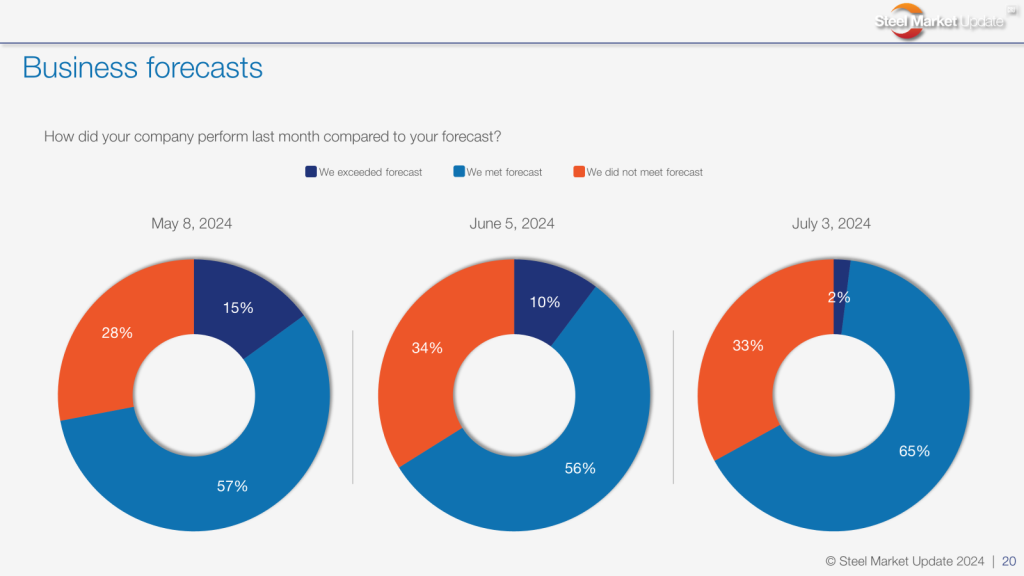

While scrap is a piece of the puzzle, let’s take a quick jump to overall Business Forecasts. While 65% of respondents said they met forecasts in our most recent survey, up from 56% two weeks earlier (a good sign), only 2% said they exceeded their forecast. This is down from 10% on June 5. That one perhaps not as good a sign.

How did your company perform last month compared to your forecast?

“Still tough in the construction world for us.”

“Continued pricing decline led to lower shipments.”

“Demand is still down and bookings down.”

“Maybe slightly softer than we would like.”

“Everyone seeing lower spot prices and upcoming lower contracts has led to decreased buying.”

“Margin is being squeezed but volume is being maintained.”

“Demand needs a shot of Red Bull.”

“It is stable but at a new low level.”

“Down from 2023 by about 15%… but still solid.”

Bottom?

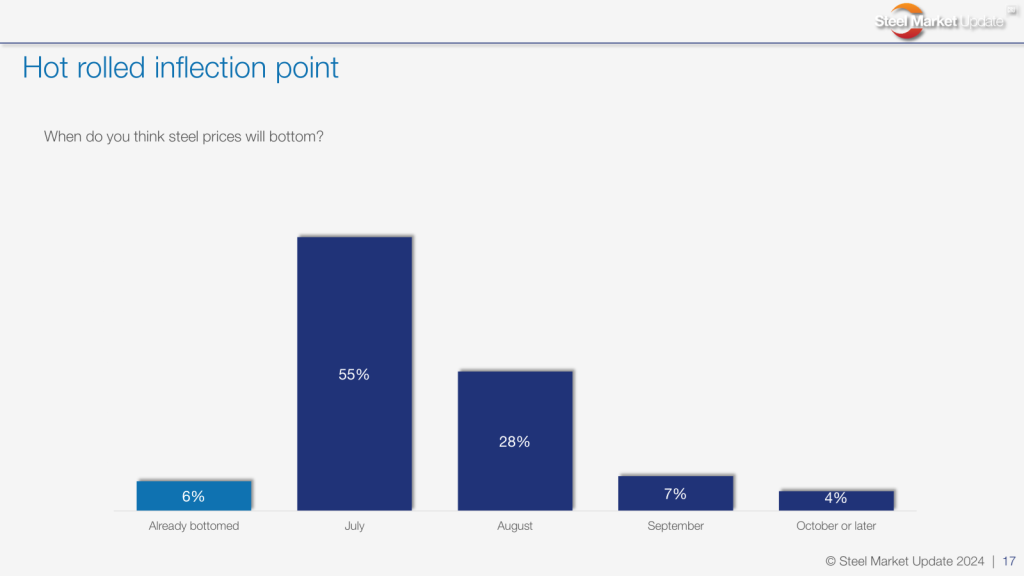

Finally, what everyone is wondering about is when these HRC prices will reach bottom. Well, in our Hot Rolled inflection point slide, 56% of respondents thought tags would bottom in July and 28% thought in August.

Prices are still moving lower. When do you think sheet prices will bottom, and why?

However, there was a bevy of comments from survey respondents noting seasonality and lower input costs as indication prices could drift lower:

“Demand is still weak.”

“I initially thought we’d see a bottom in late-July, but I think that is probably early. Imports are still coming, demand is soft(er) and scrap looks bleak.”

“Summertime impact.”

“July scrap will allow it (or dictate it).”

“Seasonality.”

Still, there was a theme among many of them. See for yourself:

“Calm before demand picks back up.”

“The breaking point for HR is close. Mills will start to push upward towards month’s end.”

“Pricing is approaching a line for which the mills (integrated mills in particular), do not like to cross. Pricing at these levels will trigger outages and idling. Additionally, larger buyers will take advantage of these numbers while they can, placing mill orders and extending lead times.”

“Mills are nearing their cost of production – which does not last long.”

“Believe mills will attempt to stop the slide in the next few weeks. May take an announced outage to move this market.”

We’ll see what this month has to bring… . In the meantime, take advantage of the sunshine. Though it might not help demand, maybe even have a Red Bull yourself if you’re feeling a little sluggish.

Steel Summit

SMU’s Steel Summit will be here before you know it! North America’s preeminent flat rolled event kicks off on Aug. 26. You won’t want to miss it!

We’re closing in on 1,000 registrations from just about 400 companies. We’re on pace to exceed last year’s high-mark of more than 1,450 attendees, and the numbers are still trending upward. If you haven’t registered yet, what are you waiting for? You can do so here.

Also, our room blocks are sold out. But there are plenty of hotels available around Hartsfield-Jackson Atlanta International Airport – so not far from where the event will be held.

And, as always, thanks to all of you for your continued support of SMU!

David Schollaert

Read more from David Schollaert