Analysis

November 13, 2022

Final Thoughts

Written by Michael Cowden

I wish I could offer you some hope about steel prices getting better. But at the moment, the thing that strikes me most is that $600 per ton ($30 per cwt) for hot-rolled coil (HRC) sure looks like the “new” $600 per ton.

That’s a joke of course. I make it in remembrance of all that talk in 2021 and following the outbreak of war in Ukraine this year about how the “new normal” for HRC would be higher than the “old normal”.

I recall predictions that the new normal for HRC would be anywhere from ~$800 per ton to as high as ~$1,000 per ton. That doesn’t seem likely now, to put it mildly.

Scrap prices are down yet again in November, and expectations are that lower steel output will continue to keep scrap prices subdued.

It doesn’t help that big deals cut earlier this year with certain domestic mills could continue to cast a shadow over the market into 2023. Those deals effectively pulled forward months’ of buying from some bigger service centers and distributors.

Also, the United Steelworkers (USW) union and US Steel have tentatively agreed to a new labor four-year labor agreement. The terms are generous, and I’d be surprised if the contract isn’t ratified. That’s bad news if you were hoping for labor strife to reverse the relentless downdrift we’ve seen in HRC prices since late April.

Recall we hit a post-war peak of $1,480 per ton then. We’re now at $655 per ton, or nearly 56% lower, according to SMU’s interactive pricing tool. And at least 43% of respondents to our last survey think that prices will fall below $650 per ton over the next two months.

Another thing that strikes me is that, as David Schollaert noted in Final Thoughts last week, we’ve got 7% of survey respondents saying that hot-rolled coil prices could fall into the $500s per ton. That wouldn’t have been a surprising result pre-pandemic. It is now.

That result also dovetails with some of the other more bearish data we’ve been picking up in our more recent surveys.

