Product

March 18, 2013

Automotive Production, Inventory & Sales – February 2013

Written by Peter Wright

Written by: Peter Wright

Automotive production, inventory and sales; February 2013. Within NAFTA, the Detroit three lost production share in February compared to February last year, dropping from 52.1 percent to 51.5 percent. Performance amongst the three varied wildly with GM and Chrysler loosing 2.2 percent and 0.8 percent respectively as Ford gained 2.1 percent. Other high volume gainers were Nissan up 0.5 percent and Honda up 0.2 percent. Toyota’s production share was unchanged. All statistics compiled by Wards are on a North American basis.

Production is considered to be at the point of final assembly. In reality this is a highly integrated market with parts and sub assemblies such as engines and transmissions moving across borders prior to assembly. This somewhat muddies the water when we try to assess the effect on overall U.S. manufacturing. The picture that emerges from Wards data is that manufacturers of cars and medium and heavy trucks have strongly favored Mexico over Canada in particular and to a lesser extent, the U.S. since 2006. Canada has held its own better in light truck assemblies. Overall NAFTA production of light vehicles in three months through February was up by 3.7 percent year over year, the rate of growth has been slowing for eight consecutive months. Medium and heavy truck production was up 20.1 percent in three months through February and has improved for three straight months.

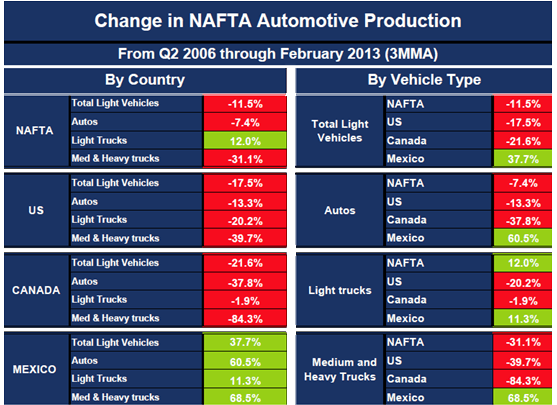

Vehicle manufacture in NAFTA began to decline a year and a half before the recession officially hit in Q1 2008. The table below shows the growth/contraction by country of final assembly on the left and by vehicle type on the right since the recent peak in Q2 2006. The result is a stunning revelation of how assembly has moved preferentially to Mexico since Q2 2006. Light vehicle assemblies in Mexico are up by 37.7 percent in this time period as the US and Canada are down by 17.5 percent and 21.6 percent respectively. The contrast is even more striking for medium and heavy trucks where Canada has been almost shut out of any growth in the last seven years. Mexico was up by 68.5 percent, US down by 39.7 percent and Canada down by 84.3 percent.

The inventory days’ supply of light vehicles in NAFTA was up by 6 from February last year to 65 days. The Detroit three were up by 2 to 74 days, Asian manufacturers by 11 to 58 days and European manufacturers by 11 to 57 days.

Light vehicle sales improved slightly in the US in February to 15.4 million units, (SAAR). In three months through February sales grew at 7.5 percent year over year. Auto sales were still a nose ahead of light trucks at 7.8 and 7.6 million respectively. Light trucks accounted for 49.3 percent of total sales in February, up from 48.6 percent in January. Of the Detroit three, sales increased most for Chrysler and Ford and were down only slightly for GM. The Detroit three accounted for 46.8 percent of total sales. Imported vehicles, assembled outside of North America, accounted for 23.8 percent of sales, up slightly from the January share.