Plate market optimism veers back toward anxious outlook

The plate market’s swell of optimistic sentiment marking the start of 2026 dissipated this week.

The plate market’s swell of optimistic sentiment marking the start of 2026 dissipated this week.

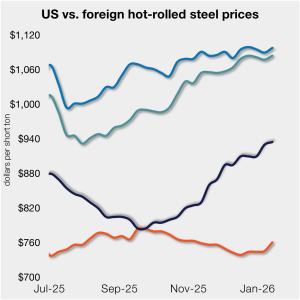

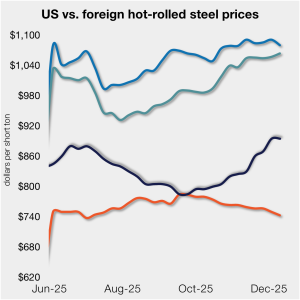

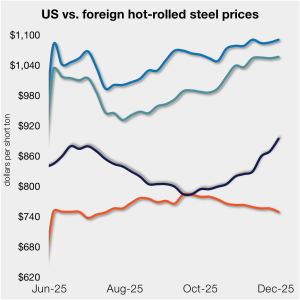

The price gap between US hot-rolled coil (HR) and landed offshore product has been relatively flat to begin the year.

US steel imports have fallen sharply under the new 50% Section 232 tariff regime. Jerry Richardson, general director of CSN LLC, discussed on an SMU Community Chat this week how the market is now structurally tighter and more volatile than at any point in the past decade.

Does the level of geopolitical uncertainty get to the point where it impacts not only the stock market but also the broader steel market? Could we see a repeat of Liberation Day, or will the news cycle move on to something else by the end of the week? I don't pretend to know what might happen in Davos. Suffice it to say, it’s going to be a newsy week.

CSN LLC General Director Jerry Richardson will join Steel Market Update (SMU) for a Community Chat on Wednesday, Jan. 21, at 11 am ET.

Last week, the government of China reported a trade balance of $1.12 trillion in 2025, the largest merchandise trade surplus in history. And this surplus was despite massive tariffs imposed by the United States and other countries, partly in an effort to rein in China’s trade juggernaut.

Members of the Congressional Steel Caucus met in Washington on Wednesday to assess the state of the domestic steel industry. Lawmakers and industry leaders discussed the importance of Section 232 tariffs, strong trade enforcement, and continued investment in American steelmaking.

CSN LLC General Director Jerry Richardson will join Steel Market Update (SMU) for a Community Chat on Weds., Jan. 21, at 11 am ET.

As we move into 2026, it’s time to look forward. While the “Donroe Doctrine,” Venezuela, and Greenland absorb significant press attention, important trade developments will also continue to make headlines this year. The unprecedented changes we saw in 2025 will continue in 2026, particularly in the areas of IEEPA and tariffs, USMCA, and the WTO.

Algoma Steel Group Inc. is preparing to report another significant quarterly loss as it winds down its blast furnace operations and ramps up electric-arc furnace steelmaking.

It's that time of year, when we look back at where we've been and forward to what the new year might bring. So, before we look forward to 2026, let’s take a quick look back at 2025.

Editor’s note This is an opinion column. The views in this article are those of an experienced trade attorney on issues of relevance to the steel market. They do not necessarily reflect those of SMU. We welcome you to share your thoughts as well at smu@crugroup.com. As we close out 2025, my best wishes to all […]

AISI's Kevin Dempsey looks back at 2025.

We will examine the wisdom of hedging from the perspective of both the LME and Midwest premium, and whether you are approaching the market as a buyer or a seller.

An SMU Community Chat with Timna Tanners.

A look at possible scenarios that could be announced during SMU's Tampa Steel Conference.

Canadian Prime Minister Mark Carney said the US probably won't reduce tariffs on steel, aluminum, and other goods from Canada anytime soon.

Most buyers expect prices to rise slightly in the short term or remain flat. But many qualify this view as transitory or dependent on demand improvements.

Sheet prices mostly ticked higher again this week. And the reasons shouldn’t come as a big surprise to anyone who has been reading SMU lately.

The European Commission is aiming to have Section 232 tariffs eased on steel and aluminum, with a special eye towards derivative products as well, as it negotiates with the Trump administration, according to a report in Politico on Dec. 15.

SMU and AMU are pleased to announce that Wells Fargo Managing Director Timna Tanners will be joining us for a Community Chat webinar on Wednesday, Dec. 17, at 11 am ET.

In our opinion, it is striking that for all the bold talk about establishing a "common external tariff" — or "Fortress North America" — the solutions being proposed fail to live up to their promises. As we have commented recently, USMCA certainly needs a rethink. But we have serious concerns about Canadian and Mexican proposals that suggest common trade policies that are, as we see it, more illusory than effective.

There was a palpable sense of optimism among folks at the HARDI conference about demand from data centers. In other words, around the physical infrastructure – which also includes energy transmission - needed to feed the AI boom. The big question: Could demand from data and AI be far stronger than the market yet realizes?

The price gap between stateside hot band and landed offshore product continues to narrow toward parity, now at its lowest level in five months.

We can be grateful for some things. One is the regional agreement between the US, Canada, and Mexico that is currently undergoing review. A decision is expected by July 2026 on whether to extend the agreement, which is set to expire in 2036, for another 16 years (to 2052). Three days of hearings just concluded with comments of five minutes’ duration from more than 50 witnesses.

The American Iron and Steel Institute’s (AISI's) Kevin Dempsey gave a series of policy proposals ahead of the review of the USMCA trade agreement next year.

It's important to keep in mind - maybe especially for those of us in the US - that the rest of the world can act too. And I think we're already seeing signs of that action, or at least that's been my takeaway from some of SMU's recent reporting and from Community Chat webinars for both SMU and AMU.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to tariffs, imports, and evolving market events.

The price gap between stateside hot band and landed offshore product has inched closer to parity, now at its lowest level since the summer.

Deere & Company's latest earnings report put a spotlight on the mounting costs of tariffs across the agricultural and heavy machinery sectors.