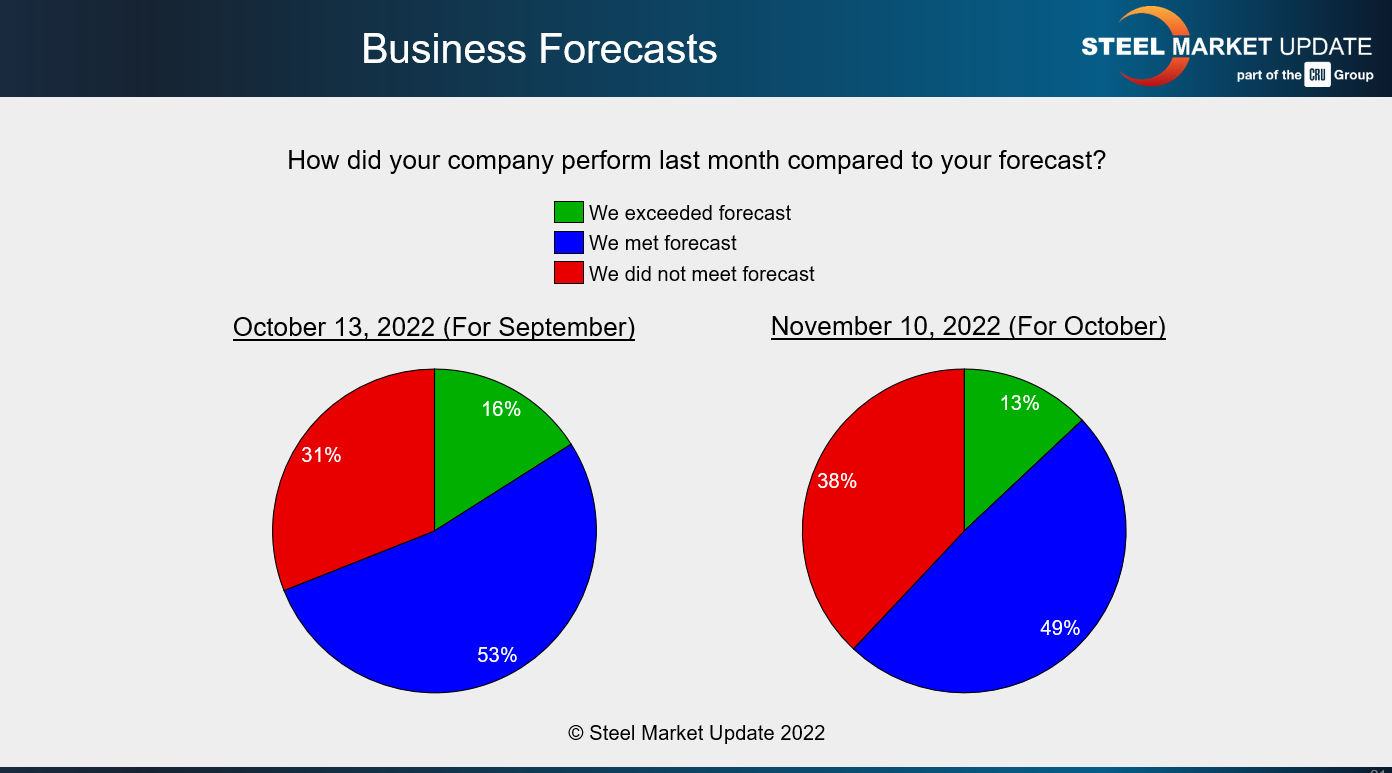

More people continue to report that their companies are not meeting forecast:

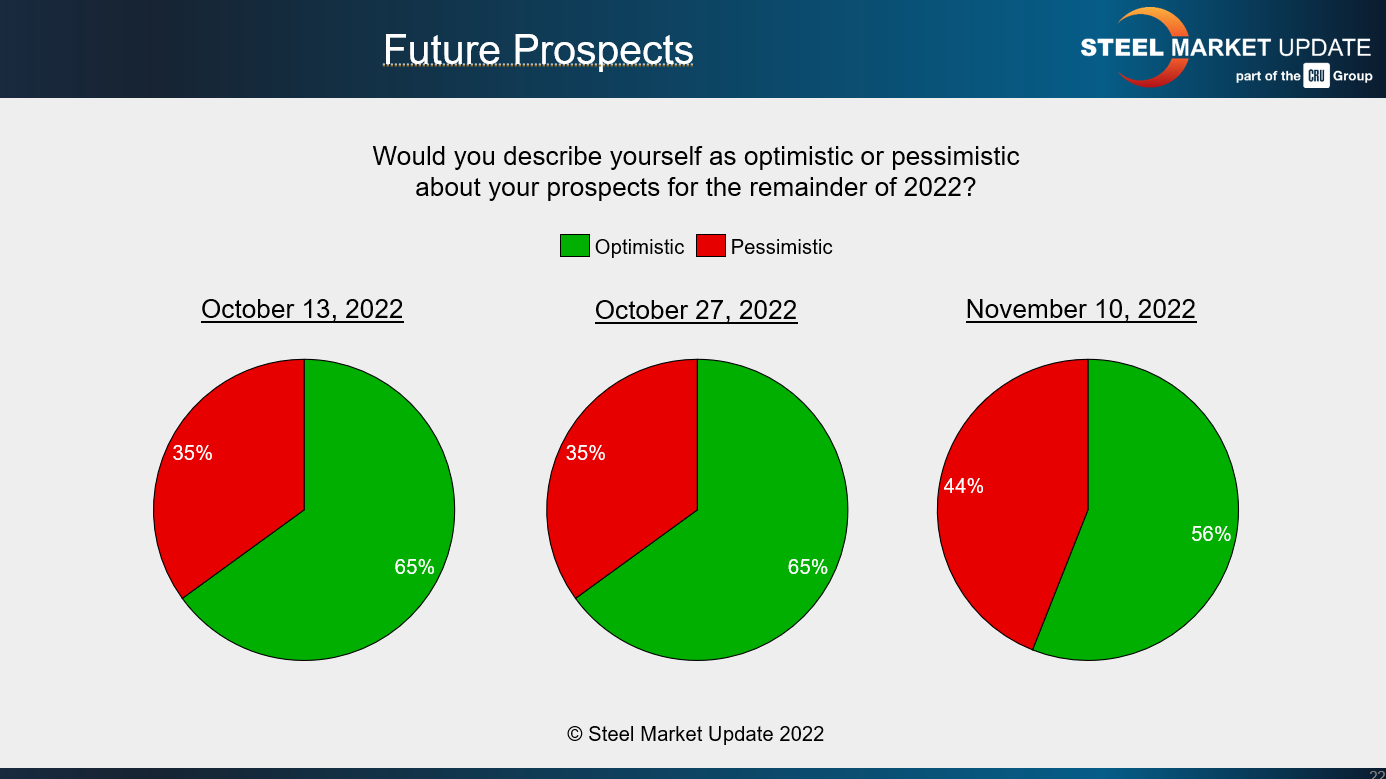

More are pessimistic about their prospects for the remainder of 2022:

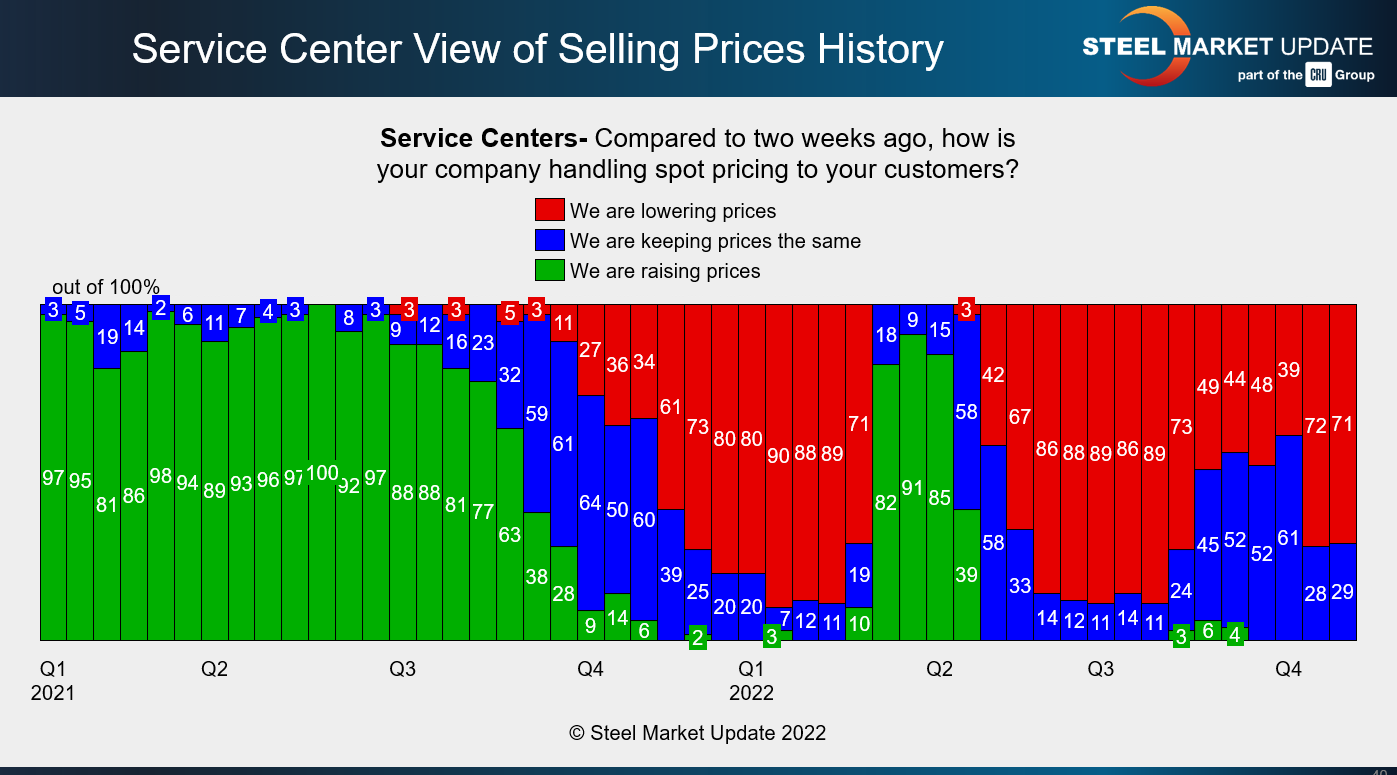

And more than 70% of service center respondents to our surveys say that they continue to lower spot prices to their customers:

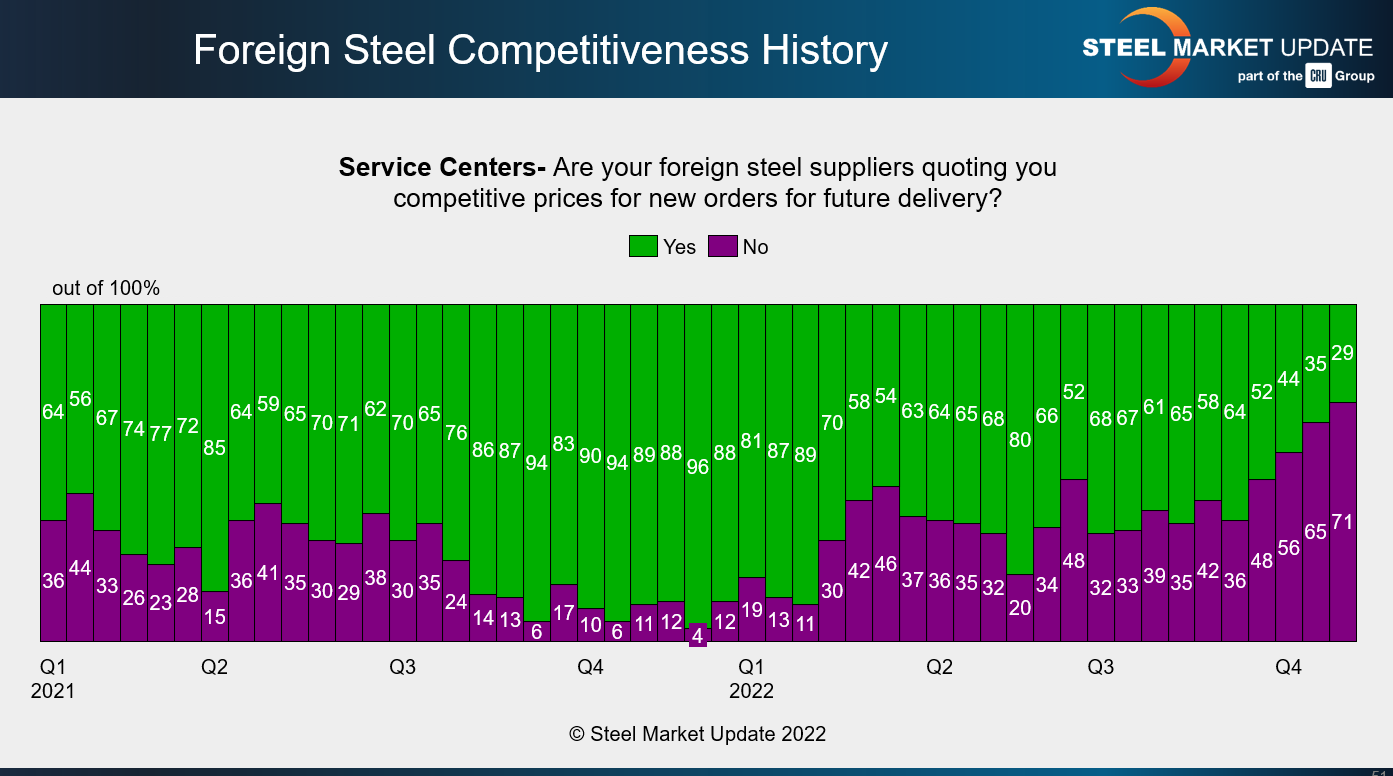

As for imports, we’ve seen interest in them decline along with falling domestic prices:

There are two ways to look at that. Mills might celebrate lower import volumes. But watch what you wish for. Another interpretation is that domestic prices are falling so fast that buyers don’t want to take the risks associated with offshore buys. Namely, that a good price secured now won’t be so attractive once that material finally arrives at port.

I wish I had some compelling silver linings to offer. Here are a few that will have to do in the meantime.

It’s worth thinking about what the result of increasingly strict trade restrictions on Russia might be – especially given the prospect of higher duties now with Russia losing market-economy status in antidumping cases.

That said, Russia has only a shadow of the presence it once commanded in the domestic steel market. So the impact on of Russia losing market-economy status on steel prices will probably be muted. Russia shipped more than 2.14 million metric tons of steel to the US in 2017. That figure had fallen nearly 40% to 1.29 million metric tons in 2021 – and it stands at only 264,202 tons through September 2022, according to Commerce Department figures.

A better case for silver linings might be USW-US Steel negotiations. Why? Businesses don’t like uncertainty. And perhaps we’ll see buying activity pick up at least a bit because companies now know that labor issues (at least in steel) won’t disrupt the market.

Also, lead times, while still low, are getting closer to 2023. And activity typically improves in Q1. Recall, too, that there are precedents – 2020, 2016 and 2010-11 – for a December price squeeze, as noted in our last column on steel and scrap futures.

Finally, just about when everyone throws in the towel on steel is usually when things start coming back.

On that note, thanks to so many of you for coming back to SMU year after year, in good markets and in bad ones too. Your business is truly appreciated.

By Michael Cowden, Michael@SteelMarketUpdate.com